Thanksgiving – and, more specifically, Black Friday – is the semi-official start of the holiday shopping season in the United States. And if history is any guide, a lot of this year’s holiday shopping will be done online, and not just on Cyber Monday.

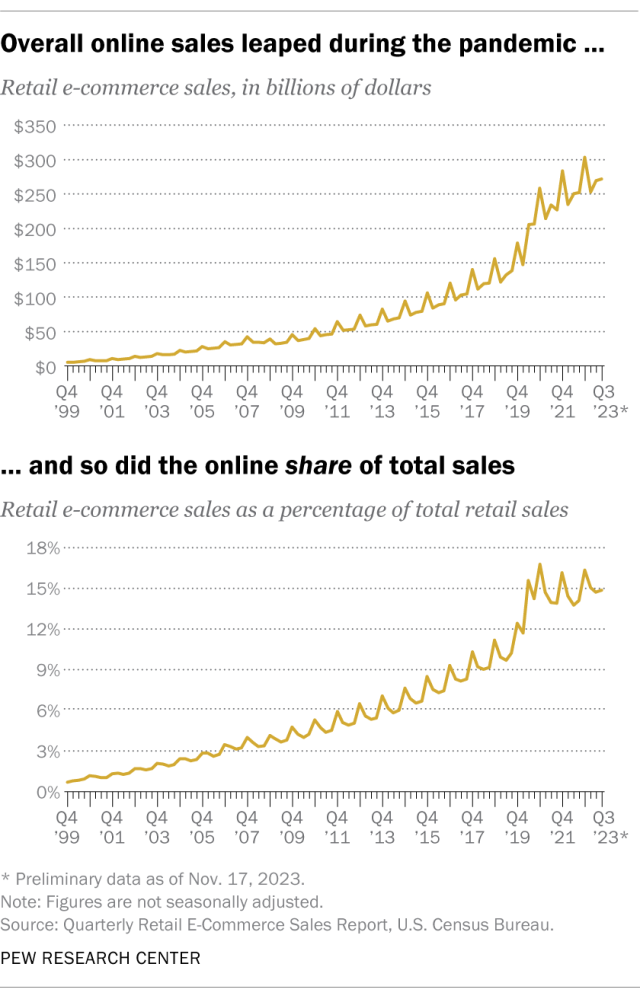

Like retail sales generally, online shopping reliably surges in the fourth quarter of every year. In 2022, for example, online sales – or, as the U.S. Census Bureau calls them, “retail e-commerce sales” – totaled $303.1 billion in the October-December period. That was 23.4% higher than the quarterly average for the first nine months of the year, which was $245.6 billion. (Figures in this analysis are not adjusted to account for seasonal variations.)

But it’s not just the dollar volume of sales that peaks in the fourth quarter – the online share of all retail sales ticks higher at year’s end, too. In the fourth quarter of 2022, for instance, online sales accounted for 16.3% of all retail sales, compared with an average of 14.1% in the first three quarters.

The fourth quarter of 2023 could be another big one for online shopping. Through the first three quarters of the year, retail e-commerce totaled $793.7 billion, or 14.9% of all retail sales.

Online sales have grown over time

Between 2000 and 2020, growth in online sales followed a predictable pattern. The online share of retail sales jumped in the fourth quarter and then fell back, but not all the way to where it had been. Then it jumped again, to an even higher level, in the fourth quarter of the following year.

By such stepwise moves, the online share of total retail sales grew from 0.7% in the fourth quarter of 1999, when the U.S. Census Bureau began tracking online sales, to 12.4% in the fourth quarter of 2019.

The COVID-19 pandemic that swept the globe disrupted that pattern, at least temporarily, beginning in early 2020. With many physical stores shuttered and millions of Americans sheltering in their homes, online sales soared. In the second quarter of 2020, for instance, e-commerce sales totaled $205.3 billion, up 55% from the $132.3 billion recorded a year earlier. In the fourth quarter of 2020, e-commerce accounted for 16.7% of all retail sales, still the record-high share.

That share fell back as stores reopened and consumers gradually resumed their old shopping habits. But the e-commerce share of all retail sales has remained well above pre-pandemic levels, suggesting that the COVID-19 outbreak gave online shopping a lasting boost. In the fourth quarter of 2022, 16.3% of retail sales were online, compared with 16.1% in 2021.

Which retailers benefit most from online sales?

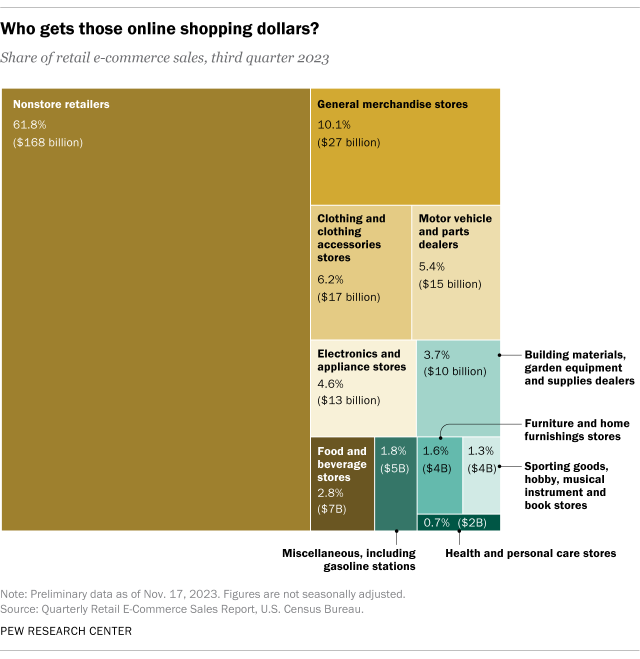

The retailers that are getting the highest share of online sales tend to be those without physical stores.

