In this article on Microsoft Corporation (NASDAQ:MSFT), we would like to focus on emerging digital workplace opportunities. Microsoft as a software company has excellent know-how to capture evolving trends, such as the most recent development of web 3.0.

Unfortunately, we live in unprecedented times in modern history labeled by global pandemics and regional wars which could even evolve into World War 3. All of these negative factors have shaped our daily lives and the way we interact with our co-workers, executives, and loved ones as well.

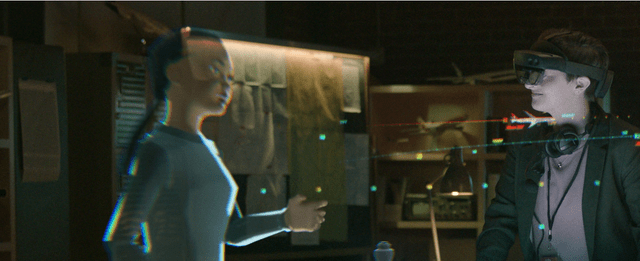

Microsoft has been investing heavily over the last decade to bring digital and real reality into a mixed reality using Microsoft Mesh and HoloLens 2 devices. Our bullish thesis is based on the fact that Microsoft is well-positioned to become one of the most important players when it comes down to the digital workplace in the metaverse. In addition, we believe that Microsoft has a competitive edge, as it can offer a complete bundle like Dynamics 365 or Office 365, which incorporates plenty of business services, that could be integrated into a digital workplace environment.

Monkeypox Pandemic and Digital Workplace Opportunity

We are on the verge of another global pandemic, as monkeypox has already been discovered in plenty of Western countries, leading to 92 confirmed infections. Therefore, Belgium has become the first country to already announce a 21-days long mandatory quarantine for all confirmed cases in the country.

Now, if monkeypox leads to even longer lockdowns, we cannot estimate how big losses for companies in traditional industries could be. In addition, there is still no information on when the vaccine for monkeypox will be developed and how much time it will take to make it commercially available on the market. Therefore, we believe that management boards of major international companies will be forced to develop a new metaverse type of digital workplace collaborations, so their employees can continue to work effectively and stay productive as a team.

