A federal judge has given the administration a Friday deadline to fully pay out food assistance for November. The White House had said earlier this week it would pay half the normal amount, in response to a previous order, but Judge John McConnell rejected that plan, saying it would cause "needless suffering." Funding for the Supplemental Nutrition Assistance Program (better known as SNAP, or food stamps) ran out Nov. 1 for 42 million Americans.

The world’s richest man was just handed a chance to become history’s first trillionaire.

Elon Musk won a shareholder vote on Thursday that would give the Tesla CEO stock worth $1 trillion if he hits certain performance targets over the next decade. The vote followed weeks of debate over his management record at the electric car maker and whether anyone deserved such unprecedented pay, drawing heated commentary from small investors to giant pension funds and even the pope.

In the end, more than 75% of voters approved the plan as shareholders gathered in Austin, Texas, for their annual meeting.

“Fantastic group of shareholders,” Musk said after the final vote was tallied, adding, “Hang on to your Tesla stock.”

The vote is a resounding victory for Musk, showing investors still have faith in him as Tesla struggles with plunging sales, market share, and profits in no small part due to Musk himself. Car buyers fled the company this year as it has ventured into politics both in the U.S. and Europe, and trafficked in conspiracy theories.

The vote came just three days after a report from Europe showing Tesla car sales plunged again last month, including a 50% collapse in Germany.

Still, many Tesla investors consider Musk as a sort of miracle man capable of stunning business feats, such as when he pulled Tesla from the brink of bankruptcy a half-dozen years ago to turn it into one of the world’s most valuable companies.

The vote clears a path for Musk to become a trillionaire by granting him new shares, but it won’t be easy. The board of directors that designed the pay package requires him to hit several ambitious financial and operational targets, including increasing the value of the company on the stock market nearly six times its current level.

Musk also has to deliver 20 million Tesla electric vehicles to the market over 10 year,s amid new, stiff competition, more than double the number since the founding of the company. He also has to deploy 1 million of his human-like robots that he has promised will transform work and home — he calls it a “robot army” — from zero today.

Musk could add billions to his wealth in a few years by partly delivering these goals, according to various intermediate steps that will hand him newly created stock in the company as he nears the ultimate targets.

That could help him eventually top what is now considered America’s all-time richest man, John D. Rockefeller. The oil titan is estimated by Guinness World Records to have been worth $630 billion, in current dollars, at his peak wealth more than 110 years ago. Musk is worth $493 billion, as estimated by Forbes magazine.

Musk’s win came despite opposition from several large funds, including CalPERS, the biggest U.S. public pension, and Norway’s sovereign wealth fund. Two corporate watchdogs, Institutional Shareholder Services and Glass Lewis, also blasted the package, which so angered Musk that he took to calling them “corporate terrorists” at a recent investor meeting.

Critics argued that the board of directors was too beholden to Musk, his behavior too reckless lately, and the riches offered too much.

“He has hundreds of billions of dollars already in the company, and to say that he won’t stay without a trillion is ridiculous,” said Sam Abuelsamid, an analyst at research firm Telemetry who has been covering Tesla for nearly two decades. “It’s absurd that shareholders think he is worth this much.”

Supporters said that Musk needed to be incentivized to focus on the company as he works to transform it into an AI powerhouse using software to operate hundreds of thousands of self-driving Tesla cars — many without steering wheels — and Tesla robots deployed in offices, factories, and homes doing many tasks now handled by humans.

“This AI chapter needs one person to lead it and that’s Musk,” said financial analyst Dan Ives of Wedbush Securities. “It’s a huge win for shareholders.”

Investors voting for the pay had to consider not only this Musk promise of a bold, new tomorrow, but whether he could ruin things today: He had threatened to walk away from the company, which investors feared would tank the stock.

Tesla shares, already up 80% in the past year, rose on news of the vote in after-hours trading but then flattened basically unchanged to $445.44.

For his part, Musk says the vote wasn’t really about the money but getting a higher Tesla stake — it will double to nearly 30% — so he could have more power over the company. He said that was a pressing concern given Tesla’s future “robot army” that he suggested he didn’t trust anyone else to control, given the possible danger to humanity.

