States are reopening and millions of people have returned to work.

In some cases, those workers may be able to continue collecting unemployment benefits. That pay would include both traditional state-level benefits and the $600-a-week enhanced benefits funded by the federal government.

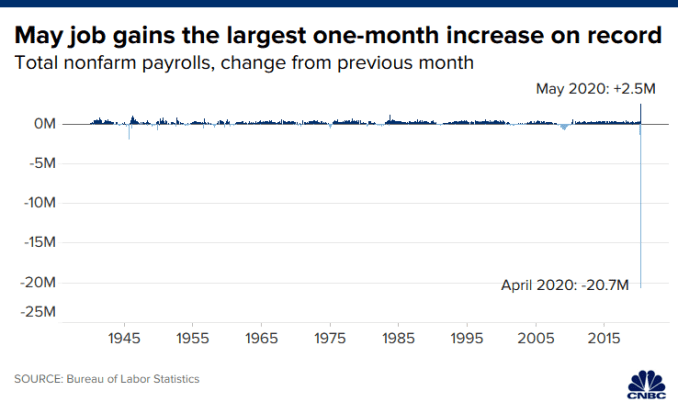

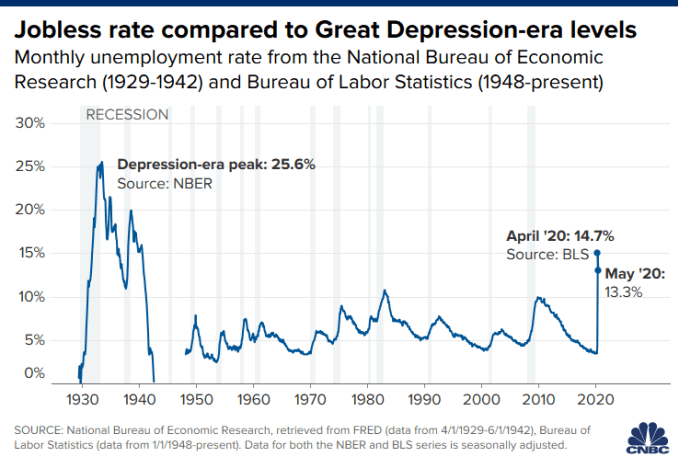

The U.S. economy added 2.5 million jobs in May, a surprising turnaround that economists largely attribute to Americans who’d been furloughed from their jobs being recalled as states loosen their rules around business closures.

However, around 30 million Americans are still collecting unemployment benefits, according to the Labor Department.

Workers can continue getting a partial unemployment check if they’re recalled on a part-time basis. Full-time workers aren’t eligible.

WATCH NOW

They would get a smaller unemployment check than if fully unemployed since benefits are supplemented by job wages.

There are two ways this can occur — via a work-sharing program or reduced unemployment insurance benefits.

Pros and cons

The former is generally preferable to the latter, according to experts.

For example, partial unemployment benefits generally require a more substantial reduction in work hours for an individual to be eligible. Access may, therefore, be limited for some.

The arrangement also often pays less handsomely than work-sharing programs due to differences in how a state calculates benefits in each program.

But there are caveats.

WATCH NOW

While all states offer partial unemployment benefits, work-sharing programs are only available in around half of U.S. states — and even then, an employer must offer the program to its workers for them to enroll.

In both programs, workers get a substantial — though temporary — financial benefit.

Along with their reduced state unemployment check, they would receive the extra $600 a week authorized by the CARES Act. That enhancement may allow workers to make more than their full-time salaries via these arrangements, though the extra pay is scheduled to end after July 31.

Work-sharing programs

Work-sharing programs — also known as short-time compensation or shared-work programs — are offered through one’s employer.

They allow businesses to reduce hours, by anywhere from 10% to 60%, for a group of employees.

The arrangement helps businesses to avoid laying off workers by letting them reduce worker hours instead. These workers receive prorated unemployment benefits from the state to compensate for lost wages.

For example, a worker whose hours are cut 50% would get half their typical state unemployment check and the $600 weekly federal unemployment enhancement in addition to their wages.

Employers must submit a plan to their state and have it approved before workers can start receiving benefits.

Partial unemployment benefits

Partial unemployment benefits are more complicated and rules vary significantly between states, experts said.

Generally, workers must have their full-time hours cut considerably — more than the maximum 60% for work-sharing programs — to be eligible, according to Susan Houseman, research director at the W.E. Upjohn Institute for Employment Research.

“You have to be earning very little,” she said.

To be eligible, workers must generally make less money per week from a job than they’d otherwise be receiving in-state jobless benefits while fully unemployed, said Michele Evermore, a senior policy analyst at the National Employment Law Project.

For example, the average American gets $378 a week in state unemployment benefits. Eligibility for partial unemployment benefits would generally mean making less than that from a job.

This isn’t the case in all states, however, Evermore said.

And the situation could be much different in a state like Louisiana, which only pays unemployed workers up to $211 a week.

Benefit formulas for eligible workers also aren’t prorated as they are with work-sharing programs and are typically less generous, Houseman said.

The generosity doesn’t impact workers as much, however, between now and the end of July due to the extra $600 a week in federal aid, she said.

Workers must apply for partial benefits, unlike with a work-sharing program, where the employer applies on the employee’s behalf.