Microsoft

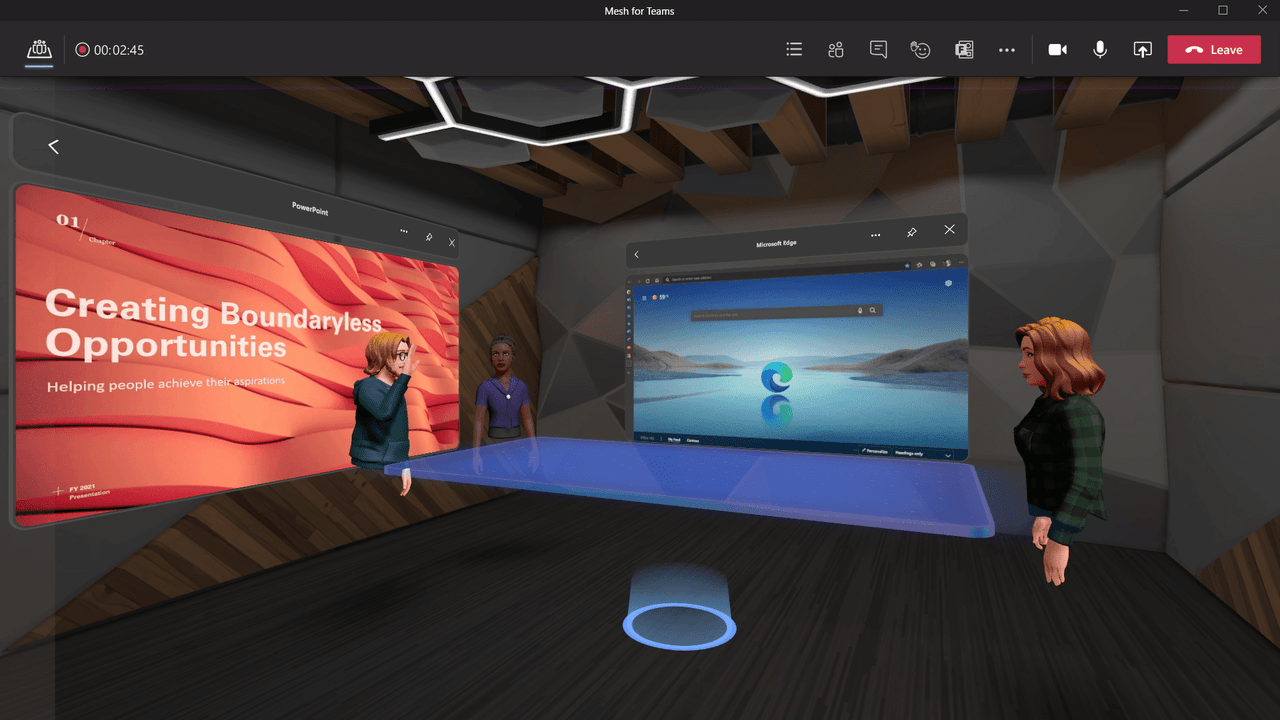

Microsoft Mesh might become an essential tool in a prolonged quarantine time to connect both the digital world (AR/VR) with the real world. In our view, an online workspace should be upgraded from commonly used 2D collaboration tools like Zoom (ZM) and Microsoft Teams into a 3D collaboration using new web 3.0 capabilities like a metaverse.

For instance, the HoloLens 2 device produced by Microsoft enables us to collaborate with our coworkers on development projects through AR/VR. One example might be in the process of brainstorming when engineers are developing a new product like an engine for Formula 1. Microsoft tools enable them together to resize a particular engine, shrink it, or even add new features or check how compatible it is within a digital twin of an F1 racing car.

We think that those companies which do not have an opportunity to implement the use of digital twins and digital collaboration of coworkers working in AR/VR to fine-tune and stress-test those twins will most likely be forced to shut down their R&D departments - or even production lines - in the case of a new wave of global pandemic-related lockdowns. In such a case, the operational loss could be even more significant, as monkeypox has the potential to be more devastating than a COVID-19 pandemic. Therefore, MSFT has been very proactive in selling its Dynamics 365 bundle to provide customers with a digital workplace automated solution in one place.

“Businesses like Heineken and Siemens are turning to Dynamics 365 to drive and deliver more consistent and personalized customer engagement and service. We are leading innovation in new industrial metaverse to help companies optimize their operations using technologies such as IoT, digital twins, connected spaces and mixed reality applications.”

(Source: MSFT’s Q3 22 Earnings Call)

We could hear in mainstream news how many companies were facing difficulties to meet their fixed costs and some the operational costs during lockdowns as their revenues dropped by more than 80%. One such example: is major airline providers like Australian Qantas.

There were also stories of how many employees were facing Zoom burnout during the initial wave of lockdowns due to the COVID-19 pandemic. We find it increases the degree of work monotony by just watching our coworkers in small windows in Zoom or Microsoft Teams conference calls. So, Microsoft Mesh together with HoloLens 2 device might minimize the digital burnout of workers.

In our view, it is way easier and more interesting to work in a 3D environment, where we can move things around with our hands and speak with our coworkers, as we see them in a group around the table as avatars. Furthermore, it brings a bigger sense of being part of a community and a team, thus limiting the negative impact of loneliness, when working remotely alone from your home.

Microsoft

Some people might be reluctant to stare at avatars at the beginning, but Microsoft has been working hard to bring holographic impressions of a real person in Microsoft Mesh as soon as possible. That could have a significant impact on international business travel, as there would be no more need to travel to Asia to see our coworkers. We could see them almost as real people in holographic form in front of us in our digital office. This becomes quite useful, especially now, when we face a reasonable risk of a new global pandemic leading to more potential global lockdowns and restrictions on trade and business travel.

