Federal law offers extra weeks of unemployment benefits to out-of-work Americans during the coronavirus pandemic, but the jobless may have to reapply in order to get them.

The CARES Act, a federal coronavirus relief law enacted in March, offers up to 13 additional weeks of jobless benefits through the Pandemic Emergency Unemployment Compensation program.

That means individuals can get about three more months of benefits once they exhaust their standard state allotment, which generally lasts for 26 weeks. The average American gets about $380 a week.

The additional aid expires after the end of the year. (This is a different program than the one paying an extra $600 a week through July 31.)

But many Americans will have to reapply for those extra weeks of benefits instead of receiving them automatically, according to the Labor Department.

“For some reason, the [Department of Labor] has taken the position that people have to file for the additional PEUC benefits,” said Michele Evermore, a senior policy analyst at the National Employment Law Project.

Delays?

More than 850,000 unemployment recipients are in the midst of collecting their extra 13 weeks of benefits, according to Labor Department data.

The PEUC program typically provides the same amount of state aid an individual had been receiving in the prior tranche of benefits. The pay would also include a $600-a-week supplement being funded by the federal government through July 31.

Many more people will likely join the ranks of PEUC participants in the coming weeks.

Florida and North Carolina, for example, pay up to just 12 weeks of standard benefits — meaning workers in those states who started collecting benefits in the early days of the pandemic may soon need the extra 13 weeks of aid.

Re-applying could mean delays in aid for some recipients, depending on how smooth the application process is, Evermore said.

Many Americans who lost their jobs at the outset of the coronavirus pandemic had to wait more than a month to receive their unemployment pay amid a historic surge in applications.

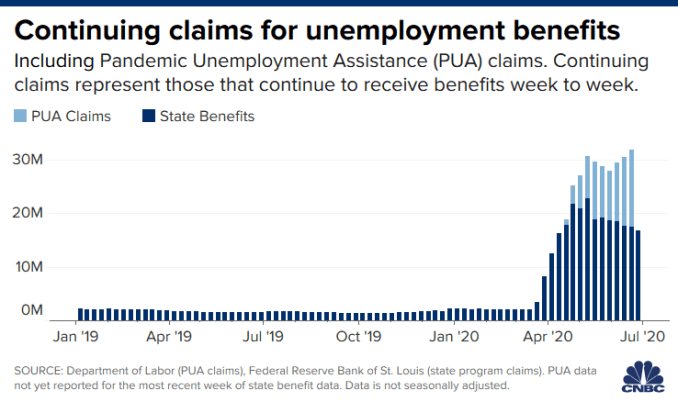

Nearly 33 million people were collecting unemployment benefits as of June 20, according to the Labor Department. By comparison, it was about 2 million people in February.

States appear to have gotten a better handle on speedier processing of unemployment applications, though. And the Labor Department requires states to notify individuals who are potentially eligible to apply.

Vetting the application for an extended duration of benefits may prove relatively easy for states, Evermore said, since they would have previously determined an individual’s eligibility for standard unemployment aid.

However, it doesn’t appear that all states are requiring another application, despite the Labor Department’s position that they need to.

Pennsylvania, for example, automatically starts paying the extra 13 weeks of benefits after workers exhaust their standard state allotment, according to the state’s unemployment website.

Extended benefits

Nearly all states currently offer additional weeks of benefits through their respective “extended benefits” programs.

These extended benefits are triggered during periods of high state unemployment, and generally offer another 13 or 20 weeks of jobless aid.

These benefits become available after federal PEUC benefits expire, according to the Labor Department.

In New York, for example, an unemployed individual could get up to 59 total weeks of benefits — 26 weeks of standard state benefits, 13 weeks of PEUC benefits, and 20 weeks of extended benefits.

Some states may also require individuals to reapply for these extended benefits.

Oregon, for example, requires people to apply by telephone, according to the state Employment Department.

However, the state acknowledges on its website that it may be “difficult” to reach a representative given “these times of extraordinarily high call volume.”

Americans who received enhanced unemployment benefits due to the coronavirus pandemic spent more than when they were working, a study released on Thursday said, adding to concerns about a steep fall in spending when the emergency benefits expire.

The $600 weekly supplement added to jobless benefits as part of the CARES Act helped unemployed households spend 10% more after receiving benefits than they did before the pandemic, according to research by the JPMorgan Chase Institute.

Researchers analyzed transactions for 61,000 households that received unemployment benefits between March and May. Spending dropped for all households as the virus spread and led to business shutdowns, but then rose when households began receiving jobless benefits, the study found.

That contrasts with a typical recession when households receiving unemployment benefits usually cut spending by 7% because regular jobless benefits amount to only a fraction of a person’s prior earnings, the research found.

The analysis highlighted how the additional unemployment benefits are helping to prop up the U.S. economy and consumer spending after the pandemic led to a surge in joblessness across the country.

More than 30 million Americans are estimated to be receiving unemployment benefits - and they could be pushed off an income cliff when the supplemental benefits, which are due to expire at the end of July, are withdrawn.

“Our estimates suggest that expiration will result in large spending cuts, with potentially negative effects on both households and macroeconomic activity,” the researchers wrote.

The data also reflected the financial pain faced by households that encountered big delays in collecting benefits after states across the country were overwhelmed by applications.

Households that had to wait several weeks for their first unemployment check to arrive cut spending by about 20%, the study found. Spending recovered after the checks arrived.