British factory activity grew for the fourth month in a row in September, though more slowly than in August, and the sector cut the fewest jobs since before the COVID-19 lockdown, a survey showed on Thursday.

The IHS Markit/CIPS manufacturing Purchasing Managers’ Index (PMI) came in at 54.1. That was down a touch from a preliminary reading of 54.3 and below August’s two-and-a-half-year high of 55.2, but well above the 50.0 thresholds denoting growth.

“Output and new orders increased as new work intakes improved from both domestic and overseas markets,” IHS Markit said, pointing to more companies reopening after the lockdown and staff returning to work from temporary layoffs.

Britain’s economy is recovering from its COVID-19 lockdown more quickly than predicted by the Bank of England and other forecasters, although it probably remains as much as 10% smaller than before the pandemic, BoE Governor Andrew Bailey has said.

The pace of the bounce-back is expected to slow in the coming months as the government scales back its job subsidies and seeks to clamp down on rising COVID-19 cases.

But Thursday’s PMI survey for the manufacturing sector - which accounts for about 10% of Britain’s economy - showed little sign of a slowdown in September.

The steepest increase in output was in intermediate goods, typically a sign that companies are investing in more equipment, and confidence was close to July’s 28-month high.

“However, there were also increased numbers of firms noting uncertainty about the path ahead, particularly regarding COVID-19 and Brexit,” Markit said.

Jobs were lost for the eighth month in a row but at the slowest pace since February.

As demand picked up and raw materials became more expensive, the cost of inputs rose at the fastest pace in 21 months, leading manufacturers to raise their selling prices again.

H&M plans to close hundreds of stores next year as the coronavirus crisis drives more shoppers online, the world’s second-biggest fashion retailer said on Thursday, after reporting a smaller than expected drop in third-quarter profit.

H&M, which over decades expanded its network of shops around the world, will aim to cut their number by a net 250 next year, representing 5% of its current network.

H&M has been shutting more stores and opening fewer over the past couple of years as it adapts to the online shift that is driving more competition. The retailer said earlier this year its net number of stores would decline already in 2020.

The company also said sales had continued to recover in September from the impact of the virus.

Chief Executive Helena Helmersson said: “Although the challenges are far from over, we believe that the worst is behind us and we are well placed to come out of the crisis stronger.”

Rival fashion retail groups have also seen a recovery, with market leader Inditex, the owner of Zara, reporting a return to profit in its May-July quarter.

“Overall, Q3 is a better quarter than expected and we think H&M continued to manage well what they could directly influence,” analysts at JPM said in a note.

“We think that the market is still not fully appreciating the improved quality of the H&M business model and infrastructure. We think instead that this set of results is further proof that H&M turnaround is still very much well on track.”

H&M’s shares were up 6.0% at 0804 GMT.

The Swedish company’s pretax profit fell to 2.37 billion crowns ($265.6 million) in its fiscal third quarter, from a year-earlier 5.01 billion. Analysts polled by Refinitiv had on average seen a 2.03 billion crown profit.

H&M had already flagged that the profit would land at around 2 billion crowns helped by cost cuts as it recovered more quickly than expected.

In the March-May quarter, the pandemic had pushed H&M into a steep loss, its first in many decades, as sales halved.

H&M said its September sales were down 5% year-on-year in local currencies after they fell 19% in the three months through August.

Of more than 5,000 stores worldwide, 3% remain temporarily shut against around 80% at the height of lockdowns, it said.

H&M, which has struggled for years to stop a rise in inventories, said those were unchanged from a year earlier. Markdowns increased half a percentage point, and H&M predicted they would grow 1-1.5% in the current quarter.

Unemployment rose for a fifth straight month in Europe in August amid concern that extensive government support programs won’t be able to keep many businesses hit by coronavirus restrictions afloat forever.

The jobless rate rose to 8.1% in the 19 countries that use the euro currency in August, up from 7.9% in July, official statistics showed Thursday. Some 13.2 million people were unemployed and the number of those out of work rose by 251,000.

Economists expect a further rise as wage support programs expire, while an increase in infections in many countries has increased fears that some restrictions on business interaction may have to be re-imposed.

Some 3.7 million people are still on furlough support programs in Germany, the eurozone’s largest economy. The government has extended its emergency support through the end of 2021. National governments have poured in fiscal stimulus in the form of support loans and guarantees for business, while the European Central Bank has launched a 1.35 trillion euro ($1.57 trillion) monetary stimulus in the form of regular bond purchases with newly printed money through at least the middle of next year. That has helped keep financial markets calm and credit flowing to businesses.

But all those measures have not halted a wave of corporate announcements of job reductions. Companies in the hardest-hit industries such as airlines, tourism, and restaurants may face a long period of substantially diminished demand for their services and are laying off workers. The coronavirus in some cases has also accelerated restructuring programs that existed before the pandemic.

A quarter of women are considering leaving the workforce or scaling back on their career aspirations because of the extra demands created by the Covid-19 pandemic, according to the annual study of women in the workplace released Wednesday by McKinsey & Company and LeanIn.Org.

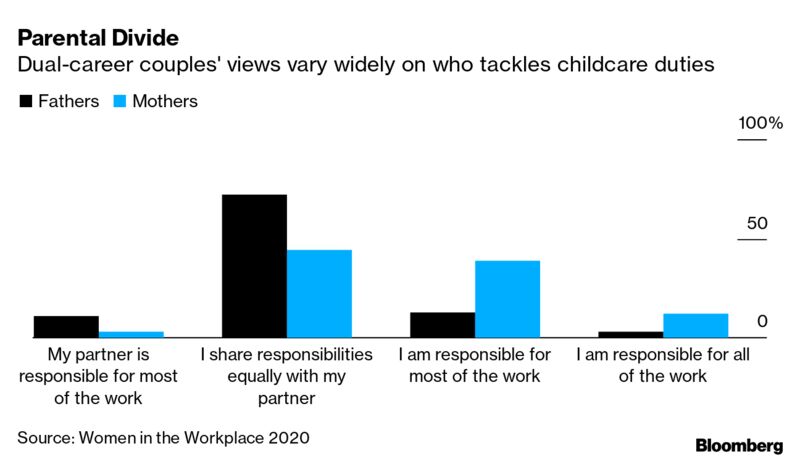

Working mothers are three times as likely as working fathers to be handling a majority of housework, and the disparity is particularly onerous for Black women, according to the Women in the Workplace report, which surveyed more than 40,000 employees at 317 companies. The study also found that senior-level women are more likely than male peers to feel burned out, in part because they are often among few women at their level and they are more likely than younger workers to be parenting.

“If we had a panic button, we'd be hitting it,” Sheryl Sandberg, chief operating officer of Facebook Inc. and co-founder of LeanIn.Org, said in a statement. “Leaders must act fast or risk losing millions of women from the workforce and setting gender diversity back years.”

The setback comes after women, who make up about half the U.S. workforce, had been making progress. Between 2015 and 2020 the share of women in senior vice president roles rose to 28% from 23% and women have secured about 21% of C-suite roles up from 17% five years ago, the McKinsey/LeanIn.org study found. Women also hold 28% of the board seats in the S&P 500, the highest level ever.

These setbacks—characterized by some economists as the nation’s first female recession—are in contrast to the gains women made after the 2008 recession. Participation among women ages 25 to 54 peaked in 2000, then dipped after the financial crisis, only to begin accelerating again from 2015 until the pandemic.

Even before the coronavirus hit, women continued to lose ground at the early stages of their careers, according to the study. For every 100 men promoted into management, only 85 women are elevated, and that drops to 71 for Latinas and 58 for Black women.