By some measures, the shrunken U.S. job market continued a solid recovery last month, with many employers recalling workers who had been temporarily laid off when the coronavirus erupted in the spring.

The economy added nearly 1.4 million jobs in August, and the unemployment rate sank to 8.4% from 10.2% in July. Those improvements came despite a summertime surge in confirmed COVID-19 cases and the failure of Congress to pass another rescue aid package that most economists say is essential to sustain any recovery.

“The recovery continues to plow on,” said Andrew Hunter, senior U.S. economist at Capital Economics.

Yet hiring slowed for a second straight month. The August job gain was also the smallest in four months. And Friday’s jobs report suggested that many of the springtime job cuts have become permanent.

Here are five takeaways from the August jobs report:

THERE’S STILL A LONG WAY TO GO

As the pandemic slammed the United States in March and April, employers slashed 22 million jobs. Since then, the job market has been gradually bouncing back. From May through August, it’s added 10.6 million positions. That’s a robust gain. But it equals not even half the jobs that vanished in the springtime collapse. To take one example, factories now employ 720,000 fewer workers than they did in February.

“There obviously remains a lot of work to be done to return the labor market to a semblance of health,” said Sophia Koropeckyj, a managing director at Moody’s Analytics. “If the labor market were to generate jobs at the August rate, it would take 8.5 months to get back to the pre-pandemic level.

“And that is a big if since we expect that pace of recovery to slow in coming months as the U.S. grapples with the containment of the spread of the virus in the absence of a widely available vaccine for COVID-19.”

THE EASY PART IS OVER

Much of the job growth in August — and since May — comes from employers recalling workers they had laid off when the viral outbreak forced them to either curb operations or close down entirely. As businesses have begun to reopen, the number of Americans on temporary layoffs has dropped sharply, from 18.1 million in April to 6.2 million in August. Last month alone, the number fell by 3.1 million.

But lots of jobs aren’t coming back. The number of people who are considered permanently laid off has risen from 1.3 million in February to 3.4 million in August. As a result, the number of Americans who have been without a job for at least six months has grown for four straight months. The figure reached 1.6 million in August even though the overall number of unemployed people dropped.

“The recovery has been rapid, but this is still the easy part of it — with the harder part ahead,” Jason Furman, a professor at Harvard Kennedy School who was a chief economic adviser in the Obama White House, wrote on Twitter. “Recalling people from a layoff is easier than creating new jobs.’’

HISPANIC EMPLOYMENT ROSE, BUT DISPARITIES PERSIST

The unemployment rate dropped for all races in August. But white Americans, as always, enjoyed much lower joblessness than Black and Hispanic workers.

One million more Hispanics reported having jobs in August, a 4% increase from July. Hispanics are disproportionately likely to work in the kinds of services jobs — at restaurants or construction sites, for example — that have been returning as businesses reopen. The unemployment rate for Hispanics tumbled to 10.5% from 12.9% in July

In August, the number of white Americans with jobs rose by 3.1 million, or 2.8%. White unemployment fell to 7.3% from 9.2%.

Black employment increased by 367,000, or 2.1%. The Black unemployment rate dropped to 13% from 14.5%.

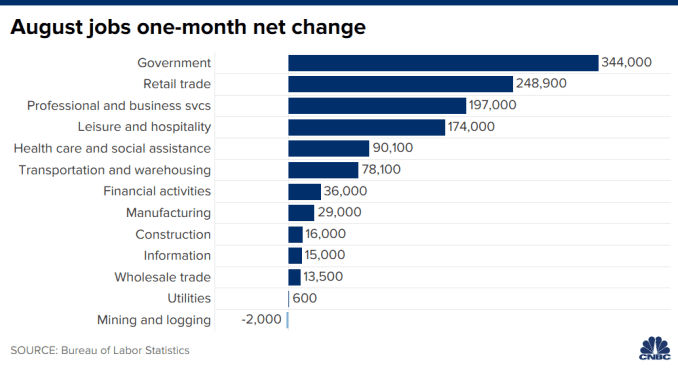

CENSUS JOBS PARTLY OFFSET SLOWDOWN IN PRIVATE SECTOR

In August, the federal government brought on 238,000 temporary Census workers. That burst of hiring drove up the number of government workers at all levels — federal, state, and local — by 344,000. It was the sharpest such monthly gain since May 2010.

By contrast, hiring by companies in the private sector has decelerated, to 1 million added jobs last month from 1.5 million in July and 4.7 million in June.

And the private companies that are now hiring tend to be those, like banks and retail stores, that provide services, rather than goods-producing employers like manufacturers, which tend to pay higher wages. Goods-producing companies had accounted for 21% of added jobs in May and 10% in June. In July and August, they represented just 4%.