Other issues up for a vote at the annual meeting turned outto be wins for Musk, too.

Shareholders approved allowing Tesla to invest in one of Musk’s other ventures, xAI. They also shot down a proposal to make it easier for shareholders to sue the company by lowering the size of ownership needed to file. The current rule requires at least a 3% stake.

IRS Direct File, the electronic system for filing tax returns for free, will not be offered next year, the Trump administration has confirmed.

An email sent Monday from IRS official Cynthia Noe to state comptrollers that participate in the Direct File program said that “IRS Direct File will not be available in Filing Season 2026. No launch date has been set for the future.”

The program developed during Joe Biden’s presidency was credited by users with making tax filing easy, fast, and economical. However, it faced criticism from Republican lawmakers, who called it a waste of taxpayer money because free filing programs already exist (though they are difficult to use), and from commercial tax preparation companies, which have made billions from charging people to use their software.

Treasury Secretary Scott Bessent, who is also the current IRS commissioner, told reporters at the White House on Wednesday that there are “better alternatives” to Direct File. “It wasn’t used very much,” he said. “And we think that the private sector can do a better job.”

The Center for Taxpayer Rights filed a Freedom of Information Act request for IRS’s latest evaluation of the program, and the report says 296,531 taxpayers submitted accepted returns for the 2025 tax season through Direct File. That’s up from the 140,803 submitted accepted returns in 2024.

Direct File was rolled out as a pilot program in 2024 after the IRS was tasked with looking into how to create a “direct file” system as part of the money it received from the Inflation Reduction Act signed into law by Biden in 2022. The Democratic administration spent tens of millions of dollars developing the program.

Last May, the agency under Biden announced that the program would be made permanent.

But the IRS has faced intense blowback to Direct File from private tax preparation companies that have spent millions lobbying Congress. The average American typically spends about $140 preparing returns each year.

The program had been in limbo since the start of the Trump administration as Elon Musk and the Department of Government Efficiency slashed their way through the federal government. But The Associated Press reported in April that the administration planned to eliminate the program, with its future becoming clear after the IRS staff assigned to it were told to stop working on its development for the 2026 tax filing season.

As of Wednesday, the Direct File website states that “Direct File is closed. More information will be available at a later date.”

The Washington Post and NextGov first reported on the email to state comptrollers confirming the program would not be offered next year.

Adam Ruben, a vice president at the liberal-leaning Economic Security Project, said “it’s not surprising” that the program was eliminated.

“Trump’s billionaire friends get favors while honest, hardworking Americans will pay more to file their taxes,” he said.

NEW PRICES UNDER DEAL

COVERAGE TRENDING DOWN

EXPANDED GOVERNMENT COVERAGE

WEAK DOMESTIC DEMAND

Has ChatGPT irreversibly altered the American economy?

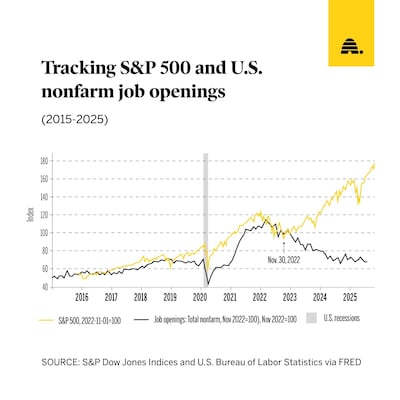

A graph deemed “The Scariest Chart in the World” by journalist Derek Thompson shows job openings falling and the stock market taking off in the wake of the rise of artificial intelligence.

The graph has garnered the attention of many, including those who believe the story has more to do with current Trump administration policies and Federal Reserve regulations than with AI stealing jobs.

Either way, the story the graph tells is more complicated than it first appears.

For the past two decades, job openings and the S&P 500 moved in tandem. However, beginning at the end of 2022, the two lines significantly diverged. Graphs tracking this divergence, circulating in finance circles on Facebook, LinkedIn, and X, claimed ChatGPT’s release on Nov. 30, 2022, was the catalyst.