We believe that those companies, which will be able to make such a digital workspace as realistic as possible, will have a clear competitive advantage against those who are using a more traditional pre-pandemic approach to work. In addition, for the largest players in the new WEB 3.0 digital workplace world, there lies a huge commercial opportunity to develop new digital products and services, which didn't exist before.

For instance, in the case of Microsoft, it can develop an online marketplace for digital clothes or other items so we can make our avatars in the metaverse look more formal. In that case, Microsoft would be able to collect a commission of, let's say, 10% or 20% on all digital units sold through its metaverse-related marketplace. They could even develop their own crypto coins and blockchain for payments in such a marketplace, which might bring an additional revenue stream.

Furthermore, it could even sell digital land to its business clients in the metaverse, so employees could have a feeling that they work in a large financial center like NYC or within an HQ of a large tech company like Apple (AAPL) or Google (GOOG) (GOOGL). In our view, it brings a lot of new creative opportunities to make a digital workplace a completely different thing, which could prompt more employees to work remotely permanently. If that would lead to better operating results and productivity within a company, we are quite sure that business clients would be willing to spend chunks of money to bring that kind of realistic digital workplace for their employees into their homes.

However, some of our readers would start to question, what would that mean for existing corporate real estate leases or all the equipment for which the company has already paid or taken a loan. We believe that both the traditional way of working, the pandemic 1.0 Zoom type of work, and a new metaverse and AR/VR type of work could co-exist. Even though we have developed plenty of new digital services on the Internet over the past three decades, people do still use the regular posts to send mail, read newspapers in physical forms or listen to Radio, which has been present for over a century.

Therefore, companies would most likely change their budgeting policies to maybe invest more in digital workplace solutions like Microsoft can offer instead of building new offices or production plants in key areas. Nonetheless, whenever some secular trend opportunities arise, there are plenty of competitors that want to take a chunk of it.

Market Dynamics of the Digital Workplace

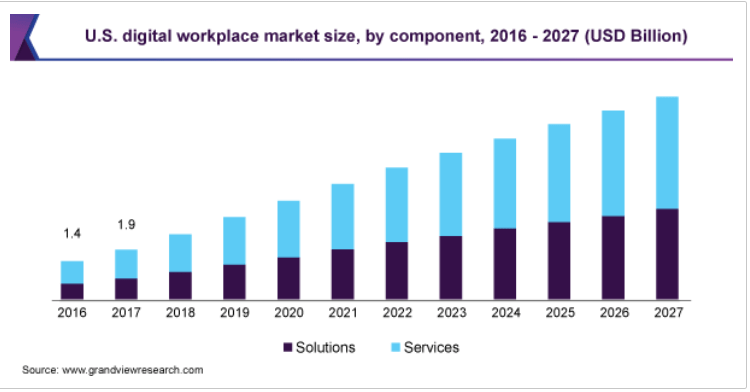

GrandWire Research

According to the report produced by Grand View Research, the digital workplace market is expected to grow at a CAGR of 11.3% from 2020 to 2027. That brings up around $54 billion in total addressable market potential in 2027. Some of the notable companies in the digital workplace market include International Business Machines (IBM), Zoom, Facebook/Meta Platforms (FB), Google, Apple, Microsoft, NTT Data Corporation (OTCPK:NTTDF), Tata consultancy services, etc. In our view, there is enough marketplace available for each individual player and there is no need to go into a fierce competition to end up as the sole winner.

We see it more in a way that major providers like Microsoft or Google would try to bring their existing customers into the digital marketplace in a metaverse and offer them a bundle of their existing products to use there:

“Our comprehensive approach reduces complexity and costs. Microsoft 365 customers can save as much as 60% compared to a patchwork of single-point identity, productivity, collaboration and meeting solutions. Teams usage has never been higher.”

