“On-Together” coworking game turns remote work into a pastel, cozy experience with friends

"To those who love to have a space to work together virtually, certainly check this game out!"

For $9.99 and a Steam login, players flocked to a new online coworking game that simulates working together with your friends in a cute pastel digital world.

On-Together: Virtual Coworking has climbed Steam’s Popular New Releases chart after its release on Jan 19, 2026, and has overwhelmingly positive reviews on its Steam page. The cozy productivity sim blends soft anime visuals with practical work tools.

A third space that doesn’t feel like work

On-Together looks more like Animal Crossing wandered into a feature animated film, with a dash of internet-era charm. Players build cute avatars and drop into shared digital spaces. Scenery options include parks, forests, and libraries, and interactions with others populating those spaces with you are optional.

Much like other focus games like Spirit City, this game provides task lists and a built-in pomodoro timer, but you don't necessarily need it to be on a second screen to see it. The co-working screen can be relegated to a corner of your computer screen, so you can see both your fellow workers and the task at hand.

Although the game is centered on coworking, it offers far more than shared focus. Players can customize nearly everything, from pet companions to the animations for their avatar. There are even mini games that allow for a reprieve from the grind of work tasks. Even so, those distractions come with structure, so people don't just play the minigames. It rewards task-based focus with tickets to unlock new outfits and accessories.

GigaPuff, the studio behind the coworking game, said the January launch and earlier demo had served roughly 60K people.

"We genuinely love that early-2000s chatroom and online game culture,” developer Ilgın S. explained to Polygon. "As we got older and more involved in work life, I guess we felt like we needed a bit of that space again."

"It’s about making the experience of working feel a little less heavy, and a little more human," Ilgın went on. "Work itself can be a form of suffering. We’re not glorifying it. We’re just trying to get through it together."

Players treat it like a social club with deadlines

Online reactions echoed that sentiment. The game’s official account, @OnTogetherGame, posted a clip of someone reading a Wikipedia article in a library. The caption read, "This is your sign to try my coworking game to body double with friends/ strangers online so you can get that task you've been putting off DONE💕"

Players quickly chimed in. @yokonnee wrote, "I have been on this productive inducing game by @OnTogetherGame for days, and I LOVE IT! To those who love to have a space to work together virtually, certainly check this game out! ☀️"

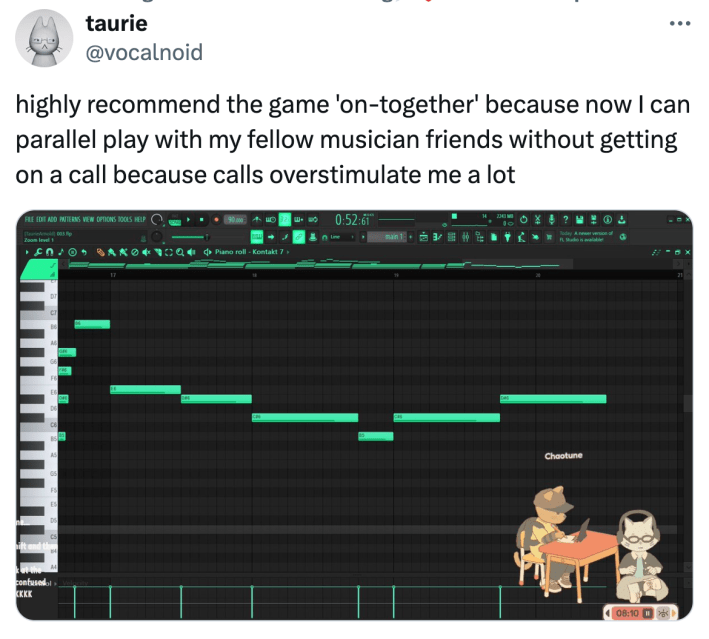

Meanwhile, musician @vocalnoid shared a different benefit. "highly recommend the game 'on-together' because now I can parallel play with my fellow musician friends without getting on a call because calls overstimulate me a lot."