The stock market has risen 80% since ChatGPT was publicly released in November 2022, and job openings are down about 33% in the same time period, according to Federal Reserve Economic Data.

Steven Kamin, a senior fellow at the American Enterprise Institute and former principal adviser for the Federal Reserve, told the Deseret News it’s “not illogical” to draw the conclusion that this divergence was spurred by the release of artificial intelligence.

But, he added, not all economists are sure that it is. “And the latter view would be premised on the idea that the dissemination of AI just hasn’t gone far enough to lead to substantive job impacts,” he said.

The available data show that the sectors of the economy with a slowdown in job openings aren’t likely to be replaced by artificial intelligence. “Mining and lodging” and “durable goods manufacturing” showed a roughly 50% decline in openings between November 2022 and August of this year, according to an economist at Employ America.

Sam Rahman, a portfolio manager at Hedge Asset Management, also told the Deseret News he was skeptical that ChatGPT is the reason for the split.

“They’re very different data sets, and I don’t think it’s as linked as the chart shows,” Rahman said.

According to Federal Reserve Economic Data, job openings dipped and unemployment skyrocketed when COVID-19 prompted nationwide shutdowns. In 2020, job openings returned to pre-pandemic levels within just a couple of months, but in the latter half of the year, they rose 70%.

Though on a soft decline since the spring of 2022, there are still more job openings now than at any time in the previous two decades. But as openings continue to drop, job-seekers feel like the market is much more competitive than it was just a couple of years ago.

“The labor market is kind of in stasis, although we don’t really know what’s happened in the last couple of months because of the shutdown,” Kamin said. “An alternative explanation for the fall in hiring is just the economy slowing in a context where businesses already had all the employees they needed.”

At the same time, the stock market has grown by leaps and bounds, and most of the growth has been concentrated in AI and tech companies.

Kamin explained that the increase in the stock market doesn’t reflect increased profitability as firms use AI to lay people off; it “more reflects hope in the future, that AI will make firms so enormously productive that their values will go up a lot.”

Tariffs, high interest rates, and strict immigration policies are also likely factors in job openings on the decline.

On “Liberation Day” in April (the day the Trump administration enforced reciprocal tariffs), the stock market plunged. With subsequent tariff announcements, the stock market has responded much less dramatically.

However, on the business side, Rahman told the Deseret News, unpredictable tariffs have made it difficult to anticipate costs and revenue, which has made them hesitant to hire new employees.

“What I’ve been seeing in both large and small companies is that they’re not necessarily cutting workforce, because they need the labor, but they’re not adding new workers because of this uncertainty as to how exactly tariffs impact their business,” Rahman said.

Rahman believes artificial intelligence is having a similar effect on hiring. Employers are evaluating where they actually need human labor and where AI could fill in the gaps. “I think they’re still trying to figure that out, which is why you’ve seen this pause or slowdown in hiring in the economy,” he said.

As for other policies and regulations, high interest rates disincentivize businesses to invest, giving them fewer resources to hire, and stricter immigration laws can prevent job openings from being created by choking off the labor supply, he said.

The internet was created in the 1960s, but the World Wide Web was not invented until 1989 — and it wasn’t made public until 1993.

Jerod Wilkerson, a professor at Brigham Young University who specializes in software development, told the Deseret News the two phenomena were extremely different in how they’ve been received by the public.

The internet was “this major technology that was going to change the world, but nobody knew about it,” he said.

In 1993, when the web was publicly released, Wilkerson was in an accounting master’s degree program with an information systems emphasis. “It was not known that it was a big deal, to the point where none of my professors even mentioned it,” he said.

Knowledge about the web “just kind of trickled out,” Wilkerson said. By 1998, he had started changing his career to become a web developer.

While some employees in niche industries (like floppy disk manufacturers) had to find other work, the general public wasn’t “worried about losing their jobs or anything like that,” Wilkerson said. Like a rising tide, “the web was creating jobs for them and creating lots of opportunity.”

ChatGPT, on the other hand, “changed the world almost instantly.”

In five days, ChatGPT went from zero to 1 million users, and in two months, it had 100 million monthly users.

