The odds of a soft landing may have just gotten a little better.

The latest employment report from the Labor Department shows job growth held steady last month, boosting hopes that the Federal Reserve may be able to curb inflation without triggering a sharp jump in unemployment.

U.S. employers added 187,000 jobs in July. While job growth has moderated, it hasn't come close to stalling, even after the Fed raised interest rates to the highest level in 22 years.

Here are five takeaways from the report.

Keeping up with population growth

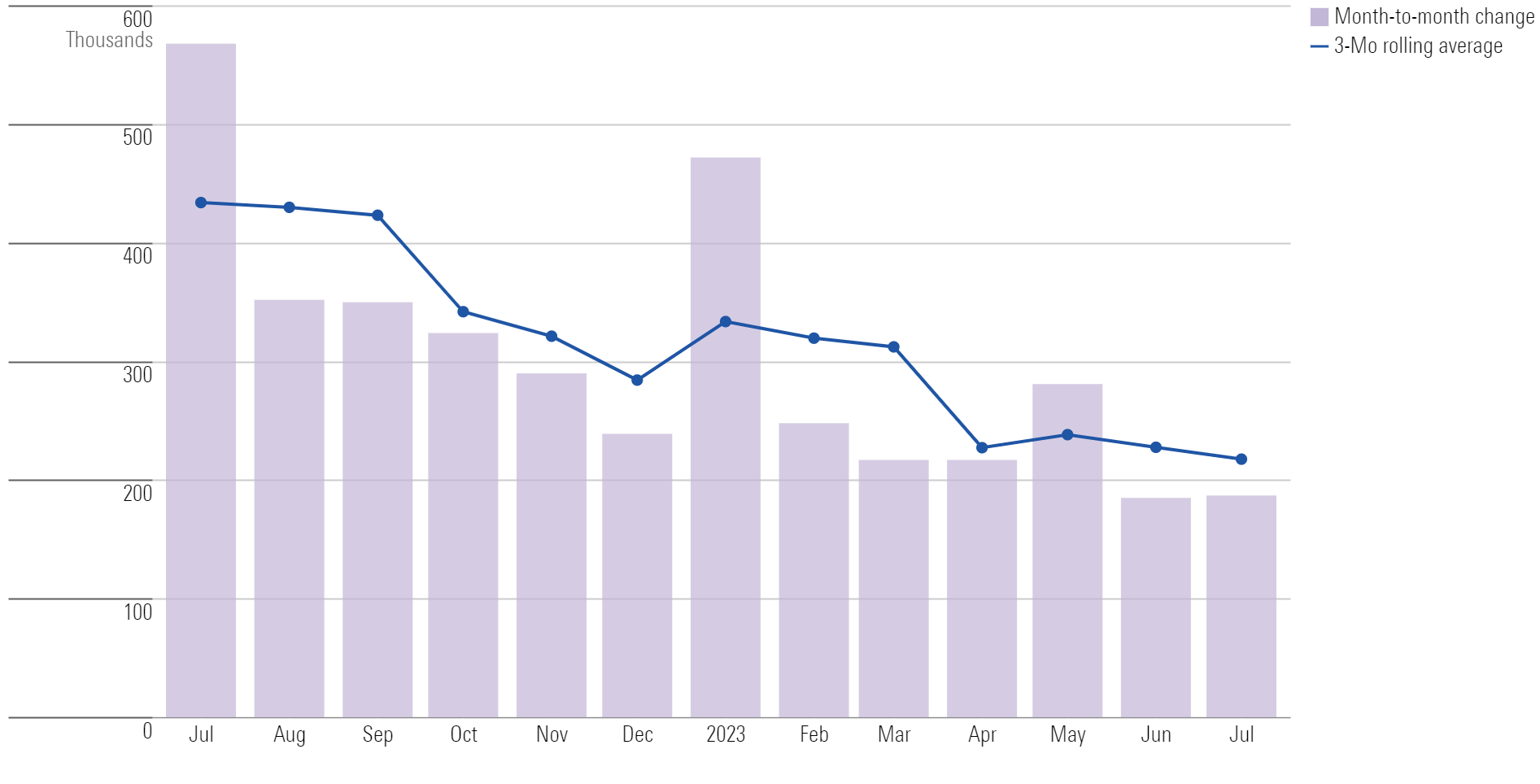

Over the last three months, employers have added an average of 217,000 jobs per month.