(Source: MSFT’s Q3 22 Earnings Call)

For instance, in the case of Microsoft, employees could use Office 365 to see excel data sheets in metaverse as a group. Later they could maybe pay for some add-on features if they want special calculations or different types of data visualizations. The same could be said for other largest providers like Apple, Google, or IBM. That is also one of the reasons why there should not be a steep pricing war and the persistent threat of competition stealing your customers.

We believe that most companies use certain solutions & products for a prolonged period of time and will most likely try to stick with them even during Web 3.0 evolution. For example, using Microsoft products like Office 365 within a Google metaverse might not be compatible at all. Therefore, companies might have a difficult time changing all existing Microsoft solutions and products for open source like Linux-based ones.

Financials

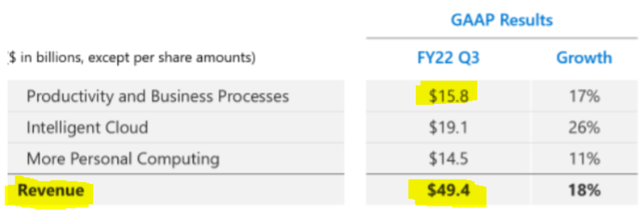

Microsoft quarterly earnings

According to the figure above, the productivity and business processes segment and intelligent cloud segment make up around 32% and 39% of Microsoft total revenue, respectively. It is now difficult to predict the exact revenue of Microsoft Mesh and other digital workplace-related products and services utilizing Web 3.0 features over the next 5 - 10 years. But we do expect they could be major secular growth drivers leading to a higher CAGR than expected in both the Intelligent Cloud segment - as people would need larger cloud subscriptions to store more complex and data-extensive projects as well as more advanced and costly productivity and business processes solutions.

Microsoft quarterly earnings

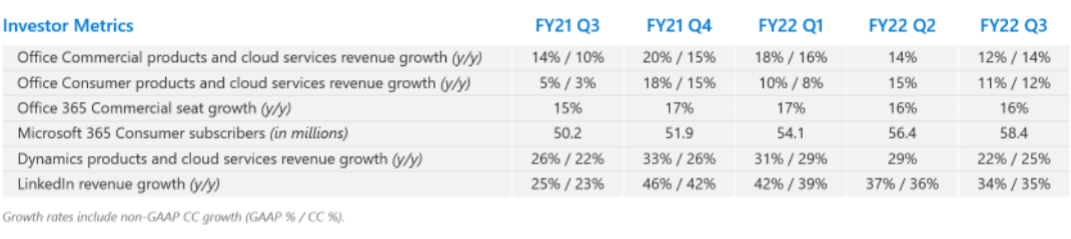

According to the figure above, we can notice that office commercial and consumer products with related cloud services have managed to reach around 14% y/y growth over the last couple of quarters. In addition, Microsoft was even able to increase the number of Microsoft 365 subscribers from 50.2 million to 58.4 million between Q3 21 and Q3 22, which makes up a growth rate of roughly 16% y/y.

Based on this data, we can see that Microsoft still has a lot of room to grow its number of Microsoft 365 subscribers even further, which could be primarily driven by the increased number of customers using the digital workplace in augmented reality and metaverse. For instance, if we estimate that its number of Microsoft 365 consumer subscribers will grow with a CAGR of approximately 11.4% (digital workplaces estimated CAGR in market dynamics part), then it could reach 100 million subscribers within 5 years. This is a very noticeable result even for a company of such size.

