McDonald’s on Monday reported quarterly earnings and revenue that beat analysts’ expectations as price hikes boosted its U.S. sales.

Shares of the company rose more than 2% in premarket trading.

Here’s what the company reported compared with what Wall Street was expecting, based on a survey of analysts by LSEG, formerly known as Refinitiv:

- Earnings per share: $3.19 adjusted vs. $3 expected

- Revenue: $6.69 billion vs. $6.58 billion expected

The fast-good giant reported third-quarter net income of $2.32 billion, or $3.17 per share, up from $1.98 billion, or $2.68 per share, a year earlier.

Excluding items, McDonald’s earned $3.19 per share.

McDonald’s revenue rose 14% to $6.69 billion.

Global same-store sales grew 8.8% in the quarter, beating StreetAccount estimates of 7.8%.

The company’s U.S. same-store sales increased 8.1%, fueled by strategic price increases. McDonald’s did not disclose how much its prices have risen compared with the year-ago period. The chain also credited its marketing campaigns and digital and delivery orders for its sales growth.

McDonald’s international operated markets division reported same-store sales growth of 8.3%, boosted by strong demand in the United Kingdom, Germany and Canada.

The company’s international developmental licensed markets segment, which includes China and Japan, saw same-store sales growth of 10.5%.

CEO Chris Kempczinski said in a statement that the broader economic environment is unfolding in line with the company’s expectations for the year.

United Auto Workers leaders approved a tentative deal on Sunday with Ford (F.N) that includes a pay hike of at least 30% for full-time workers and could more than double pay for others, in a victory for the union's fight to roll back 15 years of concessions.

Bargaining continued at General Motors (GM.N) without any deal. UAW President Shawn Fain on Saturday ordered a walkout at GM's Spring Hill, Tennessee, engine and assembly plant. Fain and GM CEO Mary Barra were meeting on Sunday night, sources familiar with the process said.

At Ford, the new deal includes $8.1 billion in manufacturing investments and could give workers up to $70,000 in extra pay over the 4-1/2-year life of the contract.

Cost-saving provisions such as paying workers at component plants less than employees at vehicle assembly lines were swept away under the new contract. The deal also eliminates all lower wage tier plants, an issue Fain highlighted from the start of the bargaining process.

Temporary workers will more than double their pay. Permanent workers could see top wage rates rise by more than 30% to $42.60 per hour by 2028, including estimated cost of living allowances.

In return, Ford will get the opportunity to offer an unlimited number of $50,000 buyouts to older workers earning the top rate. Ford can now replace them with younger hires who will earn less than the top wage for three years. Earlier, it took new workers eight years to reach top wage.

"It is a turning point in the class war that has been raging in this country for the past 40 years," Fain said on a video post on Sunday.

He credited the rich contract to the union's strategy of escalating pressure on Ford with a series of targeted strikes over six weeks: "This contract demonstrates the incredible power workers have when they are not afraid to use it."

The union did back off some of its early demands that included a 32-hour work week, restoring defined benefit pensions and a 40% pay rise over the life of the contract.

Starting with smaller plants, the UAW had expanded the strike to Ford's profitable Kentucky heavy-duty pickup factory. The union did the same with GM and Chrysler-owner Stellantis (STLAM.MI), reaching a tentative agreement with the latter on Saturday.

The UAW posted terms of its new contract deal with Ford after talks with local union leaders in Detroit on Sunday, before taking the deal to all union workers for ratification.

