🚨“Strong” job numbers are the new misinformation. Here’s why we should be worried. The U.S. just added 147,000 jobs in June. Sounds great, right?Wrong. Peel back the headlines and what you find is a labor market losing steam, with government hiring propping up weak private sector momentum.

~ Private job growth? Weakest in 8 months.

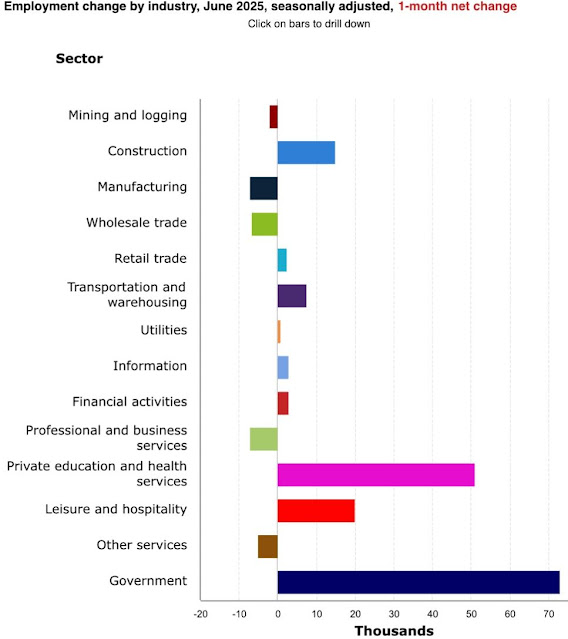

~ Manufacturing, wholesale, business services? Shedding jobs.

~ Average hours worked? Falling.

~ Wages? Stalling.

~ Unemployment? Down - but only because 130,000 people gave up looking.

This is not “resilience.” This is a slow-motion stall. Meanwhile, Singapore’s labor market is flashing similar warning lights:

* Job growth flatlined in Q1 2025

* Wage optimism is fading fast

* Businesses are cautious - they’re backfilling, not expanding

* Participation is dipping quietly under the radar

We're being gaslit by topline numbers while ignoring the structural cracks underneath. Here’s the uncomfortable truth:

⚠️ Jobs are being created - but not where we need them.

⚠️ The economy is growing - but only for some.

⚠️ Governments are celebrating - while the private sector quietly retreats.

This is policy-driven stagnation wearing a growth mask - in the U.S., Singapore, and beyond.

So to the C-suites, policymakers, and central banks:

👉 Stop pointing to headline numbers.

👉 Start focusing on labor force quality, wage resilience, and business confidence.

👉 Admit that economic narratives built on half-truths are eroding trust - fast.

Silence isn’t caution - it’s complicity.

Once again, the market misread the job report by a wide margin. The headline number shows the labor market added 147,000 new jobs. Pretty good, right? Consider that last month's numbers were so bad. The fine prints, however, show the terrible trend continues.

1. Labor participation rate declined by 0.3% from June 2024. Yet the YoY unemployment rate remains the same. So, more than 200,000 people of employment age have simply dropped out of the labor market, or given up on looking for jobs.

2. Government jobs increased by 73,000, compared to 21,000 in the same period in 2024. Why? Most college-educated folks realized that the terrible job at the local school district might be their only choice. So, the private sector only added 74,000 jobs.

3. The private sector jobs are all in low-paying fields! Finance activities and professional services both saw significant declines.

4. Total adjustments from January to April of 2025 totaled -210,000! You read it right, the total adjustment showed that the first four months over-reported 30% increases!

Context matters. The June job report is not good.

1. Labor participation rate declined by 0.3% from June 2024. Yet the YoY unemployment rate remains the same. So, more than 200,000 people of employment age have simply dropped out of the labor market, or given up on looking for jobs.

2. Government jobs increased by 73,000, compared to 21,000 in the same period in 2024. Why? Most college-educated folks realized that the terrible job at the local school district might be their only choice. So, the private sector only added 74,000 jobs.

3. The private sector jobs are all in low-paying fields! Finance activities and professional services both saw significant declines.

4. Total adjustments from January to April of 2025 totaled -210,000! You read it right, the total adjustment showed that the first four months over-reported 30% increases!

Context matters. The June job report is not good.

A surprise in the June jobs report — and it could impact everything from your mortgage to your investments.

The U.S. added 147,000 jobs last month, beating expectations. But dig deeper, and the story gets more complicated:

🔹 Most of the gains came from government hiring

🔹 Private sector job growth was just 74,000 — the weakest since October

🔹 Unemployment fell to 4.1%, but mostly because fewer people are looking for work

🔹 Labor force participation dropped to 62.3%, the lowest since 2022

This kind of mixed data — strong on the surface, soft underneath — likely takes a July interest rate cut off the table.

That means the showdown continues: President Trump is demanding sharply lower rates, while the Fed is holding its ground, saying it needs more evidence of a slowdown before making a move.

So what does this mean for you? Borrowing costs could stay higher for longer, which affects credit cards, mortgages, and stock market valuations.

📅 All eyes now turn to the June inflation report coming July 15. That will be key in shaping what the Fed does next.

What’s your take — will the Fed hold or cut this summer?

The U.S. added 147,000 jobs last month, beating expectations. But dig deeper, and the story gets more complicated:

🔹 Most of the gains came from government hiring

🔹 Private sector job growth was just 74,000 — the weakest since October

🔹 Unemployment fell to 4.1%, but mostly because fewer people are looking for work

🔹 Labor force participation dropped to 62.3%, the lowest since 2022

This kind of mixed data — strong on the surface, soft underneath — likely takes a July interest rate cut off the table.

That means the showdown continues: President Trump is demanding sharply lower rates, while the Fed is holding its ground, saying it needs more evidence of a slowdown before making a move.

So what does this mean for you? Borrowing costs could stay higher for longer, which affects credit cards, mortgages, and stock market valuations.

📅 All eyes now turn to the June inflation report coming July 15. That will be key in shaping what the Fed does next.

What’s your take — will the Fed hold or cut this summer?

The June jobs report shows a job market that is continuing to shrug off any economic headwinds. The report slightly beat expectations with payroll employment growing by 147,000 and the unemployment rate falling to 4.1%

On the flip side, private payroll growth underperformed, coming in at 74,000 jobs added. And in fact, the June beat on overall payrolls growth can be attributed to state & local education, which added 64,000 jobs, seasonally adjusted. That's likely due to smaller-than-expected summer layoffs in education, which is not the basis of a sustainable increase in the rate of job growth.

Overall, while we will always take a stronger-than-expected jobs report, it doesn't change our view that the job market is still slowing modestly.

On the flip side, private payroll growth underperformed, coming in at 74,000 jobs added. And in fact, the June beat on overall payrolls growth can be attributed to state & local education, which added 64,000 jobs, seasonally adjusted. That's likely due to smaller-than-expected summer layoffs in education, which is not the basis of a sustainable increase in the rate of job growth.

Overall, while we will always take a stronger-than-expected jobs report, it doesn't change our view that the job market is still slowing modestly.

.jpg)