Microsoft quarterly earnings

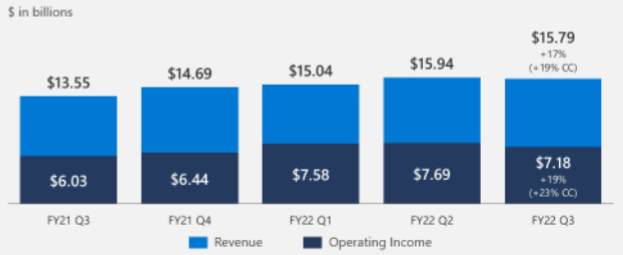

Another very important factor to take a look at is earnings elasticity, as the company might grow in revenue but should also improve its earnings as it scales up. In the case of earnings of the productivity and business processes segment, it went up from $6.03 to $7.18 between Q3 21 and Q3 22, which makes up a growth rate of 19% yo/y, compared to a revenue growth rate of 17% within the same time period. This clearly proves that Microsoft is capable of increasing its earnings as it grows in size in its key segments. That makes it an interesting stock for long-term holders looking to take advantage of compounding interest over time.

Technical Analysis And Valuation

finviz

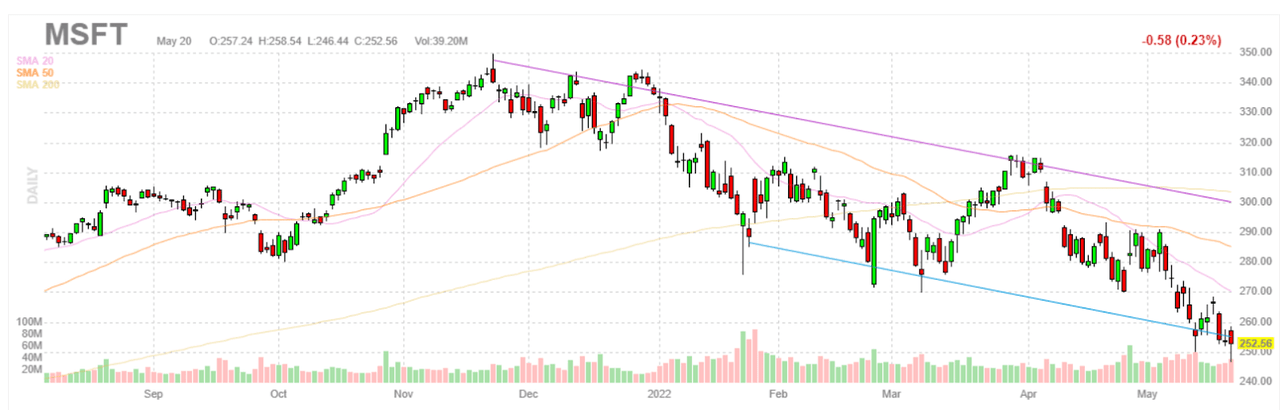

According to the figure above, MSFT has been trading in the downward tunnel year to date. We can see at the price level of $250, the stock is basically at the lower trendline and should act as important support. In case should the stock price breaks down through this support level, then the next key short-term target would be an important psychological level of $200 per share.