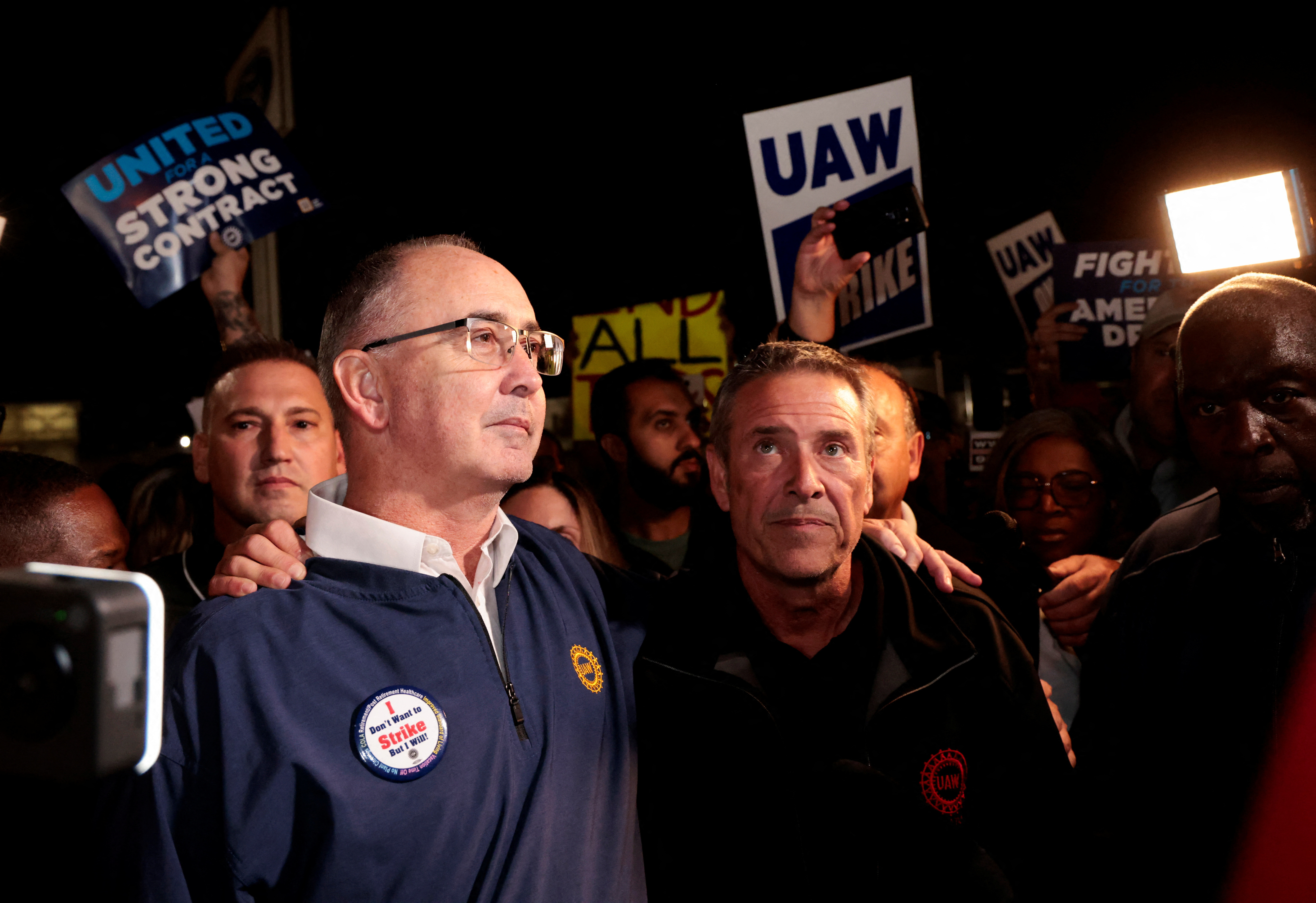

United Auto Workers union President Shawn Fain joins UAW members who are on a strike, on the picket line at the Ford Michigan Assembly Plant in Wayne, Michigan, U.S., September 15, 2023. REUTERS/Rebecca Cook Acquire Licensing Rights

TERMS OF DEAL

Ford will add electric vehicles to existing assembly plants in Louisville and Ohio, according to the UAW summary of terms, investing $1.2 billion at the Louisville assembly plant and $2.1 billion to build electric vans in Ohio.

