If you are a serial impulsive spender like me, these tips can make 2022 your best financial year.

You don’t have to look far to be bombarded with marketing. Companies pushing a lifestyle rather than a product — so easy to get sucked into.

I realized I was spending a small fortune on things I didn’t need or want.

I started making changes at the beginning of January, and I am already seeing results. So I wanted to share my insights and tips with anyone else out there who may benefit.

1. No Spend Days

This one is far more productive than you may think.

At the beginning of the week (if I do it monthly I won’t stick to it), I decide on 4 no-spend days. If I pass a shop and consider popping in for a fresh sandwich and hot coffee— whoops sorry no can do it’s a no-spend day.

If I see a 50% off sale online enticing me in with those demanding red banners and inbox infiltrations — “ah shucks not today” it’s against the rules.

They may only be my rules, but they are rules nonetheless.

I am the kind of person who needs discipline, or I become an out-of-control impulse buying maniac.

2. Weekly Allocations

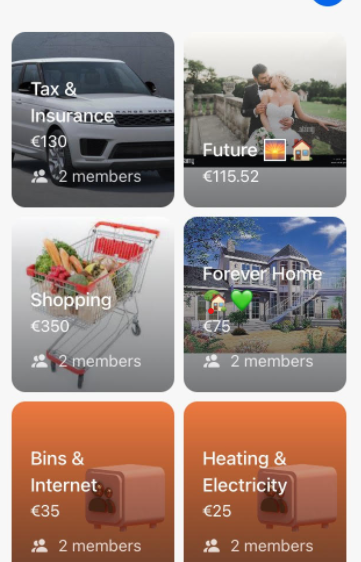

Every week I will allocate money from my budget into various categories. Some people use cash envelopes, I use Revolut.

I set up several Vaults like so:

- Rent/ Mortgage

- Heating and Electricity

- Internet and Bins

- Car Tax and Insurance

- Back to School

- Rainy Day Fund

- Treat Fund

Each week I’ll allocate a certain amount to each vault so that when those ugly bills pop their head up, I am better prepared.

It’s also important to have a “fun” vault, for treating yourself to a takeaway or new outfit, otherwise, you won’t stick at it too long.

Another great feature of Revolut Vaults is that you can add additional members and save simultaneously.

Ideal for couples paying bills and saving for the future!

3. Ban Emotional Spending

“I’ve had a hard day, I deserve it”,

“I’ve had a great day, I deserve it”

“I had some sort of day, I deserve it”

Classic signs of emotional spending — Watch out for this bad boy.

When you are in a high emotional state (hungry, angry, upset, excited) DO. NOT. PURCHASE.

Make it a rule: do not buy anything when your emotions are running high, it’s one thing marketing targets heavily (because it works).

If you learned to curb this habit you could save a small fortune by the end of the year.