ycharts

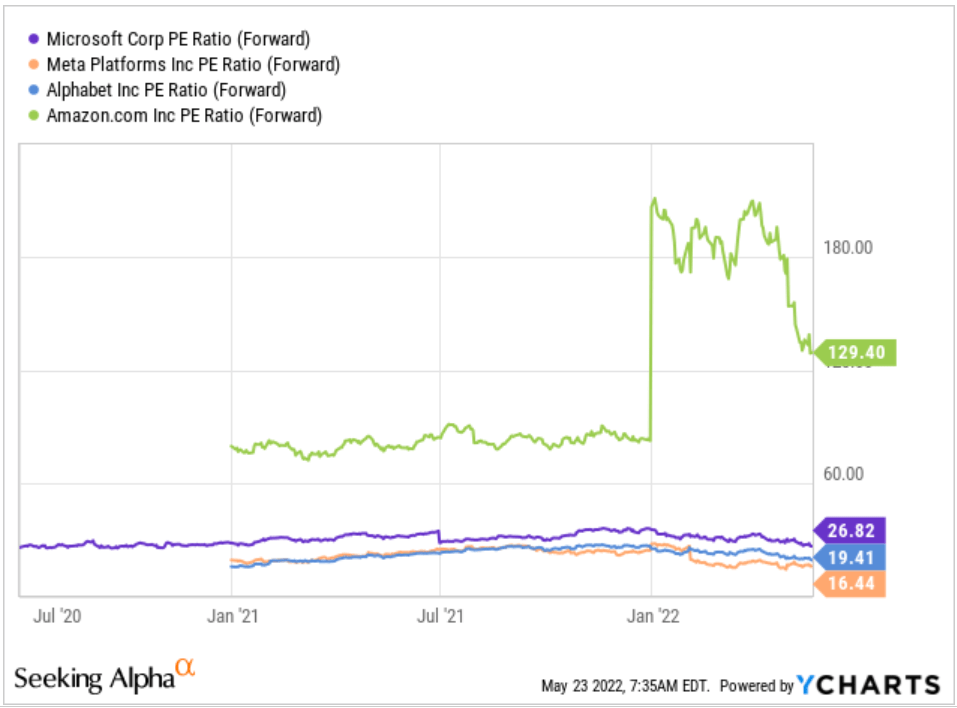

We like to use a simple forward P/E model, given that Microsoft is predominantly a software company, which makes it have solid margins and a simple business model compared to some capital intensive industries like industrial or energy conglomerates. Currently, Microsoft is trading at the forward P/E of 26.82, which is still quite high for our taste. Wall Street analysts have commented that the most recent sell-off in tech stocks is basically coming down to shrinking overstretched valuations, which have been present by the end of 2021.

Based on our technical analysis view, if the stock price reaches $200, then it would trade at forwarding P/E 21.2, taking into account the consensus estimate of $9.42 per share, as used by YCharts calculations. That is still slightly higher than the current forward P/E of Microsoft’s key competitors Google and Amazon (AMZN) of approximately 20. If we do another scenario analysis, to take the long-term 20 Y historical forward P/E of the S&P 500 of 15.5, then at the previous forward EPS estimate we would get a target price of roughly $146 per share. That is approximately 60% lower than the all-time high of $349.67, which could present a reasonable entry point for investors who are looking to buy the dip.