That's down from an average of 312,000 jobs in the first three months of the year, but it's still a healthy pace of growth.

Employers are still adding more than enough jobs each month to keep pace with population growth.

Health care, hospitality, and construction were among the industries adding jobs in July, while factories and transportation saw modest job cuts.

Historically low unemployment

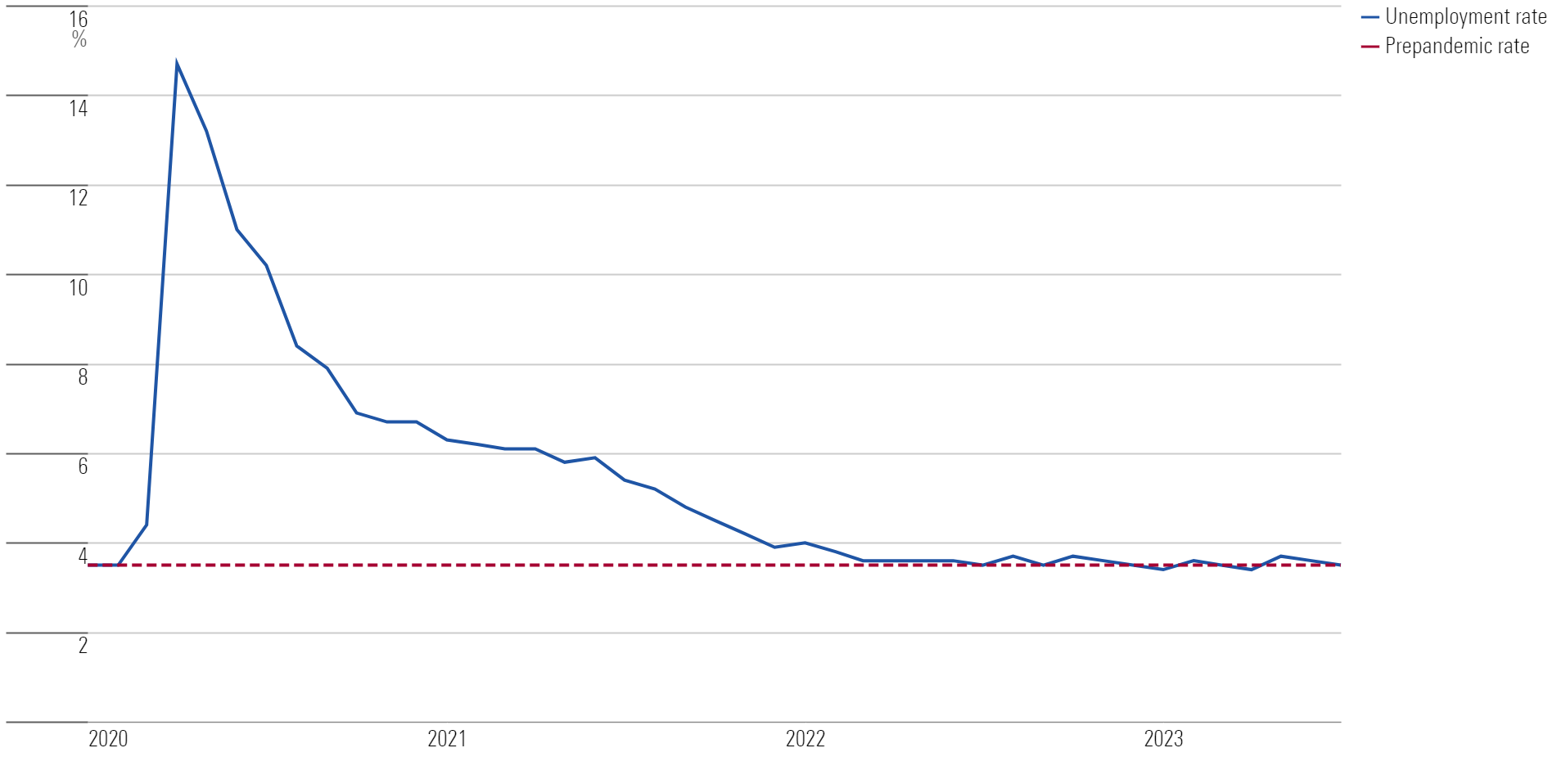

The unemployment rate dipped to 3.5% in July from 3.6% the month before. The jobless rate has hovered in a narrow range for more than a year, hitting a half-century low of 3.4% in April.

