Air travel in the U.S. has boomed in the wake of the pandemic, showing that people are no longer staying home. The problem for CEOs is they aren’t yet jetting back to the office, according to an analysis from Deutsche Bank.

In early 2020, air travel was down 95% as the pandemic took hold in the U.S., a time when only essential workers were reporting to jobs outside of their homes. But as vaccines rolled out and COVID restrictions were loosened in 2021, air travel made a resurgence.

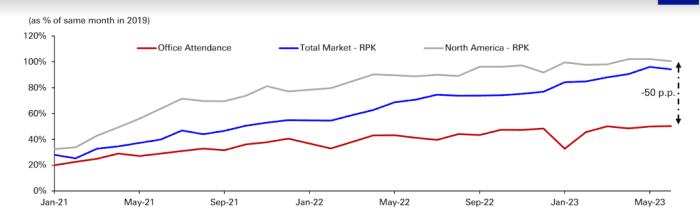

U.S. air travel this year has consistently eclipsed 2019 levels, as measured by Revenue Passenger Kilometers (see chart), an industry measurement for the number of kilometers traveled by paying customers.

Passengers are flying more than in 2019, but not returning to offices in full force.

DEUTSCHE BANK RESEARCHThe surge in U.S. air travel comes despite a 15% increase in fares from a year ago and “an increasing number of flight disruptions … that made travel an increasingly unpleasant experience for many,” according to the Deutsche Bank analysis.

Shares of Delta Air Lines Inc. DAL,

Yet office buildings still sit half empty, according to Kastle Systems’ most recent 10-city back-to-work barometer. Its weekly snapshot has been widely followed since the COVID crisis but represents only keycard swipes at buildings using its service, not all U.S. office properties.

The divergence spurred Delta Chief Executive Ed Bastian, in a recent interview with Semafor, to say of executives moaning about their struggle to get workers back in the office: “I know where they are — they’re on my airplanes!”

Delta executives said in a July earnings call that a recent corporate survey also pointed to an increase in business travel in the year’s second half.

However, an increase in corporate travel won’t necessarily dial back high office vacancy rates. A study this spring of the pandemic’s hardest-hit office buildings by commercial real-estate firm CBRE found they accounted for only about 10% of office buildings in each market it tracks, but about 80% of total occupancy lost between the first quarter of 2020 and the fourth quarter of 2022.

These buildings tended to be in downtown markets and generally in areas with higher crime rates and fewer amenities, like nearby restaurants, according to CBRE.

The team also thinks hard-hit buildings risk keeping the long-term structural vacancy rate elevated at 14.5%, from its pre-pandemic rate of about 12%.

After a brutal 2022, the S&P 500 SPX was up 14.6% on the year through Monday, while the Dow Jones Equity REIT Index XX: DJDBK was off 4% for the same stretch, according to FactSet.

.jpeg)