As of this past July, 700 million people used ChatGPT weekly, which is 10% of the world’s adult population, according to the National Bureau of Economic Research.

By the end of 2025, OpenAI CEO Sam Altman hopes the service will reach 1 billion users.

The dissemination of artificial intelligence has happened faster than any previous technology, and it is fundamentally changing the value of some goods.

Previous technological advancements, including the internet and the web, have made education more and more valuable. “AI, at least in the short term, is doing the opposite of that.”

Manual labor, construction, food services, and other blue-collar work face no immediate threat of being replaced by artificial intelligence (unless Elon Musk gets his Tesla Bot loading the dishwasher correctly soon).

“The web created jobs for programmers and everybody else. But now AI, at least in the short term, is taking jobs, especially from white-collar people,” Wilkerson told the Deseret News.

As is known especially well by educators, artificial intelligence is disincentivizing students from learning, since asking ChatGPT to work for them seemingly gives them better and quicker results.

If businesses increasingly lean on artificial intelligence, Wilkerson and other tech experts foresee potential issues on the horizon.

Currently, AI cannot adequately replace a senior-level engineer. But if tech companies stop hiring junior-level engineers and give their work to artificial intelligence, there will be no one with adequate experience from the company to step in once the senior engineers retire.

Wilkerson explained that while he uses artificial intelligence in his own work, “I correct it all the time, and I can’t just turn it loose and let it go build everything.” He’s found he has to be extremely specific in telling it what to do and how to do it for the code to turn out OK.

“Maybe eventually we’ll be able to, but we’re not there yet,” Wilkerson said, adding if it doesn’t advance enough in time, an AI winter could “create a significant problem” for the tech industry.

Nancy Fulda, a professor and artificial intelligence researcher at Brigham Young University, told the Deseret News that some creative industries and work-for-hire coding have already seen disruption in hiring due to AI.

“In the future, I expect labor displacement to continue happening, just as it has always happened in the past,” Fulda said. “Fifty to 100 years ago, human telephone operators routed phone calls, bank tellers and bookkeepers manually recorded transactions in ledgers, and farm hands planted, irrigated, and harvested crops by hand.”

Each of the roles Fulda mentioned has been replaced by advancements in technology. “Importantly, none of these changes heralded an incoming apocalypse. Human workers shifted into new roles, often more desirable roles, and the U.S. economy continued to function,” she said.

Fulda believes we will see the same pattern with the AI revolution.

But there are things employers and educators can do to empower people to be more resilient to AI-induced change.

“I would love to see more initiatives that prevent AI from being constructed or deployed in nonethical ways, and I would love to see more support in place for people who are seeking to find their place in AI-disrupted work environments,” she said.

“But I’m an optimist at heart,” Fulda continued. “I believe it will all work out.”

Condé Nast, a global media company, immediately fired four reporters on Wednesday for violating company policy by confronting the head of Human Resources (HR).

Among those fired were former WIRED reporter Jake Lahut, Alma Avalle from Bon Appétit, Jasper Lo from The New Yorker and Ben Dewey from Condé Nast Entertainment. The NewsGuild of New York, a union that organizes Condé Nast employees, confirmed in a statement. The confrontation resulted from Condé Nast’s announcement that Teen Vogue was being merged with its sister magazine, Vogue, resulting in multiple layoffs of its editor-in-chief and other staffers.

In retaliation, over a dozen staffers at Condé Nast gathered outside of HR head Stan Duncan’s office and demanded to speak with him about the layoffs, sources told Semafor. Duncan told the staffers they could not form a crowd outside his office and asked them to return to work.

New: Conde Nast fired four employees who were among a group that confronted the company’s head of human resources on Wednesday over the decision to fold Teen Vogue into Vogue/recent cuts. Employees who were fired included journalists from the New Yorker, Wired, and Bon Appétit.

— Max Tani (@maxwelltani) November 6, 2025

One of the now-fired employees asked Duncan how he planned to stand up to President Donald Trump.

“We’d like you to move forward,” Duncan said.