Unemployment among African Americans hit a record low of 4.7% that month before rebounding to 6% in June — raising some concerns. As a relief, the African American jobless rate dipped again in July to 5.8%.

It's best to take those numbers with a grain of salt. The figures can be noisy because of the relatively small sample size.

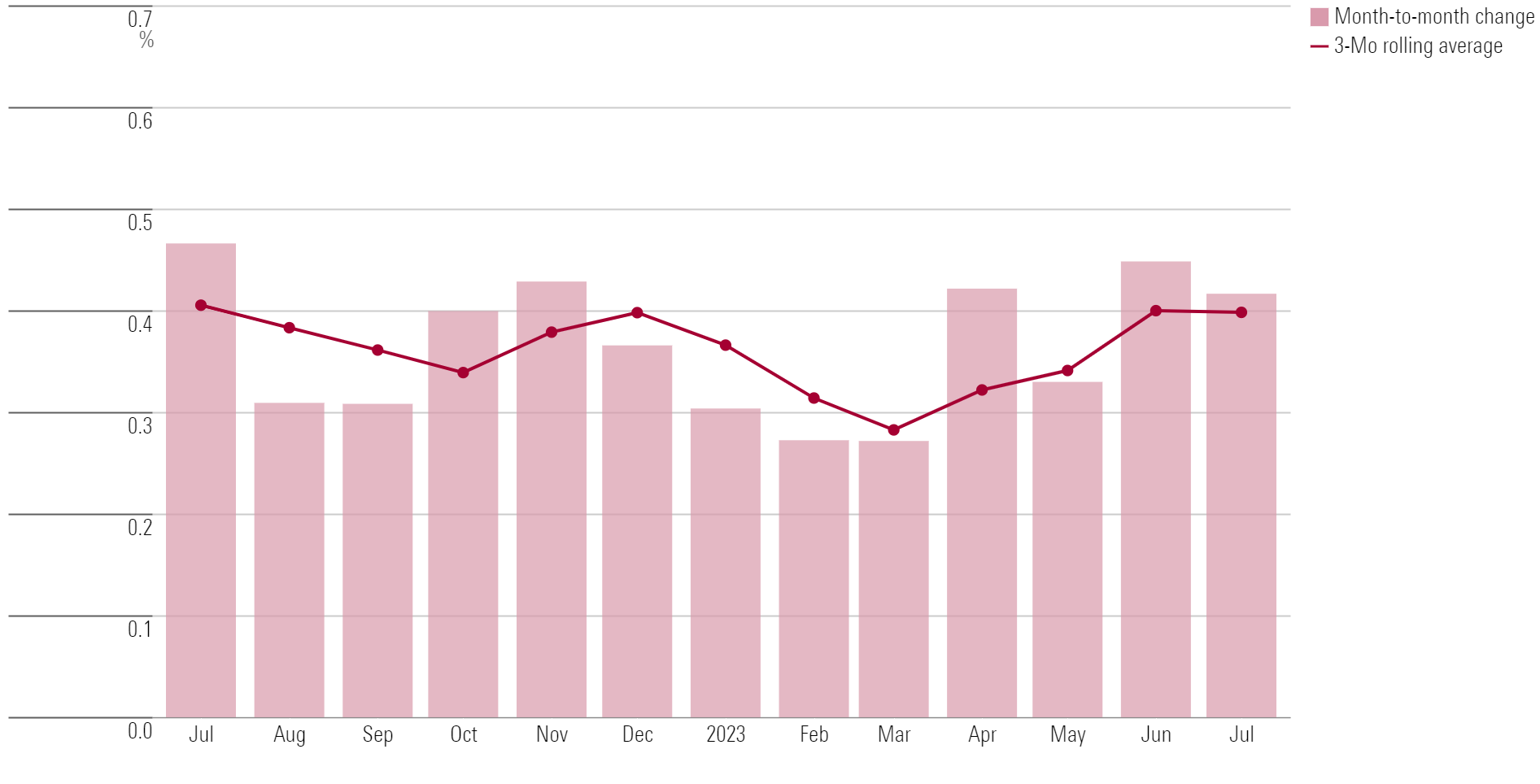

People are earning more

Here's another bit of positive news: Wages are finally outpacing inflation, boosting workers' buying power.