A TALE OF TWO SURVEYS

Last month’s 1.4 million added jobs were about what economists had expected. The gain marked the continuation of a worrisome slowdown in the pace of hiring from 2.7 million in May, 4.8 million in June, and 1.7 million in July.

But the big drop in the unemployment rate was a pleasant surprise.

The disparity between comparatively weak hiring and a steep drop in unemployment reflects how the government compiles its monthly jobs report.

The Labor Department conducts one survey to determine how many jobs were added and another to determine the unemployment rate. The two reports sometimes tell different stories, though the differences tend to even out over time.

For its payroll survey, which tracks added jobs, the department asks mostly large companies and government agencies how many people they employed.

For its household survey, it asks households whether the adults living there have a job. Those who don’t have a job but are looking for one are counted as unemployed. Those who aren’t working but aren’t seeking work are not counted as unemployed.

Unlike the payroll survey, the household survey counts farm workers, the self-employed, and people who work for new companies. It also does a better job of capturing small-business hiring.

But the results of the household survey are likely less precise. The Labor Department surveys just 60,000 households. By contrast, it surveys 145,000 businesses and government agencies for the payroll survey.

In August, the household survey was a blockbuster: Compared with July, 3.8 million more people had jobs. The number of unemployed plummeted by 2.8 million.

Hold the applause, warns Ian Shepherdson, the chief economist at Pantheon Macroeconomics. In a research report, Shepherdson noted that the household survey “is both more volatile and much less reliable than the payroll numbers. Household employment does not lead payrolls; rather, it tends to oscillate around the payroll trend.”

Given that the household employment gains have outpaced payrolls since April, Shepherdson wrote, they “could easily fall outright in September” to move more in line with the payroll survey.

The story for much of the past generation has been a familiar one for the U.S. economy, where the benefits of expansion flow mostly to the top, and those at the bottom fall further behind.

Some experts think the coronavirus pandemic is only going to make matters worse.

Worries of a K-shaped recovery are growing in the alphabet-obsessed economics profession. That would entail continued growth but split sharply between industries and economic groups.

It’s a scenario where big-box retail and Wall Street banks benefit and mom-and-pop shops and restaurants and other service professional workers lag. Though not readily visible in GDP numbers for the next several quarters that will look gaudy in historical terms, the uneven benefits of the recovery pose longer-term risks for the national economic health.

“The K-shaped recovery is just a reiteration of what we called the bifurcation of the economy during the Great Financial Crisis. It really is about the growing inequality since the early 1980s across the country and the economy,” said Joseph Brusuelas, chief economist at RSM. “When we talk K, the upper path of the K is clearly financial markets, the lower path is the real economy, and the two are separated.”

Indeed, one of the simplest ways to envision the current K pattern is by looking at the meteoric surge of the stock market since late March, compared to the rest of the economy. While the market soared to new heights, GDP plunged at its most ever at an annualized rate, unemployment, while falling, remains a problem particularly in lower-income groups, and thousands of small businesses have failed during the pandemic.

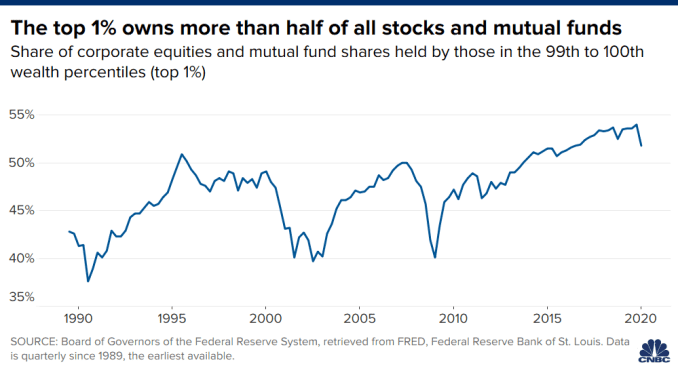

That in itself exacerbates inequality at a time when 52% of stocks and mutual funds are owned by the top 1% of earners.

But it’s not just about asset ownership, it’s the nature of those assets.

The stock market gains have been largely the result of a handful of stocks. Excluding newcomer Salesforce.com, Apple, Microsoft, and Home Depot have contributed more points to the Dow Jones Industrial Average this year than the other 27 stocks on the index combined.

That’s why Wall Street when looking for the proper letter — V, W, U or variations thereof — is beginning to see K as more of a possibility.

“The K-shaped narrative is gaining traction as the tale of two recoveries conforms well with the ongoing outperformance of risk assets and real estate while front-line service sector jobs risk permanent elimination,” Ian Lyngen, head of U.S. rates strategy at BMO Capital Markets, said in a note.

The dominating stocks, in fact, help tell a story about a shifting economy that is leaving those behind with less access to the technology that will shape the recovery.

