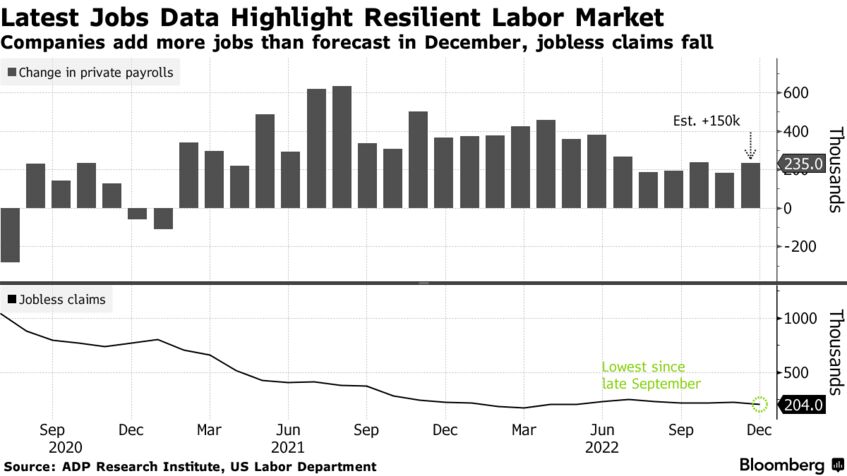

Data out Thursday reinforced the strength of the labor market, with hiring at US companies far exceeding expectations and applications for jobless benefits falling to a three-month low.

Private payrolls increased by 235,000 last month, led by small- and medium-sized businesses, according to data from ADP Research Institute in collaboration with Stanford Digital Economy Lab. The figure exceeded all but one forecast in a Bloomberg survey of economists.

Additionally, applications for unemployment benefits fell last week to the lowest since late September, according to Labor Department data. In the prior week, continuing claims for those benefits also declined.

Job gains were concentrated in businesses with less than 500 employees. The largest companies cut 151,000 workers from payrolls, the most since April 2020. Leisure and hospitality, education and health services, professional and business services, and construction led jobs growth.

“The labor market is strong but fragmented, with hiring varying sharply by industry and establishment size,” Nela Richardson, chief economist at ADP, said Thursday in a statement. “Business segments that hired aggressively in the first half of 2022 have slowed hiring and in some cases cut jobs in the last month of the year.”

The figures suggest the labor market while cooling in certain pockets, remains strong. Despite concerns of a looming recession, labor demand still far outstrips supply, keeping upward pressure on wages and giving consumers the wherewithal to keep spending. Layoffs also remain extremely low and openings are elevated.

Treasury yields spiked and the S&P 500 opened lower as investors speculated the Federal Reserve has room to keep raising rates.

What Bloomberg Economics Says...

“Layoff announcements were contained to a limited number of sectors in 2022, but we expect a broader cooling of the labor market in 2H 2023, when a recession will likely hit.”

—Eliza Winger, economist

To read the full note, click here

The ADP report also includes a fresh look at wage growth in the month, a key focus and concern for the Fed in its inflation fight. Chair Jerome Powell has pointed to wages as the main driver of price growth in services excluding housing and energy, a leading factor in his overall inflation outlook.

In a welcome sign for the Fed, the data showed a sharp deceleration in wage growth in December. Those who changed jobs experienced a 15.2% pay increase from a year ago, the lowest in 10 months. For those who stayed at their job, the median increase in annual pay was 7.3%, down from 7.6% in the prior month.

The figures precede the government’s payrolls report on Friday, which is forecast to show companies added 183,000 jobs in December and a moderation in wage growth. The unemployment rate is seen holding at a historically low level of 3.7%.

All but one region posted job growth, with the tech-heavy West shedding 142,000 positions, per ADP. Amazon.com Inc. is laying off more than 18,000 employees — the biggest reduction in its history — in the latest sign that the industry’s slump is deepening.

ADP, which updated its methodology last year, bases its figures on payroll data of more than 25 million US workers.

There are other signs that economic growth picked up at the end of the year. The US trade deficit shrank in November to a more than two-year low as imports retreated, which may provide a tailwind for the gross domestic product in the fourth quarter.