Average wages in July were up 4.4% from a year ago. Wage gains have moderated in the last year, but inflation has cooled as well, so workers' paychecks now stretch farther.

For the twelve months ending in June wages rose 4.4%, while prices climbed just 3%. (The inflation rate for the year ending in July will be released next week.)

Coming off the sidelines

The number of people working, or looking for work, increased by 152,000 last month.

Importantly, the share of people in their prime working years (ages 25-54) who are in the labor force is growing. After hitting a two-decade high in June, it fell just slightly last month.

That's important because a growing workforce allows the economy to expand without putting upward pressure on inflation.

And it's good news for women

Before the pandemic, women briefly outnumbered men on U.S. payrolls.

The ranks of working women fell sharply in 2020, when schools and restaurants were shuttered and many women were forced to leave work to look after family members or for other reasons.

Women's share of jobs has been slowly recovering, however, thanks in part to job growth in health care and education — fields where women outnumber men. (In contrast, the male-dominated manufacturing industry lost 2,000 jobs last month.)

As of July, women held 49.9% of all payroll jobs, up from 49.8% the month before.

The July report showed that 187,000 jobs were added in July—slightly below FactSet’s consensus forecast for an increase of 200,000 jobs. This follows a revised 185,000 gain in June.

Nonfarm payroll employment has grown at a 1.7% annual rate over the last three months. While that’s down from a 2.4% rate in the first quarter, it’s in line with the 1.7% average annual growth from 2015 through 2019, notes Preston Caldwell, senior U.S. economist at Morningstar.

“While job growth is continuing at a healthy pace, increasing signs that inflation might return to normal without a recession should induce the Fed to refrain from further rate hikes,” Caldwell says. “This is better than a soft landing. This is an immaculate disinflation.”

Ultimately, Caldwell believes the jobs market will slow, and he points to hints of slackening in the July report. There’s evidence of employers cutting hours worked and declines in temporary help hiring—a job category that was a leading indicator of overall employment in the 2001 and 2008 recessions.

“Even while headline job growth remains strong, we do see signs that employers are trying to cut back their usage of labor,” Caldwell says.

July Jobs Report Key Stats

- Nonfarm payrolls rose by 187,000 versus a revised 185,000 in June.

- The unemployment rate declined to 3.5% from 3.6% in June.

- Average hourly wages grew by 0.4% to $33.74 after rising a revised 0.45% in June.

“Job growth is still decelerating, albeit at a slow pace,” Caldwell says. He cautions that routine annual preliminary benchmark revisions to the employment data will be reported on Aug. 23. The BLS will make corrections to its survey-based estimates of employment since March 2022. “That could shift the picture of job growth shown by the data,” he notes.

Healthcare Leads Hiring

With the July increase in hiring, the three-month moving average of nonfarm payroll employment gains dropped to roughly 218,000 from 283,000 in June. The number of new jobs created in July is well below the average for the last 12 months, which stands at 312,000, according to the BLS.

Monthly Payroll Change

Hiring in July was led by the healthcare sector, which added 63,000 jobs—above the average monthly gain of 51,000 for the past 12 months. Healthcare has accounted for more than a third of the job gains over the last three months, with the sector adding jobs at a 4.4% annualized rate. “That’s likely to slow now that healthcare employment is well ahead of pre-pandemic levels,” Caldwell says.

Construction employment showed continued strength despite the substantial increase in interest rates over the past year. With nonresidential building construction adding 11,000 jobs, the overall sector saw growth of 19,000 jobs in June. Construction hiring has increased at a 3.6% annualized rate over the past three months, compared with 0.8% in the prior three months. Caldwell calls it “a solid rebound.”

The gains in construction employment are showing up in both residential and nonresidential hiring. “Residential construction employment ticking up again is consistent with a rebound in residential investment in Q3 and the seeming trend reversal in housing starts,” Caldwell says. “The increase in nonresidential construction employment makes sense, given the ongoing surge in factory construction.”

Unemployment Rate Remains Stable

The unemployment rate ticked down to 3.5% in July from 3.6% in June. Economists had forecast an unemployment rate of 3.6% for July. However, the jobless rate has held within a narrow range of 3.4%-3.7% since March 2022.