“We believe this is now settled and that we are seeing a ‘K-shaped’ recovery,” wrote Marko Kolanovic, global head of macro quantitative and derivatives research at JPMorgan Chase.

Kolanovic, who has foreseen a number of major market changes, said the rapid evolution of society during the pandemic has triggered movements that have exacerbated inequality.

“The use of devices, cloud and internet services was bound to skyrocket while the rest of the economy took a nose dive (airlines, energy, shopping malls, offices, hospitality, etc.),” he said. “This has created enormous inequality not just in the performance of economic segments, but in society more broadly. On one side, tech fortunes reached all-time highs, while lower-income, blue-collar workers, and those that cannot work remotely suffered the most.”

Federal Reserve Chairman Jerome Powell has bemoaned the momentum that lower earners had just begun to see prior to the pandemic.

That’s one of the reasons the central bank last week adopted a major policy shift in which it will allow inflation to run above the Fed’s 2% goal for a period of time after it has run below the mark. More than just a philosophical statement about inflation, codifying the approach allows the Fed to keep interest rates low even after the jobless rate drops below what had once been considered full employment.

Fed officials believe that keeping policy loose when the unemployment rate hit a 50-year low over the past year helped contribute to the wider distribution of income gains, and should be the approach going forward.

“It’s a good start that the Federal Reserve, based on two decades of structural change in the economy and a rapidly changing demographic structure in the United States, decided to walk back its long-held preference to act to preventatively against inflation when expectations were clearly anchored,” Brusuelas said.

The Fed, though, has taken some of the blame for the inequality by implementing policies that seem to benefit asset holders and ignore the rest of the population. While loans to smaller businesses have been slow to get out, the central bank has been buying junk bonds and debt of big companies like Apple and Microsoft to support market functioning. The inflation pivot and an accompanying change on the approach to the unemployment rate, then, is seen as a way to focus policy more broadly.

A variety of paths

To be sure, the actual shape of the recovery depends on a number of factors, high among them the direction of the virus and the extent to which Congress and the White House come through with more fiscal aid.

This downturn is unique in that it did not follow one of the usual paths lower, such as a credit crunch or an asset bubble. Instead, this was a government-induced recession, a byproduct of efforts to contain the pandemic by purposely keeping people away from their jobs and subsequently greatly reducing the ability of businesses to operate.

That’s why predicting the path of recovery is difficult.

“Every business cycle since 1990 has been one where there have been some ‘K’ characteristics to it,” said Steven Ricchiuto, U.S. chief economist at Mizuho Securities. “Because they’ve been credit cycles, rising waters don’t always lift all boats the same way. Some boats are tiny little lifeboats without much baggage, and some other boats have heavier bags that need more energy to lift. Those are the ones that have credit problems.”

In the current situation, credit is not the problem and the Fed has backstopped any of those issues that may arise through its myriad lending and liquidity facilities.

Ricchiuto sees a “more traditional recovery environment” that will turn into a “swoosh,” or one where an initial burst levels off. That also is a popular view.

“Clearly some areas are going to be slower to come back. That’s going to be true even when the vaccine comes about,” said Yung-Yu Ma, chief investment strategist at BMO Wealth Management. “I don’t buy into the K shape so much. I think it’s more a matter where there will be some industries that take an extra six to nine months to really pick up economic momentum. But once that happens, everything will go together in the same general trajectory.”

Economic data generally reflects a multi-speed recovery. The Citi Economic Surprise Index, which measures data points against Wall Street expectations, is well above any level that it had seen pre-crisis. Hiring finally has picked up in bars and restaurants as well as retail establishments but is well behind pre-pandemic levels and dependent on a slew of intangibles ahead.

“We went into this downturn without having severe imbalances in the economy that needed to be corrected,” Ma said. “The external shock, yes, it’s dramatic and one that requires a lot of effort to get past and a lot of time and resources. But it’s not the case that the underlying fundamentals of the economy were distorted.”

Still, worries that uneven growth could accelerate wealth disparities are on the minds of some economists and elected officials, in the latter case becoming particularly acute as the heat turns up on election season.

The subject came up on multiple occasions during a hearing Treasury Secretary Steven Mnuchin had before a House panel on the coronavirus earlier this week.

“Rather than a V-shaped recovery, economists have warned we face an uneven K-shaped recovery, where the wealthy quickly bounceback to pre-pandemic prosperity while lower-income families continue to suffer economic harm,” Rep. James Clyburn (D-S.C.) told Mnuchin.

The Treasury secretary said the administration is sensitive to the issue though he insisted that “we are set for a very strong recovery.”

“I just want to assure you the president and the administration thinks there is more work to be done,” Mnuchin said. “Let’s not get lost on different letters of the alphabet. Let’s move forward on a bipartisan basis on areas we can agree upon. Because there are certain parts of the economy that need more work.”