The Ford investments include several new hybrid models, including gas-electric hybrid versions of Ford's largest SUVs, the Lincoln Navigator and Ford Expedition. Ford CEO Jim Farley has outlined plans to invest more in expanding the automaker's hybrid lineup, even as it scales back plans to expand capacity for fully electric models.

The UAW won agreements covering new battery plants that could result in thousands of new UAW members at a planned battery plant in Marshall, Michigan, and the Tennessee Electric Vehicle Center, also known as Blue Oval City, that Ford is building in western Tennessee.

Fain said that once unionized, workers at battery plants would earn the same wages as Ford assembly workers.

The UAW-Ford contract offers some of the biggest gains for some of the lowest-paid production workers.

Union leaders will now fan out to regional meetings to explain the deals to members, who will then vote on approving it.

GM WALKOUT

GM and Ford shares have fallen roughly a fifth since the beginning of the strike on Sept. 15. Stellantis shares are down just 1%.

Sources have told Reuters that one key sticking point with GM was retiree pension costs. GM has many more retirees eligible for that increase than either Ford or Stellantis, because its workforce was far larger in the 1980s and 1990s.

Fain on Saturday criticized GM's management's "unnecessary and irresponsible refusal to come to a fair agreement." GM said it was disappointed by the UAW decision to strike Spring Hill.

The Spring Hill walkout could hobble GM's large pickup production as well as assembly of other popular GM vehicles. Ripple effects from an extended Spring Hill strike could boost the costs of the stalemate for GM well beyond the $400 million a week the company reported last week.

Since the onset of the pandemic, the specter of a deep and prolonged recession has weighed heavily on business leaders. Organizations have navigated external challenges: sustained inflation, rising interest rates, a historically tight job market, and fundamental changes to workplace arrangements. For many, the question seemed to be not about if but when a recession would hit.

However, over the last several months, encouraging signs have appeared. The economy grew 2.4% in the second quarter, and while the Consumer Price Index rose slightly in September to 3.7%, core inflation (which excludes volatile food and energy prices) only increased ever so slightly, indicating that inflationary pressures appear to be steadily easing. The job market also seems to be remaining strong, with unemployment steady at 3.8%. Though borrowing costs are still rising due to the Federal Reserve’s rate increases, they are historically competitive. In short, the hope of a soft landing may be possible, if not likely.

Risk and reward

It may be time to put aside that trepidatious outlook and prepare for a sustained economic recovery. In Q3, Deloitte’s quarterly survey noted a more positive outlook among CFOs for the economy as well as for their own companies’ financial prospects and growth. The survey found that 57% of North American respondents believe the current economic conditions are good or very good, up from 34% in the second quarter of the same year.

CFOs who participated in the survey also expressed cautious interest in the use of generative artificial intelligence (AI), while noting concerns over its potential risks, as well as investment requirements for its implementation.

Although CFOs showcased an optimistic tone and positive year-over-year growth expectations, geopolitics has been their most often cited external risk for several consecutive quarters. As a result, the primary focus of companies is now cost reduction. Given the recent economic volatility, this is understandable, but reactionary strategies may not position companies for success in a recovery. To help usher in a soft landing, businesses should shift from bracing for the recession that might happen to preparing for the recovery that will likely happen.

The business case for optimism

The reasoning is simple: Bull markets last longer than recessions. On average, bull markets last 2.7 years, compared to just 10 months for bear markets. Companies that succeed during a recovery tend to enjoy many advantages. Access to capital increases as they become more attractive to investors and valuations are likely to grow. Companies can gain the reputation of being well-managed and profitable, making them more attractive to customers, partners, and employees. These are the companies that can define the decades after an economic disruption.

To stand out in a period of economic recovery, executives should consider their organizations’ long-term goals and act on them. What investments are required? What are the necessary divestments to become more agile? How can technology improve efficiency? What forecasting tools should be integrated to better understand how the business is operating?