“We’d like you to answer our questions,” the fired employee demanded.

Jake Lahut, a former WIRED reporter, confirmed on X that he was fired.

I was one of the four people who got canned.

In the interim, you can subscribe to my newsletter, Straight From The Hut. No paywall, but feel free to choose the pay to support model. I’m not going anywhere — the show goes on, and I’ll be back on MSNBC this weekend:… https://t.co/N0RgsZexSr

— Jake Lahut (@JakeLahut) November 6, 2025

In its statement, The NewsGuild of New York accused Condé Nast of attempting to “intimidate and silence” its staffers for standing up for the laid-off workers at Teen Vogue.

“These egregious terminations are a flagrant breach of the Just Cause terms of our contract and an unprecedented violation of their federally protected right as union members to participate in a collective action,” The NewsGuild said. “Through these illegal terminations, Condé Nast management is attempting to intimidate and silence our members’ advocacy for the courageous cultural and political journalist at Teen Vogue, as well as diverting attention away from the obvious lack of corporate leadership at the company.”

Condé Nast filed a charge with the National Labor Relations Board against the NewsGuild of New York, accusing them of having complete “disregard of [their] collective bargaining agreement,” according to Semafor. The company stated that any kind of “aggressive, disruptive, and threatening behavior of any kind” is “unacceptable” in the workplace.

“Extreme misconduct is unacceptable in any professional setting. This includes aggressive, disruptive, and threatening behavior of any kind,” a spokesperson said. “We have a responsibility to provide a workplace where every employee feels respected and able to do their job without harassment or intimidation. We also cannot ignore behavior that crosses the line into targeted harassment and disruption of business operations. We remain committed to working constructively with the union and all of our employees.”

The union had previously condemned the layoffs at Teen Vogue following Condé Nast’s merger announcement.

Eli Lilly announced Thursday it will start late-stage clinical trials on a promising new obesity treatment that could tighten the company's hold on the weight-loss market. The experimental drug helped some weekly users drop 20% of their body weight over roughly a year. The injectable belongs to a next-generation class known as amylin analogs, which suppress appetite by mimicking a pancreatic hormone, but with fewer potential side effects than blockbusters like Lilly's Zepbound. Amylin treatments are currently part of a takeover war between Novo and Pfizer.

Google is taking aim at the undisputed king of artificial intelligence chips: Nvidia. The tech giant is making its most powerful chip, Ironwood, widely available in the coming weeks, hoping to win users from Nvidia and other tech giants in the AI race, including Amazon and Meta. The custom Ironwood chips "can offer advantages on price, performance, and efficiency" over the most commonly used Nvidia chips, per CNBC. AI startup Anthropic has already committed to using up to 1 million of the chips, Google said.

CarMax on Thursday forecast a weak third quarter as the company announced the abrupt departure of its longtime chief executive. On Dec. 1, outgoing CEO Bill Nash will hand the reins to board member David McCreight on an interim basis. The company, which has struggled to resell vehicles amid tariff pressure, is scheduled to report its complete third-quarter results on Dec. 18. Last week, CarMax reportedly cut 350 jobs as rival Carvana reported higher third-quarter profit and revenue, fueled by strong demand for pre-owned vehicles.

DraftKings has become the official betting site and odds provider for ESPN under a new multiyear agreement with Disney. The deal comes just as Disney’s exclusive online partnership with casino operator Penn Entertainment draws to a close. Under the new agreement, whose financial terms were not disclosed, DraftKings products will become available through ESPN’s websites. Earlier Thursday, Disney and Penn said they would end their 10-year, $2 billion partnership after it failed to capture a significant market share during its two-year tenure.

Foreign graduates of U.S. colleges are finding a new roadblock to employment — a lack of companies willing to sponsor their work visas. Heavyweights like Walmart have announced a pause on the separate H-1B program amid shifting government guidance on the $100,000 fees attached, Bloomberg reports, leaving thousands of foreign workers in limbo, especially in tech and finance. The share of jobs offering visa sponsorship has dropped from 10.9% in 2023 to 1.9% today, though the drawback also owes to a tighter overall labor market.