Germany expects the economic devastation caused by the COVID-19 pandemic to be less severe than originally feared this year, but it now sees a weaker rebound for Europe’s largest economy next year, two sources told Reuters on Tuesday.

The government revised upward its economic forecast for 2020 to a decline of 5.8% from a previously expected slump of 6.3%, said two people with knowledge of the figures.

Still, this would be the biggest plunge since the end of World War Two. During the world financial crisis, the German economy contracted by 5.7%.

For 2021, the government revised downward its growth forecast to an expansion of 4.4% from its previous estimate of 5.2%, said the two people who both spoke on condition of anonymity.

This means the German economy will not reach its pre-pandemic level before 2022.

An economy ministry spokesman declined to comment.

Economy Minister Peter Altmaier will present the updated outlook later on Tuesday (0900 GMT) after the economy suffered its worst recession on record in the first half of the year.

The updated GDP forecast will form the basis of tax revenue estimates, which the finance ministry is expected to update next week, and with them the 2021 budget, which Finance Minister Olaf Scholz is expected to present later this month.

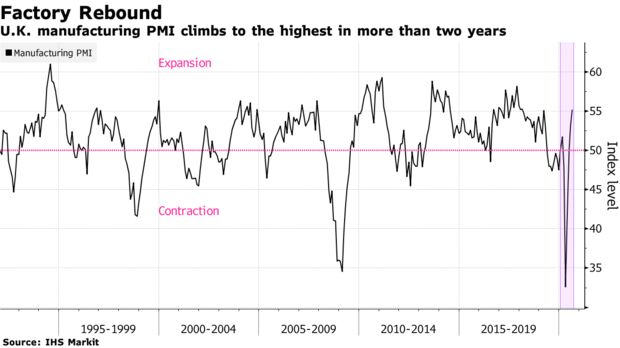

U.K. factory output expanded at the quickest rate in more than six years as firms ramped up operations following the nationwide Covid-19 lockdown.

IHS Markit’s measure of production posted its highest reading since May 2014. The overall manufacturing Purchasing Managers Index climbed to 55.2 in August, the highest in more than two years and well above the 50 marks indicating expansion.

Britain is emerging from the worst economic slump in centuries after the coronavirus brought activity to halt in the second quarter. The question now is how well the rebound can be sustained as government support programs taper and firms adjust to the new reality.

The unemployment rate has risen again in the eurozone as the impact of the coronavirus pandemic continues to be felt. Official figures Tuesday put the jobless rate in the region at 7.9% for the month of July.

It comes after the eurozone logged a revised unemployment rate of 7.7% in June. Tuesday’s numbers show a deteriorating picture but are still below the record high seen in the midst of the sovereign debt crisis.

The euro area has been grappling with a severe economic recession in the wake of the coronavirus pandemic. The 19-member economy contracted by 12.1% in the second quarter of the year following strict lockdown measures to prevent further contamination. The contraction was the worst since records began in 1995, according to Eurostat.

To revamp the economy, the wider European Union agreed in July to tap financial markets and raise 750 billion euros ($898 billion) to be invested in programs across the region. The plan is currently being scrutinized by European lawmakers, who are expected to greenlight it before the end of the year. The first funds are not planned to be released until 2021.

In the meantime, governments in the EU need to put together a draft document stating how they will be using these funds. Their programs will then have to be approved by the majority by the other EU governments.

In addition to EU-wide and national fiscal efforts, the European Central Bank is buying government bonds which is keeping sovereign funding costs low. This is part of its 1.35 trillion euro pandemic emergency purchase program, which is set to last at least until June 2021.

Euro area #inflation down to -0.2% in August 2020: food +1.7%, services +0.7%, other goods -0.1%, energy -7.8% - flash estimate https://t.co/MA7NFEKqz6 pic.twitter.com/qsgRJlxdbA

— EU_Eurostat (@EU_Eurostat) September 1, 2020

Euro area #unemployment up to 7.9% in July 2020 (7.7% in June). EU up to 7.2% https://t.co/uoinT7AHjm pic.twitter.com/QPgXxzhKEe

— EU_Eurostat (@EU_Eurostat) September 1, 2020