Even without receiving a raise, you might notice a slightly larger paycheck in 2026. This increase is due to the Internal Revenue Service (IRS), which announced significant adjustments to the tax code last October to account for inflation. These changes will specifically affect the tax year 2026, which will be filed in 2027.

A major update involves the standard deduction, the amount of income that is not subject to taxation. Because this deduction is rising, taxable income will drop, leading to potential tax savings.

"For tax year 2026, the standard deduction increases to $32,200 for married couples filing jointly," the IRS announcement stated. "For single taxpayers and married individuals filing separately, the standard deduction rises to $16,100 for tax year 2026, and for heads of households, the standard deduction will be $24,150."

**New Tax Bracket Thresholds**

The IRS has also adjusted the income thresholds for the seven federal income tax brackets. These shifts are designed to combat "bracket creep," a phenomenon where inflation pushes taxpayers into higher tax brackets even though their real income hasn't increased. Without these adjustments, taxpayers could owe more money without actually seeing a raise.

The updated thresholds include:

* **37% Rate:** Applies to individual filers with incomes over $640,600 and married couples filing jointly earning over $768,700.

* **35% Rate:** Applies to individual incomes over $256,225 and joint incomes over $512,450.

* **12% Rate:** Applies to individuals earning at least $12,400 and married couples earning at least $24,800.

* **10% Rate:** Applies to individuals earning $12,400 or less and married couples earning $24,800 or less.

While these adjustments are likely to provide some financial relief, experts note they are relatively modest compared to previous years. The Tax Foundation highlights that such changes are normal, yet the current adjustments pale in comparison to recent history. For instance, between 2023 and 2024, the threshold for the 10% bracket rose from $11,000 to $11,600 for single filers, and from $22,000 to $23,200 for joint filers. In prior years, tax brackets saw changes of approximately 7% due to high inflation.

Individual income taxes make up the largest share of the government's revenue, accounting for more than half of federal revenue in fiscal 2024, according to Fiscal Data. But who is actually footing the bill? Many people don't have a clear sense of how much federal income tax each bracket. The reality is that those in the top tax bracket account for the largest share of tax revenue, paying $560,000 on average, for a total of $863 billion. Meanwhile, those in the lowest brackets pay less than $1,000 on average, contributing $63 billion to the federal tax revenue.

The U.S. income tax system taxes different portions of income at different rates, which means not all income is subject to the top marginal tax rate. A taxpayer in the highest bracket, for instance, will only pay the top rate on income above that threshold. Income below that is taxed at lower rates. This system allows the tax burden to rise in tandem with income levels. But the amount you ultimately owe in taxes depends on more than just total income and the federal tax bracket you're in. Factors such as deductions, tax credits, and the type of income earned — whether it's ordinary wages, business income, or investment gains — play a role in determining how much you pay in taxes.

Single filers earning $626,350 or more

To be in the top income bracket in 2025, a taxpayer must have an adjusted gross income (AGI) of $626,350 or above for a single filer, or more than $751,600 for those filing jointly, according to the Tax Foundation. Those in this bracket pay a top marginal tax rate of 37%. Although they make up a small share of total tax filers, they contribute the lion's share of federal income taxes. While the Internal Revenue Service (IRS) doesn't break out the exact amount paid by each income tax bracket, The IRS Statistics of Income data from 2022 (the most recent data available) shows that those making more than $663,164 — overlapping with many in today's top tax bracket — paid more than $863 billion of the roughly $2.14 trillion in total individual federal income tax revenue that year. This group, which represented the top 1% of earners, contributed more than 40% of all federal income taxes. While this number has fluctuated over the years, it's substantially higher than in 2001, when the top bracket accounted for around 33%.

Based on the data, these high earners paid an average of more than $560,000 in federal income taxes in 2022. Because only income above each bracket threshold is taxed at the top marginal rate — and due to factors such as deductions and the fact that many in the top bracket derive much of their income from businesses and investments — the rate paid by the top earners tends to be much lower than 37%. According to the data, the average tax rate for those in the top bracket was around 26% in 2022.

Single filers earning $250,525 to $626,350

The next highest income tax bracket covers taxpayers earning between $250,525 and $626,350 for single filers, based on the IRS's new 2025 income tax brackets, and between $501,050 and $751,600 for those married filing jointly. This bracket faces a top marginal tax rate of 35%, just below the highest bracket. On average, those in this group paid around $73,000 in federal income tax.

These figures are based on data for the top 5% to 1% of earners, whose income range was slightly higher at the time, between $261,591 and $663,164. Taxpayers in the second-highest bracket contribute roughly half as much as the nation's top earners, though they still account for the second-highest share of federal income taxes. According to the IRS, in 2022, taxpayers in this bracket contributed around 21% of total income tax revenue, or roughly $449 billion.

One key difference between the top two tax brackets is the amount of income subject to the top marginal tax rates. Even if your household makes a higher income than another, it doesn't necessarily mean you'll pay more in taxes. That's because for those in the highest bracket, a substantial portion of income comes from businesses, capital gains, and dividends, which are taxed at lower rates than regular wages. According to the Peter G. Peterson Foundation analysis of Congressional Budget Office data, regular wages make up just 33% of total income for the top tax bracket, compared with 61% for the second-highest income bracket. The spread is even greater for those in lower tax brackets.

Single filers earning $197,300 to $250,525

The third-highest income tax bracket has a 32% top marginal rate for the 2025 tax year. This rate applies to taxpayers earning between $197,300 and $250,525 for single filers, and between $394,600 and $501,050 for married individuals filing jointly. While these earners fall below the top tiers of income, they still contribute a significant share of federal income tax revenue. Taxpayers in this bracket paid around $30,600 in federal income tax on average.

