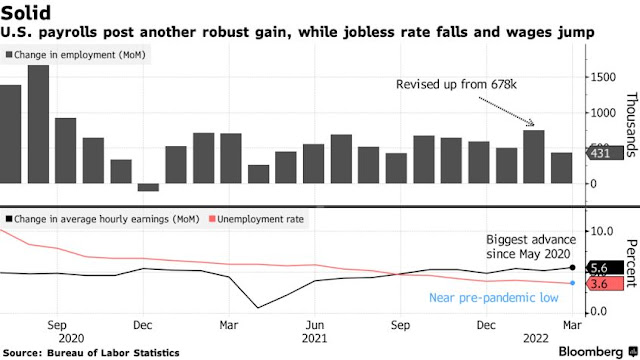

U.S. job growth continued at a brisk clip in March, with the unemployment rate falling to a new two-year low of 3.6% and wages re-accelerating, positioning the Federal Reserve to raise interest rates by a hefty 50 basis points in May.

The Labor Department's closely watched employment report on Friday also showed employment in professional and business services, financial activities and retail sectors were now above pre-pandemic levels. It underscored solid momentum in the economy as it faces headwinds from inflation, tighter monetary policy as well as Russia's war against Ukraine, which is further straining global supply chains and adding to price pressures.

Fed last month raised its policy interest rate by 25 basis points, the first hike in more than three years. Policymakers have been ratcheting up their hawkish rhetoric, with Fed Chair Jerome Powell saying the U.S. central bank must move "expeditiously" to hike rates and possibly "more aggressively" to keep high inflation from becoming entrenched.

"The Fed is focused on the unemployment rate," said Chris Low, chief economist at FHN Financial in New York. "Brace for more aggressive tightening rhetoric."

The survey of establishments showed that nonfarm payrolls increased by 431,000 jobs last month. Data for February was revised higher to show 750,000 jobs added instead of the previously reported 678,000. Overall employment is now 1.6 million jobs below its pre-pandemic level.

Economists polled by Reuters had forecast payrolls increasing by 490,000. Estimates ranged from as low as 200,000 to as high as 700,000.

Demand for hiring is being driven by a sharp decline in COVID-19 infections, which has resulted in restrictions being lifted across the country. There is no sign yet that the Russia-Ukraine war, which has pushed gasoline prices above $4 per gallon, has impacted the labor market.

The broad increase in payrolls was led by the leisure and hospitality industry, which added 112,000 jobs. Professional and business services payrolls increased by 102,000 jobs. Employment in the sector is now 723,000 jobs higher than before the pandemic. Retailers added 49,000, lifting the level of employment 278,000 higher than in February 2020.

LABOR POOL INCREASING

Financial activities employment grew by 16,000 and is now 41,000 above its pre-pandemic level. Manufacturing payrolls increased by 38,000 jobs and is yet to recoup all the jobs lost during the pandemic. Construction employment is now back at its pre-pandemic level, with 19,000 jobs added in March.

With a near-record of 11.3 million job openings on the last day of February, payrolls growth is likely to remain solid this year. The labor pool continued to steadily increase in March.

The household survey, from which the unemployment rate is derived, showed 418,000 entered the labor force last month. That was more than offset by a 736,000 surge in household employment. As result, the unemployment rate dropped two-tenths of a percentage point to 3.6%, the lowest since February 2020.

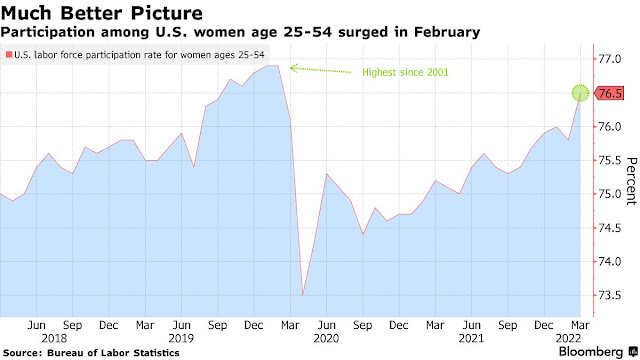

The labor force participation rate, or the proportion of working-age Americans who have a job or are looking for one, rose to 62.4% from 62.3% in February.

With workers still scarce, average hourly earnings increased 0.4% after edging up 0.1% in February. That lifted the annual increase to 5.6% from 5.2% in February.

The employment report further dispelled financial market fears of a recession following slight inversions of the widely tracked U.S. two-year/10-year Treasury yield curve this week.

Economists said the Fed's massive holdings of Treasuries and mortgage-backed securities made it hard to get a clear signal from the yield curve moves. Some noted that real yields remained negative, while others argued that the two-year/five-year Treasury yield curve was a better indicator of a future recession. This segment has not been inverted.

.webp)