“The unemployment rate is basically stable over the past several months,” Caldwell notes. He points to the differences between the two methods of collecting data for the jobs report. The household survey employment data (which is used to determine the unemployment rate) has not seen much growth, in contrast to the gain seen in the establishment survey data (which is used for payroll statistics).

Unemployment Rate

Wages Tick Higher

Average hourly earnings rose by 14 cents, or 0.4%, in July. Over the past 12 months, average hourly earnings have increased by 4.4%.

“The recent uptick in wage growth is something to watch, with that number accelerating to 4.9% annualized in the past three months, up from 3.9% in the prior three months,” Caldwell says. “However, this data series is very volatile, and growth is a somewhat milder 4.4% in year-over-year terms. Additionally, other measures of wage growth—other surveys, such as the employment cost index—are still showing signs of decelerating.”

Monthly Wage Growth

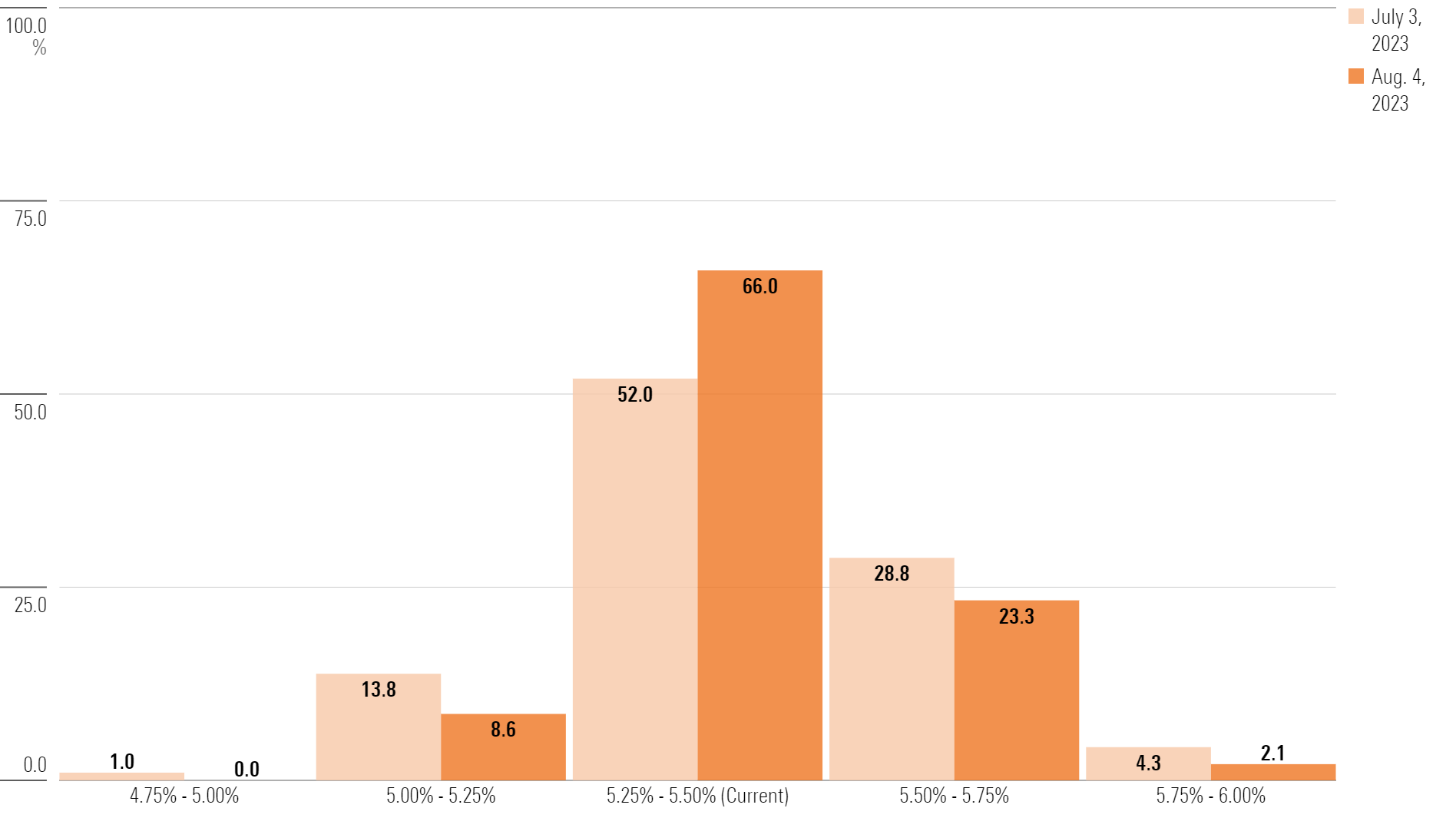

Fed Believed to Be Done Raising Rates

Against this backdrop, Caldwell thinks the Federal Reserve won’t need to raise interest rates any further. At its July meeting, the Fed raised the federal-funds rate target range by a quarter of a percentage point to 5.25%-5.5%. The question facing investors was whether Fed officials would feel the need to raise rates again before the end of this year.

“For now, growth in jobs and economic activity is eschewing the ‘below-trend’ pattern of growth which is usually held by economists as necessary to reduce inflation,” Caldwell says. “Yet inflation is nevertheless falling owing to supply side improvement and other factors.”

He continues: “The possibility that this can continue will induce the Fed to refrain from another rate hike in its September meeting.” Caldwell believes that in 2024, a slowing economy and declining inflation will lead the Fed to significantly lower interest rates.

In the bond market, traders see the Fed on hold through the rest of the year. According to the CME FedWatch Tool, which tracks investors’ bets on the direction of interest rates, there is a 66% chance the Fed will hold the federal funds rate at its current level through the end of 2024.

Expectations for the Federal Reserve Meeting on Dec. 13, 2023

Former Treasury Secretary Lawrence Summers said that he’s still concerned about inflation picking up after wage growth was more than expected in July.

His comments on Bloomberg Television’s Wall Street Week with David Westin came after the US payrolls report Friday showed job gains slowed to 187,000 in July and the prior two months were revised down. At the same time, wages rose more than expected from the prior year, up 4.4%.

