The survey, conducted in the US, Germany, and India, also shows that there is a significant appetite for flexible ways of working among employees, as well as increased openness to this from managers. As working methods become increasingly remote or hybrid in the wake of the COVID-19 pandemic, a key question for companies is how to maintain and improve this productivity in the workplace of the future.

While employees were working on collaborative tasks (such as exchanges with coworkers, working in teams, or interacting with clients), the number was lower, though still more than half—51%—of all respondents said they have been able to maintain or improve their productivity. This applies across geographic areas and both to employees working remotely and to those onsite. “It turns out that social connectivity is a critical element of what enables us to be productive when collaborating in the workplace,” said Debbie Lovich, a BCG managing director, and senior partner. “So, for any company looking to adapt to new virtual or hybrid virtual/onsite workplaces, promoting virtual social connectivity between colleagues is going to be critical.”

Key Factors for Enhancing Productivity

When analyzing the data, BCG found four factors that correlate with employees reporting continued or even enhanced productivity on collaborative tasks: social connectivity, mental health, physical health, and workplace tools.

Of these, social connectivity emerged as the most powerful force. Respondents who reported satisfaction with social connectivity with colleagues are two to three times more likely to maintain or improve their productivity on collaborative tasks as those who are dissatisfied with this (for mental and physical health and workplace tools, it is about twice as likely).

Employees who experience satisfaction or doing better on all four factors are almost five times as likely to say they have felt able to maintain or improve productivity on collaborative tasks as those who are dissatisfied or doing worse on at least three factors.

A New World of Work

Equally striking in the data is evidence of a seismic shift in the way employees are thinking about their workplace, which is important for how companies recruit and retain talent. In the survey, 60% of employees said they want some flexibility in where and/or when they work. “In the future, we’ll see an increasingly distributed workforce in a workplace whose physical footprint will have shifted beyond recognition and will serve very different needs,” said Adriana Dahik, a BCG managing director and partner.

What all this means for employers is that they will have to work to implement new systems, norms, and technologies that will enable them to continue to support and increase workplace productivity. Key interventions include:

· Identifying ways to maximize social connectivity among employees—whether work happens face to face or remotely

· Creating awareness, tools, and benefits that support the mental and physical health of all employees

· Investing in and building capabilities to use the technologies, tools, and systems that enable employees to work and collaborate remotely

· Measuring employee productivity in conjunction with employee perceptions

· Ensuring that the transitions between respective team norms for onsite and remote are as smooth as possible, giving employees a cohesive experience that feels designed, not random

“While COVID-19 has caused great personal, health, and economic hardship, it has also presented a once-in-a-lifetime opportunity to reinvent the workplace,” said Lovich. “And doing so will be essential if companies are to meet employee desires for flexibility while harnessing their potential for productivity and remaining competitive when it comes to recruiting and retaining the best talent.”

Those that get it right will not only position themselves for business success—they will also enable everyone to contribute to the creative, innovative, collaborative, and productive workplace of the future.

We always need to be careful with economic numbers. What matters isn't in fact what they are but the reason why they are what they are.

As an example, as we entered lockdown the purchasing manager's indices seemed to be indicating that not all that much bad was happening. Which was odd as we could look out the window and see that lots bad were happening. It took some digging around in the explanations to work out why this was. The answer is the way they were constructed.

They're really a series of correlations with the thing we're interested in, economic growth. That's fine, but correlations don't always work out the same way. In the PMI case, they registered an increase in delivery times as a market of increased growth. Fair enough in normal times, if everyone's too busy to deliver on time then we probably are in a growth spurt. But when half the economy (I exaggerate) is closed because of a pandemic inspired lockdown it could be that rising delivery times are an indication of people being closed, not busy. As the compilers of the PMIs agreed after they'd thought about it for a bit.

They understated the slowdown because of this delivery time thing. And now, as lockdown is ending and delivery times are falling they're - slightly at least - understating the recovery.

This isn't about that at all. It's just to use that as an example of the care we must take over economic statistics. They're never just a number. We need to know why the number is as it is to decide about it. For example, ricing productivity is normally a good thing. At present, it's bad.

Productivity

Paul Krugman is on record as saying that "Productivity isn't everything but in the long run it's pretty much everything". By which he means that labour productivity, over that long term, is really the only important measure of what living standards are going to be. Productivity here is being measured as the value of output per hour of human labour put in. Which becomes obvious really, the greater the value being produced by each hour of labour then the greater the value that can be consumed from each hour of labour. Since our living standard is what we can consume it all ties together.