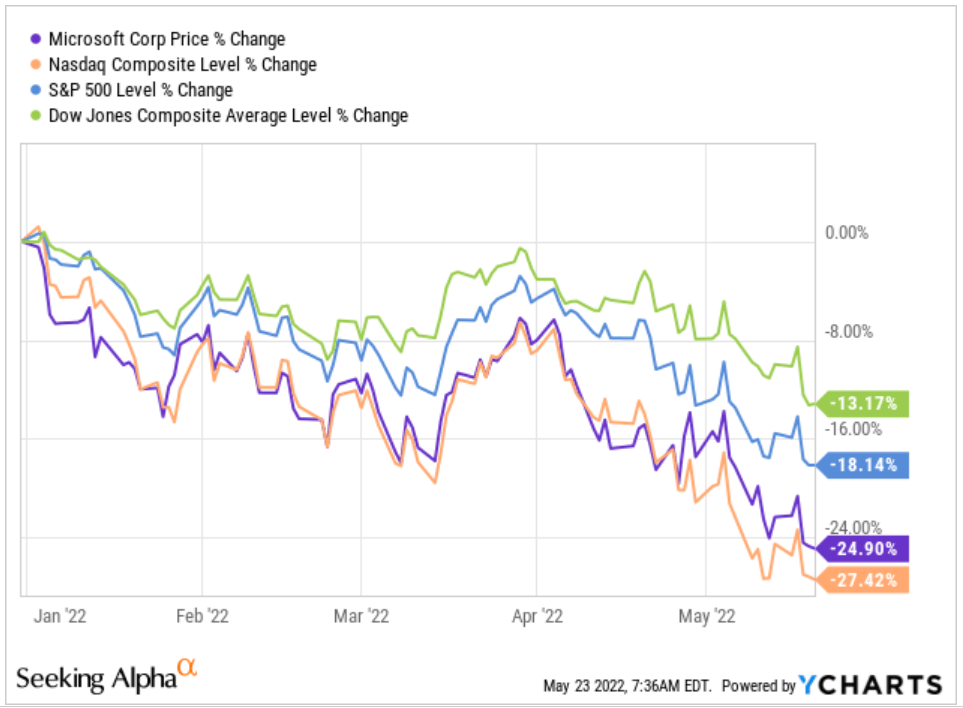

ycharts

According to the figure above, MSFT has outperformed the Nasdaq 100 Index (QQQ) by reaching 252 bps lower stock price % change drop year to date. However, it has performed relatively poorly compared to the S&P 500 index (SPY) and Dow Jones Industrial (DJI). A 25% drop puts Microsoft in bearish territory. Therefore, we believe that the coming weeks will be of crucial importance for the future trend of Microsoft; whether it can bounce back sharply and reach a new all-time high driven by strong operating results and business model, or begin a technical correction of key tech companies that puts even stronger downward pressure on the stock price performance.

To sum it up, we do advise our readers to be very careful when looking for short-term trading opportunities in the currently volatile markets. Furthermore, if buying the dip now at more favorable valuations compared to six months ago, investors should be aware of the risk that the stock prices may drop even further. For longer-term investors who are comfortable with the current stock price and believe in Microsoft’s management, products, services, and digital workplace opportunities, the current stock price might be irrelevant if they are willing to hold the stock for more than 15 or 20 years.

Key Risks

Whenever a new secular trend arises, plenty of companies begin to invest heavily beforehand to gain a competitive advantage already at the start. One such example in recent history might be the failure of CNN+, which could not create a strong subscription base for its newly adopted streaming service.

"In a complex streaming market, consumers want simplicity and an all-in service which provides a better experience and more value than stand-alone offerings, and, for the company, a more sustainable business model to drive our future investments in great journalism and storytelling," Discovery's streaming boss J.B. Perrette said in a statement.

(Source: CNN)

After a month, the service was forced to shut down its operations and get a taste of what it means to be too late in evolving digital industries. CNN wants to diversify away from its traditional cable and news business into a new digital streaming service.

Something like that could also happen to Microsoft if it fails behind its key competitors like Facebook, Amazon, Apple, or Google. Therefore, we see as a key risk a potentially saturated market, with plenty of competitors in the digital workplace in the metaverse.

Another noticeable risk might be the fact that employees might find AR/VR boring, annoying, or just not be willing to watch avatars around the virtual 3D table the entire day. Therefore, they might prefer to stick with their pandemic habits like using Zoom calls or Microsoft Teams virtual conferences in 2D.

In our view, the Metaverse should be a completely new thing without a clear set of previous regulatory or legal frameworks. Therefore, regulators might step in to prevent certain digital workplace development features. For instance, Microsoft might plan to feature some digital workplace services using blockchains globally, and regulators might find a legal issues regarding the data transfer or privacy issues of end-users. This could end up as a big obstacle for Microsoft's global expansion ambitions, as it would be forced to deal with regulators in each country or continent separately.

Conclusion

We are long-term bullish on Microsoft as a stock, primarily driven by the digitization of business processes and increased demand for cloud services to store, capture, and analyze the vast amount of data businesses consume and create these days. However, based on the most recent developments in the U.S. stock market leading to sharp selloffs of major tech stocks and the entire NASDAQ 100 index, we think that MSFT stock price remains under severe pressure in the short run.

Therefore, we assign a HOLD rating as of this moment. Furthermore, the current forward P/E ratio of 26.82 is above its key peers Amazon and Google, as well as above the historical 20 Y S&P 500 ratio. Therefore, we believe that a more reasonable current forward P/E could be between 15-20, leading to an approximate target price range between $140-200.