In the early ’80s, I worked at an investment bank in the Deep South. From the beginning, the biggest shock to my system was the language. I don’t mean cursing per se, but there is a sort of vulgar, sometimes crude dialect that is unique to trading.

Back then, ‘sexual harassment’ wasn’t part of the lexicon — the term ‘diversity’ wasn’t a thing.

As the sole newbie and the only Black person on the trading floor, some of the things I heard in the workplace made my jaw hit the floor. Fortunately (or not), trading floors are more politically correct now.

So when I watched how the financial pundits and the stock market reacted to the May jobs report, a phrase I haven’t thought of for years immediately popped into my head:

The Dead Cat Bounce.

Now before you unfollow, unsubscribe, or otherwise cancel me for not being politically correct, let me explain.

I have nothing against cats. One of my two rescue cats is staring over my shoulder at this very moment as if he’s judging me for repeating the term. I am a firm believer that you don’t f*uck with cats.

I wasn’t alone in my assessment. Austan Goolsbee, former chairman of Obama’s Council of Economic Advisors, had the same thought.

The Dead Cat Bounce is a term of art in trading used to describe a small, short-lived recovery, or bounce, in a stock or the stock market in general.

To give cat lovers a less disturbing mental picture, instead, imagine yourself dropping a basketball from the roof of a ten-story building.

When the ball hits the pavement, it bounces, but not to the roof. Maybe it bounces as high as the third floor, but one thing’s for sure, it never gets back up to the tenth floor.

When I look at the jobs report, it tells me that this is what is happening in our economy. A Dead Cat Bounce.

I’ve been at this for a while, but I’ve never seen a report quite like this. According to the latest numbers from the Bureau of Labor Statistics (BLS), the country added 2.5 million payroll jobs in May, the largest increase ever.

The jobless rate fell to 13.3%, down from 14.7% in April. Most economists expected it to rise to as much as 20%.

As you might expect, the stock market took off because these numbers beat expectations. According to Jim Cramer, and his colleagues on CNBC, the unemployment number was evidence the recession was over — in three months. ‘Could this be the beginning of a V-shaped recovery?’ they asked. Unsurprisingly, President Trump was even more over the top.

All the hoopla was incredible, given that the 14% jobless rate is worse than at any time during the 2008 financial crisis.

Now, I am not an economist, but I spent a career analyzing economic reports like this. Also, I can read. So let me sum up my thoughts on the cheerleading pundits this way:

The President is wrong. Jim Cramer is wrong. They all are wrong. Dead wrong. As wrong as two left shoes.

The TV pundits didn’t read the fine print

When the BLS releases economic reports, they usually contain revisions to the prior month, due to the accumulation of additional data over time.

The May BLS release contained a significant revision for April. From February 16th to March 14th, the economy lost 1.4 million jobs before the lockdowns even started. These organic job losses were the result of canceled meetings, travel, etc. as people proactively stopped venturing out of their homes.

Black unemployment jumped to 16.8%, the highest in more than a decade, and for Latinos, it was even higher at 17.6%. But here’s the most significant oversight on the part of financial media:

