Eurozone services activity contracted more than expected in September fuelling concerns that rising infections and tightening restrictions are already choking the region’s fragile economic recovery.

The bloc's purchasing manager index for services fell to 47.6 in September from 50.5 in the previous month. This is the lowest reading since May and worse than forecasts by economists who were polled by Reuters.

“The eurozone’s economic recovery stalled in September, as rising Covid-19 infections led to a renewed downturn of service sector activity across the region,” said Chris Williamson, a chief business economist at IHS Markit.

“A two-speed economy is evident, with factories reporting that production growth was buoyed by rising demand, notably from export markets and the reopening of retail in many countries, but the larger service sector has sunk back into decline as face-to-face consumer businesses, in particular, have been hit by intensifying virus concerns.”

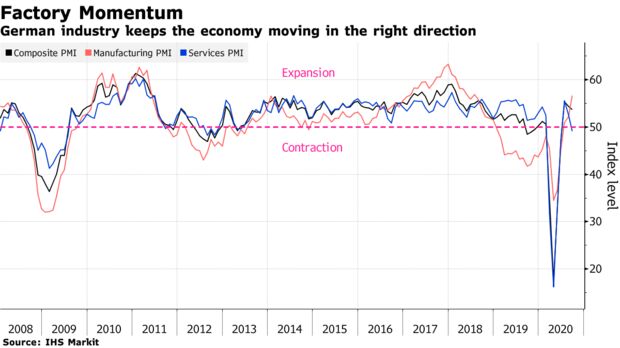

German factories kept Europe’s biggest economy moving in the right direction this month as virus concerns took a toll on services.

IHS Markit’s manufacturing Purchasing Managers Index jumped to 56.6 in September -- the highest in more than two years -- from 52.2 in August. In contrast, the services index fell to 49.1, knocking the combined composite gauge to a three-month low.

The report echoed earlier figures out of France, where there was also a divergence between manufacturing and services. The weakness in the latter was linked to the rise in coronavirus cases seen across Europe in recent weeks that pushed countries to impose new restrictions to contain the spread.

The euro slipped a little after the French numbers were published, though recovered again. The currency was at $1.1693 as of 9:34 a.m. Frankfurt time, down 0.1% on the day.

On Tuesday, Germany’s Ifo Institute said the economic slump this year will be smaller than previously anticipated, revising its prediction to minus 5.2%. While noting that manufacturing will benefit from improving global demand, it warned that restrictions on consumer behavior mean some companies won’t survive, with implications for unemployment.

Services “has possibly reached a ceiling thanks to ongoing social restrictions and still-high levels of uncertainty in the economy, including around job security,” said IHS Markit economist Phil Smith. “Manufacturing is still rebounding strongly thanks to in part to improving export demand.”

The pound falls as new U.K. restrictions put an abrupt end to the government’s drive to open its economy and revive growth https://t.co/z9W3of6Wwe

— Bloomberg (@business) September 23, 2020