According to IRS data, taxpayers earning between $178,611 and $261,591 in 2022 — a range that closely mirrors the current 32% bracket — accounted for roughly 11% of all federal income taxes collected, or $235 billion in total federal income taxes. Together with the top two tax brackets, these taxpayers, which represented the top 5% to 10% of earners nationwide that year, were responsible for more than $1.5 trillion in tax revenue, or 72% of the total paid. For those in the top three brackets, it's important to note that the IRS might flag you as they often do when income reaches a certain level. That's why it's essential to be as accurate and transparent as possible when filing your taxes, particularly for higher earners.

Single filers earning $103,350 to $197,300

The next marginal tax rate represents a fairly large step down from the preceding bracket, at 24%. For the 2025 tax year, this rate applies to single filers earning in the low six figures — between $103,350 and $197,300 — and for married couples filing jointly with income of $206,700 to $394,600. The average amount paid in taxes by those in this bracket was around $13,900. Though you may not feel rich with an income at this level, it may be nice to know that many baby boomers would consider you to be "upper-class" once you've reached this range.

Those in this bracket made up the top 25% of earners per the 2022 IRS data, based on incomes of roughly $100,000 to $178,000 and were responsible for a sizeable amount of federal income taxes. For that year, those in the bracket paid more than $320 billion, amounting to 15%. Though this was a jump from the previous year's share of 13.4%, it has seen an overall decline since 2001, when it accounted for nearly 18%. The combined federal income tax revenue that comes from those in the top four tax brackets is roughly $1.86 trillion, which is more than 87% of the total.

Single filers earning Less than $103,350

Below the 24% marginal tax rate, the IRS has three additional thresholds that apply to lower- and middle-income taxpayers. The 22% bracket sits just below the 24% rate and applies to taxable income from $48,475 to $103,350 for single filers, and $96,950 to $206,700 for married couples filing jointly. Those in this income bracket are included in the top 50% of earners. Individuals in this bracket paid $5,560 in taxes on average.

The tax rate — and tax contributions — drop substantially for those making below this threshold. The next level is the 12% bracket, which applies to income between $11,925 and $48,475 for single filers, and $23,850 to $96,950 for married joint filers. This is followed by the lowest, 10% bracket, which covers taxable income from $0 to $11,925 for single filers and $0 to $23,850 for married couples filing jointly. Combined, the lowest two brackets, representing the bottom 50% of earners, pay just 3% of total federal income taxes, which amounts to roughly $63 billion, per the IRS 2022 data. That equates to an average income tax payment of $820 for taxpayers in this group.

One factor contributing to the lower tax burden for those in the bottom half of earners is a tax refund for low- and moderate-income households, known as the Earned Income Tax Credit (EITC), which can provide tax refunds ranging from $600 to almost $8,000 to eligible taxpayers. To qualify, the taxpayers' AGI must be below a certain amount, and the amount of the refund depends on the filing status and the number of children.

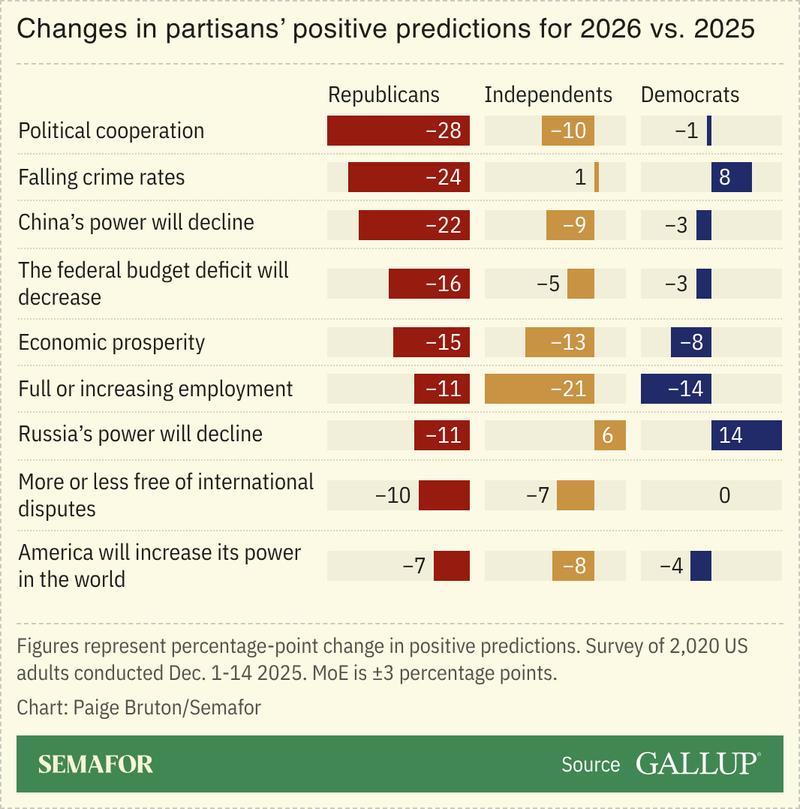

Americans are already sour on 2026.

According to new Gallup polling, most US adults expect crime rates, prices, taxes, and unemployment to rise in 2026, while a majority also believe this year will be characterized by economic difficulty. Meanwhile, majorities believe the US will see its power decline, while China will see its own influence increase globally.

Americans are optimistic about one thing: 55% believe the stock market, a key focus of Trump’s, will rise.

While Republicans are more optimistic than their independent and Democratic counterparts across the issues polled, the negative shift from 2025 to 2026 was largely driven by growing pessimism among conservatives — a warning sign for the White House in a midterm election year. Still, those numbers also suggest Trump may face a low bar for success.