“It’s getting hard to watch”: Thrift store manager details the most heartbreaking aspects of the job

“I received a bag full of little boys’ clothes, and the moment that I opened the bag, everyone gasped,”

A manager at a non-profit thrift store laid out the dark side of her job in a series of TikTok videos that went over waste, neglect, and grief. The manager is fed up with seeing how much people buy just to basically throw away, especially since much of what they receive isn’t fit to resell.

What these donations reveal about people’s home lives can be downright heartbreaking.

In a lengthy video posted on July 6, Alejandra (@fungalmicrobe) recounts tales of donations smeared with feces and massive overconsumption. In the TikTok video, which gained 1.6 million views, she sits in front of a massive pile of stuffed garbage bags, half of which she says will end up in a landfill.

Only some of the donations people drop off are fit for the store shelves. They send a portion of the rest to a recycling center, which pays the store for the scrap, but the rest is just trash. The amount of stuff the thrift store receives smacked Alejandra in the face with how much we buy.

“Witnessing people’s consumption habits and realizing how much we really don’t need,” she started off. “We are crazy, and we just buy and buy and shop and shop and what’s brand new and blah blah blah—it’s getting hard to watch.”

What’s worse than the sheer volume of stuff they get is the condition it comes in. Not only is it sometimes utterly disgusting, covered in bodily fluids that might make you think twice about ever working at a thrift shop, but the donations reveal something about the donors.

“I received a bag full of little boys’ clothes, and the moment that I opened the bag, everyone gasped,” she said. “You could tell that the clothing had not been washed. The smell was so putrid.”

Alejandra didn’t mind the smell so much. What disturbed her was what the stench meant.

“All I could think of was that poor child.”

While loads of trash might be predictable, Alejandra did not expect to become a grief counselor at her job. Unfortunately, that’s what happens when people donate items from deceased loved ones.

In a follow-up video, Alejandra said that her thrift store will schedule pickups at the homes of these loved ones, and sometimes the donors are still grief-stricken.

“We have people coming in sobbing, like, ‘I just lost my mother,’ ‘I just lost my grandma,’ ‘I just lost my dad,’ or even people losing their pets,” she explained. “Not something that I thought I was going to have to witness on a regular basis.”

The horror of what the TikToker described led one commenter to ask if it ever plunges her into an existential crisis. All Alejandra needed to answer were some choice facial expressions.

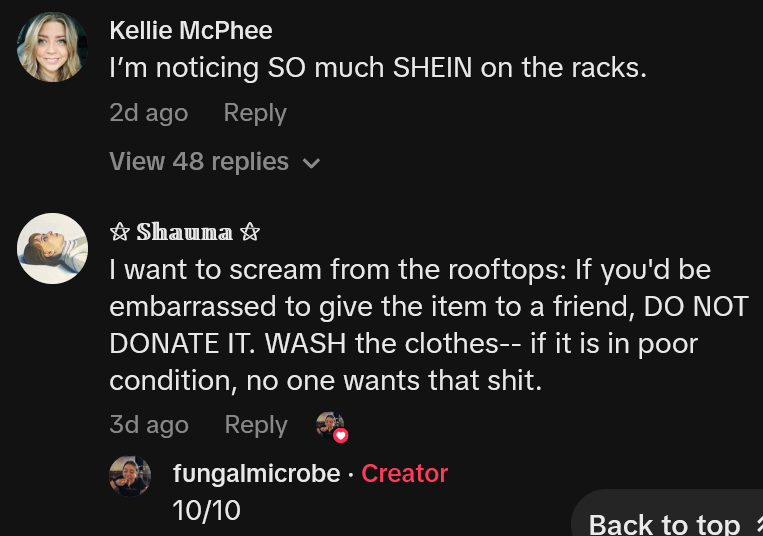

Thrift store workers and shoppers in the comments supported Alejandra’s conclusions, having experienced much of the same. The volume of donation (especially from certain brands) and the quality is a theme they see again and again.

“I’m noticing SO much SHEIN on the racks,” said @kelliemcphee.

“I want to scream from the rooftops: If you’d be embarrassed to give the item to a friend, DO NOT DONATE IT,” advised @supinewoman. “WASH the clothes—if it is in poor condition, no one wants that sh*t.”

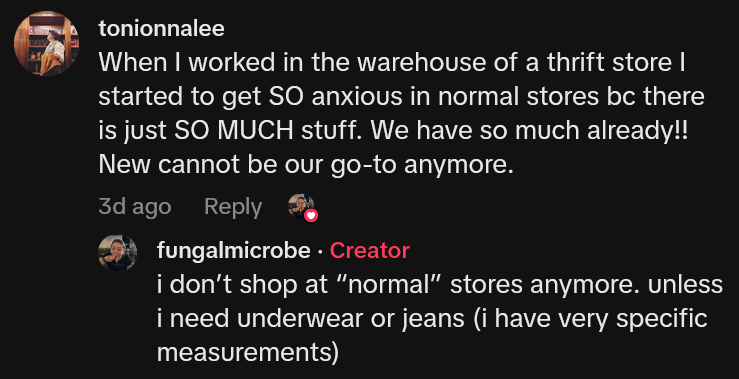

One worker’s time at a thrift shop, witnessing all that waste straight up gave them anxiety.

“When I worked in the warehouse of a thrift store, I started to get SO anxious in normal stores bc there is just SO MUCH stuff,” wrote @tonionnalee. “We have so much already!! New cannot be our go-to anymore.”