Nonstore retailers, as the Census Bureau calls them, took nearly 62% of all retail e-commerce sales in the third quarter of 2023, versus just over 59% a year earlier. E-commerce sales at nonstore retailers rose 12.4% year over year, faster than the online sales sector as a whole.

Among retailers that do have physical stores, online sales rose 8.7% at general merchandise stores, 5.1% at food and beverage stores, and 4.7% at health and personal care stores. But online sales fell 1.6% at electronics and appliance stores, 3.2% at motor vehicle and parts dealers, and 16.2% at furniture and home furnishings stores.

Where does Black Friday get its name?

For years, the claim circulated that Black Friday got its name because of its role in retailers’ profitability. The notion was that most retailers operated at a loss, or “in the red,” for most of the year and relied on holiday sales to become profitable, or “in the black.”

However, the actual origins appear to be more prosaic. Philadelphia police began calling the day after Thanksgiving “Black Friday” in the 1950s because the floods of holiday shoppers downtown made their jobs extra difficult.

More than 400 Macy's (M.N) workers in Washington state are planning a three-day strike from Black Friday through Sunday, alleging unfair labor practices and demanding better wages, according to UFCW Local 3000's website.

The union said it was planning to start the strike on Nov. 24 at 3 a.m. PT with a parade at the Southcenter Mall in Tukwila. The fourth Friday of November is one of the busiest and most profitable days of the year at the department store chain.

The strike would be at three of Macy's busiest stores and the workers are expected to return to duty from 3 a.m. PT on Monday.

Macy's did not immediately respond to Reuters' request for comment.

As of Jan. 28, excluding seasonal employees, Macy's had 94,570 full-time and part-time employees, of which about 8% are represented by unions, a regulatory filing showed. Its minimum wage for workers was $15 per hour.

The UFCW Local 3000 represents more than 50,000 members working in grocery, retail, healthcare, meat packing, cannabis, and other industries in Washington, Oregon, and northern Idaho.

Cyber Week, the five days from Thanksgiving to Cyber Monday is one of the biggest shopping periods in the U.S. where retailers try to cash in on demand from customers looking to snap up products at the cheapest available prices.

Unions representing hospitality staff in Las Vegas said on Wednesday that workers employed at Wynn Resorts (WYNN.O) have voted in favor of ratifying a new five-year contract, days after similar moves by its competitors Caesars Entertainment (CZR.O) and MGM Resorts International (MGM.N).

The unions, which represent about 5,000 employees at Wynn Resorts properties, said 99% of its members voted in favor of the new agreement.

Earlier this week, union members at Caesars and MGM voted to ratify their contracts.

The newly ratified contracts, which would apply to workers at MGM, Caesars, and Wynn, would bring in increased wages for a total of 40,000 employees and an end to the threat of a labor stoppage against casino operators that could have crippled tourism in the city.

The total compensation won by the Culinary Union for workers employed at MGM Resorts, Caesars Entertainment, and Wynn Resorts casino properties is about $2 billion over the five-year contract, according to Ted Pappageorge, secretary-treasurer at Culinary Union.

The Las Vegas unions, considered among the most powerful in the United States, said they had secured the largest wage hikes ever negotiated in their history, which would bring a 10% wage increase for every worker in the first year and a total of 32% in raises over the life of the new contract.

Meanwhile, the unions said separate negotiations for 10,000 workers including cooks, bartenders, and housekeepers, are ongoing with 24 smaller casinos and resorts for a new five-year contract.

Casino resort operators in Las Vegas have been earning record profits from a steady post-pandemic recovery.

Volkswagen (VOWG.DE) said on Wednesday that it would hike salaries for production workers at its Tennessee-based Chattanooga assembly plant by 11%, weeks after the United Auto Workers union won significant pay and benefit hikes from the Detroit Three automakers.

The German company and other non-union automakers in the U.S. have come under increased pressure to improve pay and benefits following the record contracts achieved by the UAW in late October after thousands of its members went on a six-week targeted strike.

Japanese automakers Honda Motor (7267.T) and Toyota (7203.T) have raised wages for non-union U.S. factory workers in recent weeks amid signs that the union is turning its attention to organizing the workforce at foreign-owned and Tesla auto plants.

Hyundai Motor (005380. KS) has also announced a 25% increase over the next four years for non-union production workers in Alabama and Georgia.

UAW President Shawn Fain told Reuters last week that the union was getting expressions of interest in organizing from many Tesla (TSLA.O) workers.

The Elon Musk-led company, which enjoys an operating profit advantage over other automakers, has not announced any salary hikes in the U.S.

Volkswagen's pay increase is effective from December, with a compressed wage progression timeline beginning in February.