The U.S. economy has reached an inflection point. To help usher in a soft landing, businesses should prepare for a sustained economic recovery. Strategic decisions over the next year may very well determine winners and losers for the next 10. By proactively considering long-term goals and leveraging technology and human capital, businesses can position themselves as leaders in the post-recession landscape, contributing to sustained growth and success in the future.

Germany's economy shrank slightly in the third quarter, data showed on Monday, as Europe's largest economy continues to be weighed down by weak purchasing power and higher interest rates.

Gross domestic product fell by 0.1% quarter on quarter in adjusted terms, the federal statistics office said.

A Reuters poll had forecast the economy to shrink by 0.3%.

"These data alone underline that the German economy has at least become one of the growth laggards of the euro zone," said Carsten Brzeski, global head of macro at ING.

Looking ahead, the ongoing pass-through of the European Central Bank's monetary policy tightening, still no reversal of the inventory cycle and new geopolitical uncertainties will continue weighing on the German economy, Brzeski said.

"The German economy looks set to remain in the twilight zone between minor contraction and stagnation not only this year but also next year," Brzeski said.

The contraction in the third quarter is not seen as an outlier as Commerzbank expects the German economy to contract again in the winter half-year.

"Consumption is unlikely to recover as optimists had hoped," Commerzbank's chief economist Joerg Kraemer said.

Household consumption fell in the third quarter, as high inflation continued to erode consumers' purchasing power.

Due to base effects in food and energy prices, Germany's headline CPI rate is expected to fall further in October. Inflation data will be published later on Monday.

Higher-than-forecast inflation is seen as one of the main risks by central bankers, as it could extend the tightening campaign of central banks, keeping interest rates higher for longer.

Economists will pay close attention to national inflation data from Germany and Spain, as they are published one day before the euro zone inflation data release.

Spain's European Union-harmonised 12-month inflation was at 3.5%, up from 3.3% in September.

Euro zone inflation is expected to ease to 3.2% in October from 4.3% in September, according to economists polled by Reuters.

While consumption in Germany was a drag on GDP, capital investment made a positive contribution, the statistics office said.

"The net result, however, is that Germany’s economy is now firmly stuck in the mud," Pantheon Macroeconomics' chief eurozone economist Claus Vistesen said, adding the he doubts the economy will emerge from the mud in the fourth quarter.

The statistics office, however, revised the figure for the second quarter to a modest 0.1% expansion, from stagnation.

The figure for the first quarter was revised to stagnation, from a previous contraction that had led the economy into recession. A recession is defined as two consecutive quarters of contraction in GDP.

OpenAI's chief scientist admitted that he didn't think ChatGPT was very good before its record-breaking launch.

Ilya Sutskever, OpenAI's cofounder and chief scientist, told MIT Technology Review that he was initially unimpressed by the chatbot's inability to answer questions accurately, and was taken by surprise by its explosive popularity.

"I will admit, to my slight embarrassment … when we made ChatGPT, I didn't know if it was any good," said Sutskever.

"When you asked it a factual question, it gave you a wrong answer. I thought it was going to be so unimpressive that people would say, 'Why are you doing this? This is so boring!'" he added.

Sutskever told MIT tech review that the true draw of ChatGPT was convenience, not accuracy, comparing the first time people used it to a "spiritual experience."

"That first-time experience is what hooked people," he said. "You go, 'Oh my God, this computer seems to understand.'"

ChatGPT was an instant record-breaking success when it launched late last year, reaching 100 million users in just two months and sparking a global AI gold rush as tech companies scrambled to build their own models.

It seems that no one was more surprised by that than OpenAI itself. OpenAI president and cofounder Greg Brockman told Forbes earlier this year that the startup's staff did not think the chatbot was particularly useful and were taken aback by its sudden popularity.

The AI startup was reportedly on the fence about when to release ChatGPT, and was building alternative models before ultimately deciding to launch it.

OpenAI did not immediately respond to a request for comment from Insider, made outside normal working hours.