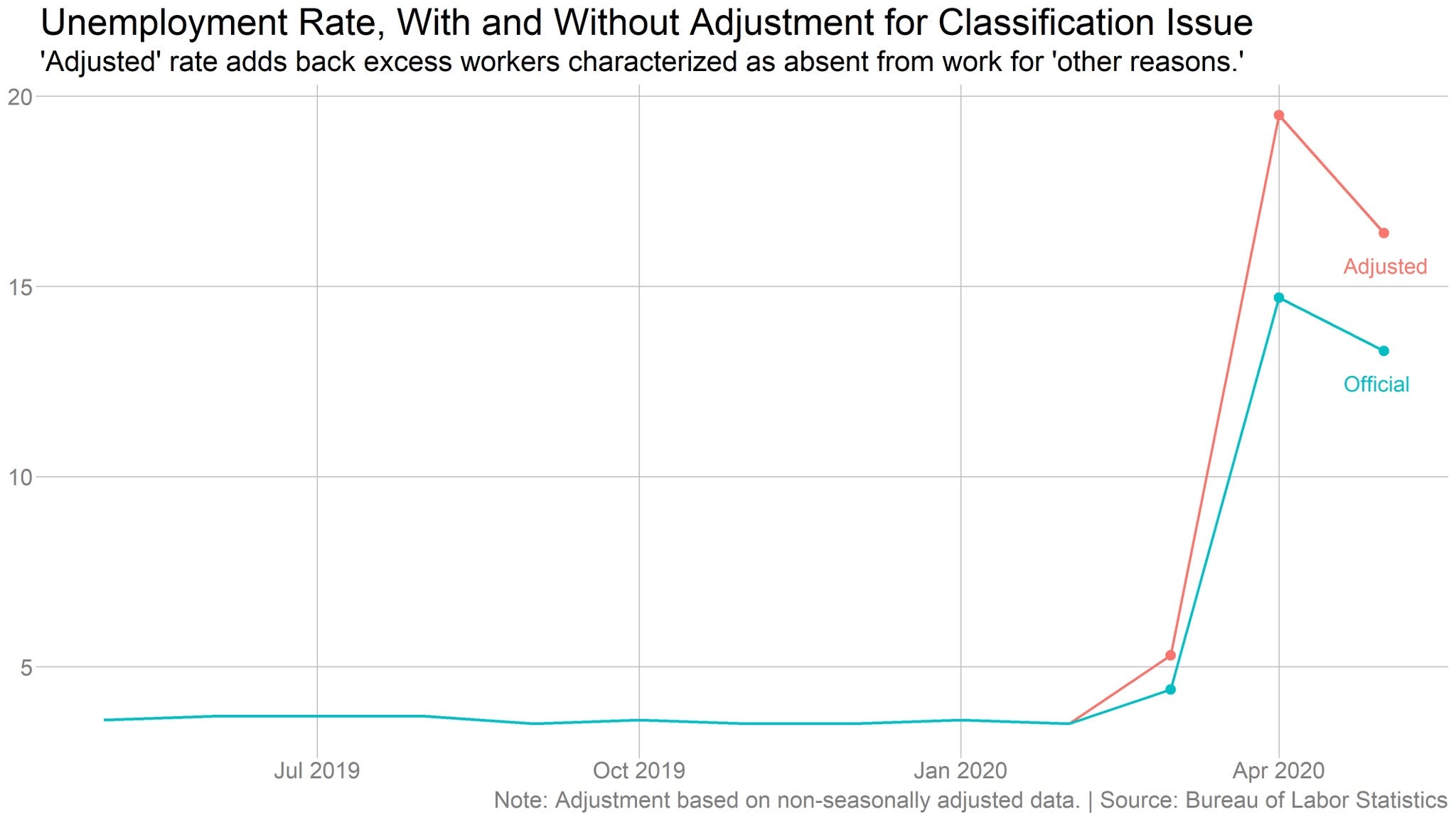

The jobs report for May included a special note at the bottom, referencing a “misclassification error.” Here’s the upshot: during the shutdown, millions that should have been as “temporarily unemployed” were instead misclassified as employed but “absent” from work for “other reasons.”

Heather Long, the economics correspondent for The Washington Post, explained the upshot of the BLS note this way:

“The special note said that if this “misclassification error” had not occurred, the “overall unemployment rate would have been about 3 percentage points higher than reported,” meaning the unemployment rate would be about 16.3 percent for May, but that would still be an improvement from an unemployment rate of more than 19 percent for April, applying the same standards…The “other reason” category is normally used for people on vacation, serving jury duty or taking leave to care for a child or relative. These are typically situations where the worker decides to take leave. But in this unusual pandemic circumstance, the “other reason” category was applied to some people staying at home and waiting to be called back.”

So, if not for the error, which has been happening for months, the unemployment rate would have been around 16.3% for last month and roughly 19% for April.

By the way, this is not Trump screwing with the numbers. It takes thousands of people at BLS to pull jobs data together, and it has to be orders of magnitude more difficult during a pandemic. I’m sure the BLS folks are working their butts off trying to keep up with the massive job losses.

To give you an idea of what these government workers are up against, someone I spoke to the at SBA recently told me that in the first two weeks of the shutdown, they received more applications for relief than in the 65-year of the agency. They are working 12 hour days, seven days a week.

Trump is too busy tweeting and playing golf to put in that kind of work.

It’s not about getting a job; it’s about keeping a job

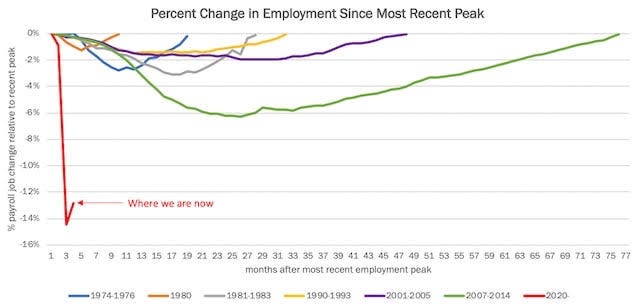

Adding 2.5 million new jobs in one month is excellent. But remember, in April, the country lost nearly 21 million jobs. Even at 14%, we still have one of the highest rates of unemployment in history. The economy will need to add this many jobs every month for almost a year just to get back to where we were in January.

Plus, most of the jobs are from small businesses that received the Payroll Protection Plan (PPP), bringing back furloughed workers. Even with the better than expected numbers, there are still more than 15 million workers on temporary layoffs.

Because of the phased-in reopenings across several states, businesses will operate at a fraction of capacity. That means a lot of these re-hires may not last. More than half of the re-hires were in the restaurant sector — and that’s what worries me.

Here’s why: restaurants typically need to operate at 75% capacity to stay afloat, but most reopenings only allow 50% at most. How long can these businesses hang on before cutting jobs or calling it quits?

By the way, here’s a handy chart you can whip out when someone tries to convince you that happy days are here again:

I’m not trying to be doom and gloom, but we’re not out of the woods. Not by a long shot. But I recently wrote about The University of Chicago’s Becker Friedman Institute’s prediction that 42% of all jobs lost through April 25th due to the coronavirus would become permanent.

So don’t believe the hype. This is nothing but the proverbial Dead Cat Bounce.