Debt limit talks between the White House and House Republicans stopped, started, and stopped again Friday at the U.S. Capitol, a dizzying series of events in high-stakes negotiations to avoid a potentially catastrophic federal default.

President Joe Biden’s administration is reaching for a deal with Republicans led by House Speaker Kevin McCarthy as the nation faces a deadline as soon as June 1 to raise the country’s borrowing limit, now at $31 trillion, to keep paying the nation’s bills. Republicans are demanding steep spending cuts the Democrats oppose.

Negotiations came to an abrupt standstill earlier in the day when McCarthy said it’s time to “pause” talks. But the negotiating teams convened again in the evening only to quickly call it quits for the night.

The president, who has been in Japan attending the Group of Seven summit, had no immediate public comment. But White House press secretary Karine Jean-Pierre said Biden was “still optimistic” that a deal could be reached.

“The president is confident there is a path forward,” said Jean-Pierre, but she acknowledged the difficulty of negotiations. “There’s no question we have serious differences.”

Top Republican negotiators for McCarthy said after the evening session that they were uncertain about the next steps, though it’s likely discussions will resume over the weekend. The White House publicly expressed optimism that a resolution could be reached if parties negotiated in “good faith.”

“We reengaged, had a very, very candid discussion, talking about where we are, talking about where things need to be, what’s reasonably acceptable,” said Rep. Garret Graves, R-La., a top McCarthy ally leading the talks for his side.

Another Republican negotiator, Rep. Patrick McHenry of North Carolina, was asked if he was confident an agreement over budget issues could be reached with the White House. He replied, “No.”

As the White House team left the nighttime session, counselor to the president Steve Ricchetti, who is leading talks for the Democrats, said he was hopeful. “We’re going to keep working,” he said.

Biden had already planned to cut short the rest of his trip and is expected to return to Washington Sunday night.

Earlier in the day, McCarthy said resolution to the standoff is “easy,” if only Biden’s team would agree to some spending cuts Republicans are demanding. The biggest impasse was over the fiscal 2024 top-line budget amount, according to a person briefed on the talks and granted anonymity to discuss them. Democrats staunchly oppose the steep reductions Republicans have put on the table as potentially harmful to Americans and are insisting that Republicans agree to tax hikes on the wealthy, in addition to spending cuts, to close the deficit.

“We’ve got to get movement by the White House and we don’t have any movement yet,” McCarthy, R-Calif., told reporters at the Capitol. “So, yeah, we’ve got to pause.”

White House communications director Ben LaBolt said Saturday that “Any serious budget negotiation must include discussion both of spending and of revenues, but Republicans have refused to discuss revenue.”

He added: “President Biden will not accept a wishlist of extreme MAGA priorities that would punish the middle class and neediest Americans and set our economic progress back.”

Jean-Pierre insisted Biden was not negotiating on raising the borrowing limit, despite the clear linkage in talks between securing a budget deal and raising the debt ceiling.

“It is not negotiable — we should not be negotiating on the debt,” she said.

