In 2020, the U.S. student loan debt burden rose to $1.56 trillion spread across 45 million borrowers. According to Forbes, student loan debt is the second-highest consumer debt category behind mortgage debt.

The average student loan burden per person is about $32,000.

That doesn’t seem that bad when you compare it to the $500,000 I’ve managed to accumulate.

At least I managed to be in the top 1% of something, right?

How Did I End Up in This Mess?

My educational journey plays out as follows; 4 years of undergraduate education, a 1 year Master’s degree program, and 4 years of medical school, which combined, costs enough to buy an upper-middle-class home in a quaint suburban neighborhood. My experience is not unique. Students hoping to become doctors or lawyers often fork up massive amounts of money to achieve their goals.

According to the American Medical Association, the average loan burden of graduating medical students is $201,490. So how did I end up with twice that amount?

Part of it is from a lack of guidance. I’m a 1st generation immigrant, 1st generation college-student, 1st generation medical student, and a 1st generation doctor. I went through higher education with little to no guidance and relied on my own perseverance in pursuit of my passion.

I didn’t even take the expensive route. My undergraduate institution was private, but I enrolled with a merit scholarship for most of my 4 years, which drove the cost to under $50,000 for my B.S. in physiology.

The cost skyrocketed during my Master’s and medical school education. Each year costs nearly $100,000, including tuition and living expenses. Since I have no income and no family capable of helping to cover costs, I have to do everything through loans. This is where the difference between my $500,000 in loans compares to the $201,490 national average.

But I’m perfectly content with my situation. I’m living comfortably and plan to pay off my loans without putting a strain on my lifestyle.

What Are My Options?

Throughout my graduate school education, I decided to take out the maximum amount of loans each semester. Student loans are flexible. While the interest rates are high, the difference in total payback between a $460,000 loan and a $500,000 loan is negligible in the long run. But by taking out the maximum amount, I was able to live comfortably, without counting every penny and limiting my experiences.

Some may frown on that notion, but becoming a doctor has taken me 9 years. I was not willing to live on ramen, eggs, rice, and beans, for that long while studying and working 18 hour days. If the government allowed me to take out more money than my bare minimum, then I did.

Furthermore, I was able to build up a savings cushion. If my family or I had an emergency, I had funds to survive. It’s essential to have that capability, even if the funds are loans.

Now that I’m in my last year of medical school getting ready for my a paying job as a resident physician, how am I going to pay the debt?

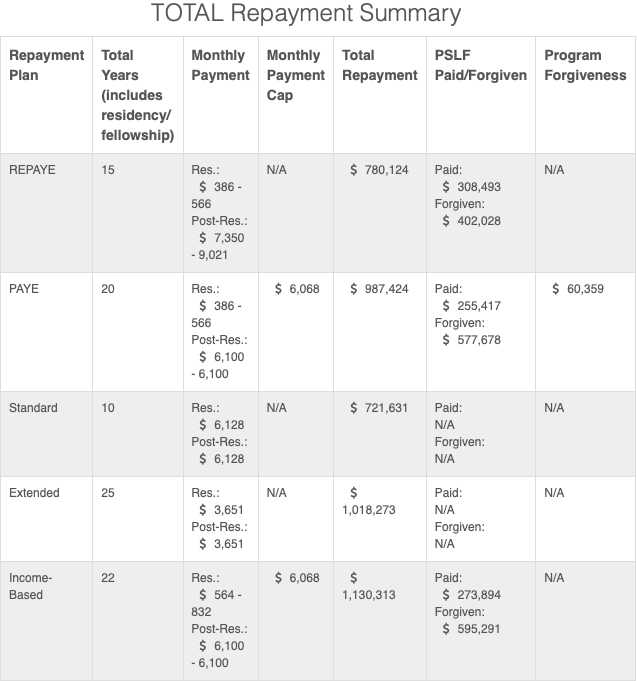

Well, unfortunately, resident physicians don’t make a substantial amount. The average starting salary is between $58,000 — $62,000. According to the standard, 10-year repayment plan, my payment would be $6,128 per month. That’s impossible.

After-tax, my net monthly income is $3,907, so how am I supposed to afford $6,128?

This is where federal student loans become a great deal. The federal government has devised 3 different repayment programs to help people like me afford student loans while our earning potential is low. These programs are the Income-Based Repayment (IBR), Pay-As-You-Earn (PAYE), and Revised-Pay-As-You-Earn (REPAYE).

REPAYE is my best option. As a resident making approximately $4,000 per month, I can quite easily afford a $500 loan payment. It seems like a good solution, right?

Not quite. Paying only $500 per month for 7 years (the length of my residency), means that my student loans will continue to grow even though I’m paying. The interest rate of 6–8% on all of my loans gets compounded yearly. Even though I’ll start paying on a sum of $468,000 at the start of my residency, I’ll have $585,820 in loans at the end of 7 years (see chart below).

How big is your shovel?

It’s hard to predict what my salary will be after I complete my residency. Still, most doctors bring home a significant amount. Although I dug myself a large hole with loans, I’ll have a substantial shovel to dig myself out. This is the most critical consideration to make when taking out student loans. I would never have taken $500,000 in student loans with 8% interest if I knew that my earning potential was low.

Plugging in my projected salary into the table above, I will be paying $7,350 — $9,021 per month for an additional 8 years after residency. That seems like a lot, and it is, but my “shovel” will be considerably bigger, allowing me to live comfortably and pay the debt. My goal is to continue living a resident’s life for a couple of years and pay off my outstanding debt as soon as possible.

What Could I Have Done Differently?

There are a million different situations to play out. The most significant difference that I could’ve made is to have gone to my home state’s medical school, which would have meant drastically lower tuition.

However, being accepted to medical school is extremely competitive. With over 5,000 applicants for approximately 100 seats at most schools, you can see the odds of acceptance being slim.

Another option was to enroll in a military scholarship during medical school. The military will pay for all tuition, provide a signing bonus, and pay a monthly stipend. It sounds like a deal too good to be true. It’s an incredible deal if you have your heart set on serving the U.S. in the military, but that’s just not me. Additionally, it would mean less chance that I would end up in the specialty I desire, and that I would serve 5–7 years after my residency. Furthermore, the military pays its physicians far less after completion of training, making the overall deal less appealing.

I could’ve applied to scholarships. Believe me, I tried. They’re time-consuming, difficult to receive, and most of the time is for a sum that would be negligible with the number of loans I carry.

Why I’m Okay With My Situation

I planned my path early. I entered college, knowing that I wanted to be a neurosurgeon. I have never taken my mind off of the idea since day one.

Yes, I have a lot of loans, but I’ve lived a comfortable life throughout my 20s, and I have the pleasure of doing what I love every day. That’s worth the investment.