So, overtime at least, we want labour productivity to increase for this is the same thing as stating that we're all getting richer. Except this isn't always true:

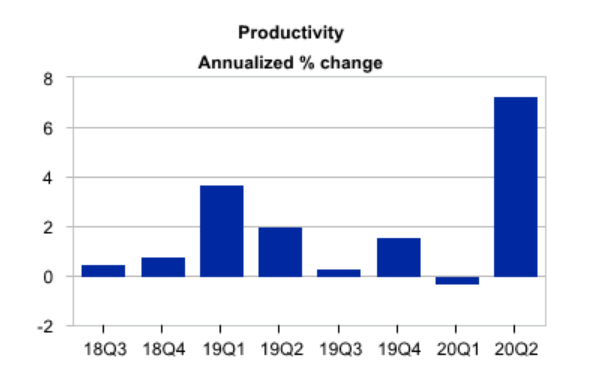

Nonfarm business sector labor productivity increased 7.3 percent in the second quarter of 2020, the U.S. Bureau of Labor Statistics reported today, as output decreased 38.9 percent and hours worked decreased 43.0 percent. (All quarterly percent changes in this release are seasonally adjusted annual rates, and show what the percent change would be if the quarterly rate continued for four quarters.) In the four quarters from the second quarter of 2019 to the second quarter of 2020, productivity increased 2.2 percent, reflecting an 11.8-percent decrease in output and a 13.7-percent decrease in hours worked.

In normal times we'd be overjoyed with that increase in productivity. We'd regard it as very good news indeed for both the economy and profits - and thus stock prices.

(US labour productivity from Moody's Analytics)

(US labour productivity from Moody's Analytics)

The things are this is not a good thing. Sure, it's nice that productivity rose but why? Because lots of people are out of work.

This is going to sound a little political but it's not - it's just noting the same mistake. We're often told that people in France, or Germany or wherever are more productive than American workers. This is because - and take your pick of the political reasons put forward - American companies don't invest but only payout to shareholders, or because of paid childcare, or national health care, or cultural differences, or training and so on. All might indeed have their effects but one significant reason is that in the US we tend to have everyone employed. In Europe, the least productive workers don't have jobs at all. And our measurement of productivity is based only upon those in work, not the population as a whole.

Which is what has happened in the US. A lot of people are now out of work and as these things go it's the least productive who have been fired first. So, the measured productivity of those still in work rises.

Further, it's been those low productivity services - restaurants, hairdressing etc - that have really carried the brunt of the job losses. It's not just the least productive workers, it's the least productive sectors that have been hardest hit. And so recorded labour productivity rises.

This is really just background for us, part of the general education. The same economic number - rising productivity - can be a good thing or a bad thing. As with rising delivery times. We need to know why a number is moving the way it is as well as how it's moving.

The detailed point here is that we shouldn't take the current rising productivity as being a positive spin for stock prices.

JOLTS

We've also recently had the JOLTs report and this shows the US labour market - slowly - returning to normal:

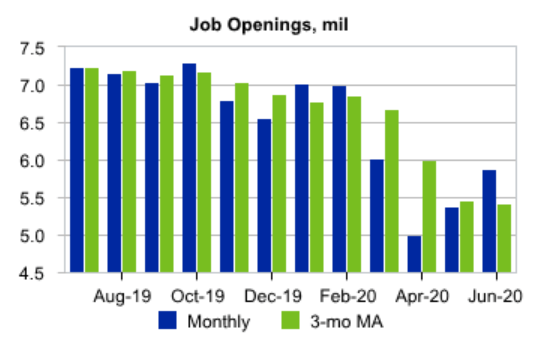

The number of job openings increased to 5.9 million on the last business day of June, the U.S. Bureau of Labor Statistics reported today. Hires decreased to 6.7 million in June, but was still the second-highest level in the series history. The largest monthly increase in hires occurred in May 2020. Total separations increased to 4.8 million. Within separations, the quits rate rose to 1.9 percent while the layoffs and discharges rate was unchanged at 1.4 percent.

And:

(Job openings from Moody's Analytics)

(Job openings from Moody's Analytics)

Rising job vacancies - although clearly still well below the number of unemployed - is a good sign. But the one I always pay most attention to is "quits". This is the number of people feeling confident enough to leave a job. If everyone is cowering in terror at the difficulty of gaining another one then no one does quit. A rising quits rate is an excellent sign of rising confidence in the jobs market.

We're not there yet, we're not back to normal. But things are moving in the right direction.

My view

As I continually explain I expect a V-shaped recovery, relatively swift and getting us back close at least to where we were. I am actively looking for statistics - no, not claim about them, but actual numbers - which will disprove this thesis. I'm not finding them yet.

The investor view

The market indices are about right for that relatively swift and V-shaped recovery back to roughly where we were then carrying on in the normal manner from there. Finding numbers which disprove this would indicate a significant move downwards. Numbers which support the thesis only do not disprove it.

Our macroeconomic indicators are not giving us any clear investing plan at present. We're stuck with having to do microeconomic investing, in specific companies and situations.