The Federal Reserve has been raising interest rates at a rapid clip over the past year to quell inflation. While Summers said that the path to a soft landing is more likely than before the jobs data, price pressures remain a threat.

Other economists also remained cautious.

“The slowdown in job growth is significant but average hourly earnings and the low unemployment rate suggest the job market is still tight,” said Kathy Jones, Charles Schwab’s chief fixed income strategist. “The Fed may pass in September, but that depends on inflation data. I think another rate hike is on the table.”

And Michael Skordeles, head of US economics for Trust Financial Corp., said “It’s too early to say we’re done and this is the end of the end of the hiking cycle. They do have a ways to go.”

At the same time, there’s a “good amount of data” before Fed policymakers have to decide in September, he said.

Randall Kroszner, a professor at the University of Chicago Booth School of Business and a former Fed governor, said that wage growth should remain in focus. Even Fed doves will need to be cautious, he said. “There’s enough here for them to say we have to be vigilant.”

There were signs of cracks in the jobs report, though, including a drop in temporary service help and sectors that were previous engines of growth, such as manufacturing and transportation. Hours worked also declined, signaling less demand from employers.

That’s a sign that Fed policy is working. Fed officials “have been saying they’ve wanted to get the short term rate up to a restrictive level and I think it’s there. I don’t think they have to do anymore” hikes, said Edward Yardeni, president of Yardeni Research Inc.

Bloomberg Economics analysts said the surprisingly low nonfarm payrolls data reinforce that cracks are emerging in the labor market. “All in all, the report bolsters the case for the Fed to keep rates on hold in September,” economists Anna Wong and Stuart Paul wrote in a report. They highlighted that while headline wages increased, average weekly earnings grew at a more subdued 0.1% monthly pace when factoring in the drop in average hours worked.

Ian Shepherdson, chief economist at Pantheon Macroeconomics said we’re seeing “softish payroll numbers” that show a clear cooling in the labor market. “The bottom line here is that this report is not strong enough to change Fed doves’ minds, and not weak enough to change any Fed hawks’ minds.”

A cooling was to be expected, said Cecilia Rouse, former chair of the White House’s Council of Economic Advisers who stepped down to return to Princeton University this year.

“That’s what we want to see. That is what the Federal Reserve is looking for,” she said. Still, the labor market remains “remarkably resilient.” “We fundamentally have a strong labor market with some signs that there’s some cooling as we would hope to see.”