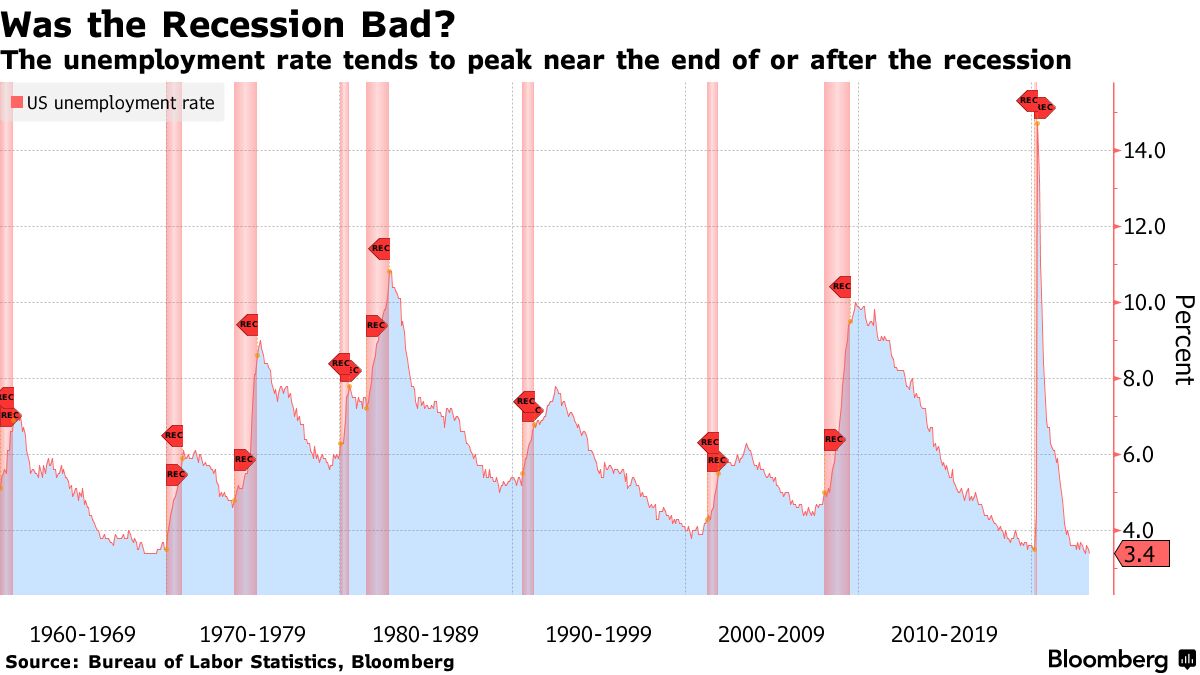

Wall Street turned lower as negotiations came to a sudden halt. Experts have warned that even the threat of a debt default would spark a recession.

Republicans argue the nation’s deficit spending needs to get under control, aiming to roll back spending to fiscal 2022 levels and restrict future growth. But Biden’s team is countering that the caps Republicans proposed in their House-passed bill would amount to 30% reductions in some programs if Defense and veterans are spared, according to a memo from the Office of Management and Budget.

Any deal would need the support of both Republicans and Democrats to find approval in a divided Congress and be passed into law. Negotiators are eyeing a more narrow budget cap deal of a few years, rather than the decade-long caps Republicans initially wanted, and clawing back some $30 billion of unspent COVID-19 funds.

Still up for debate are policy changes, including a framework for permitting reforms to speed the development of energy projects, as well as the Republican push to impose work requirements on government aid recipients that Biden has been open to but the House Democratic leader Hakeem Jeffries has said was a “nonstarter.”

“Look, we can’t be spending more money next year,” McCarthy said at the Capitol. “We have to spend less than we spent the year before. It’s pretty easy.”

McCarthy faces pressures from his hard-right flank to cut the strongest deal possible for Republicans, and he risks a threat to his leadership as speaker if he fails to deliver. Many House Republicans are unlikely to accept any deal with the White House.

The internal political dynamics confronting the embattled McCarthy leave the Democrats skeptical about giving away too much to the Republicans and driving off the support they will need to pass any compromise through Congress.

Biden is facing increased pushback from Democrats, particularly progressives, who argue the reductions will fall too heavily on domestic programs that Americans rely on.

Some Democrats want Biden to invoke his authority under the 14th amendment to raise the debt ceiling on his own, an idea that raises legal questions and that the president has so far said he is not inclined to consider.

Pressure on McCarthy comes from the conservative House Freedom Caucus, which said late Thursday there should be no further discussions until the Senate takes action on the House Republican plan. That bill approved last month would raise the debt limit into 2024 in exchange for spending caps and policy changes. Biden has said he would veto that Republican measure.

In the Senate, which is controlled by majority Democrats, Republican leader Mitch McConnell has taken a backseat publicly, and is pushing Biden to strike a deal directly with McCarthy.

“They are the only two who can reach an agreement,” McConnell said in a tweet. “It is past time for the White House to get serious. Time is of the essence.”