I MADE MY LAST STUDENT LOAN PAYMENT AND BECAME 100% DEBT FREE!

For the first time in my life, for the first time in my wife’s life, we became 100% debt-free. We owe no one nothing. The borrower is not a slave to the lender in my house. The feeling was amazing. When we went to the grocery store on July 18th, 2020, the food tasted better, the sun shined brighter, the insanity of a COVID filled world didn’t seem to matter as much because, for the first time in our life, we didn’t have to worry about our “monthly debt service”.

Together we crushed our credit card debt, cash flowed a wedding, supported our loved ones as they personally suffered (financially, mentally, and physically) from COVID19. Those aforementioned events cost us north of $100,000 over a 24-month window. Yet this event was special in its own way, paying off $170,000 seemed untenable given the current economic climate, 15% unemployment rate, $1.3 trillion dollars of outstanding student loan debt, the list goes on and on. But we overcame.

The start.

Exactly 24 months ago, after graduating from USC with an MBA, it was finally time to meet my maker; the US Department of Education. After a not so kind 6 month grace period, our first payment became due; $2,002 a month for the next 10 years on a balance of $170,247.61. That’s a total repayment amount of over $240,000.

We went through a roller coaster of emotions. First, we were apathetic; “whatever,” we thought… “this is normal, everyone has student loan debt”. Well… “we make enough money, it’s not that big of a deal”. Then panic set in, the idea of homeownership in the bay area was fleeting, even with a dual-income household w/ no kids. Then sadness and depression set in, wishing that we could go back in time and rewind the hands of student loan debt.

But ultimately the end result was ownership. We realized the only way out debt, is to pay off debt. We canceled our honeymoon and all vacations. We downsized our living situation and got a roommate. We sold our expensive German-made luxury sedans and got a used 2008 ford focus. More importantly, we agreed that it was time to change our relationship with money. Specifically:

NO CONSUMER DEBT: We decided that there is no scenario where consumer debt (credit cards, car loans, car leases, student loans, etc) would be acceptable. Ever again. We became a 100% pay-with-cash family. When we decided to close all of our credit cards and adhere to a life of cash, it became incredibly freeing. We do not regret it at all, yet we caught alot of grief from others “over the value of credit”. My personal opinion is that credit cards are the cigarettes of the financial services industry. Credit cards keep poor people poor, and the middle class from climbing the socioeconomic ladder, here's why:

LIVE ON A WRITTEN BUDGET: We committed to living on a written budget where we set a goal to live on 60% of our post-tax income. This would enable us to throw around 40% to student loan debt. Some of our more popular tips are referenced below.

BE ALIGNED ON GOALS: Over this 24-month journey there were definitely times where I squeezed the budget a little too hard and tried to live on nothing..literally. Although that may work for a month or two, it caused a lot of un-needed grief and tension between my wife and I. It is a lot easier to align on a big macro goal “Pay off student loan debt in X months”, and adjust to the interim ebbs and flows. If you make a small mistake along the way, forgive yourself. Our original goal was to pay off $170,000 of student loan debt in 21 months, but we failed:

We were bummed, but candidly some unexpected stuff happened. Family emergencies, career changes, missed bonus pools, COVID etc. All in, it took us 24 months, and we’re ok.

The plan vs reality.

I think an upside of this crazy student loan debt pay off journey was building a meaningful relationship with our money. My wife and I meticulously tracked our expenses, by transaction and category, every month. We were able to track our planned pay off date vs our actual. Externally to our friends, family, and the internet, starting on July 2018, we wanted to pay off $170,000 by March 2020. That’s about 21 months. Internally, we set an aggressive goal to pay it off by December 2019, that’s around 18 months. On both fronts we failed. The table below outlines the details. The columns with the black header represent our “planned” payoff amount, balance, and date. The columns in blue represent our reality.

Note just how short we were by December 2019. We still had $91,000 of student loan debt to pay off. Looking back on the journey, we made this plan when my wife and I were both in different roles at different organizations. Believe it or not, since July 2018 my wife and I have each changed employers twice. That was something we didn’t plan for or expect in 2018. She now runs her own company, and I work at a start up. Unfortunately life events such as ‘career changes’ weren’t factored into the original 18 month pay off window.

I actually ended up making alot less in 2019 than I planned, by almost $100,000. This is because I changed careers from an incredibly stressful consulting role where I was traveling 100% to something that enabled me to be home everyday. Again, not planned in 2018, but a definite implication to the pay off plan. In hindsight I do not regret this at all because our income is now on the upside, which leads me to my next point: Taking a risk.

By June 2020 we still owed ~$47,000 of student loan debt. COVID was in full motion and candidly we thought it would take us until the October or maybe December 2020 to pay off the balance..a 3rd extension. But boom, in the middle of covid, my wife’s business takes off. She gets a major client, and just like that we have an extra ~$35,000 influx of cash that we could potentially apply to our student loan pay off balance. Candidly she has been pursuing her side hustle/turned business for over 24 months, this was not an ‘overnight windfall’, but rather a culmination of many small iterations/events over a 2 year window.

We actually sat on this cash for a couple weeks, unsure if it was a good idea to pay off this debt in the middle of COVID. But candidly, logging into earnest every morning , at 8am, on the dot, and seeing that damn student loan balance was just too much. Looking back we don’t regret this at all. It’s incredibly lifting, freeing, almost spiritual, to wake up in the morning knowing you owe no one nothing, nada, zip , zilch, zero.

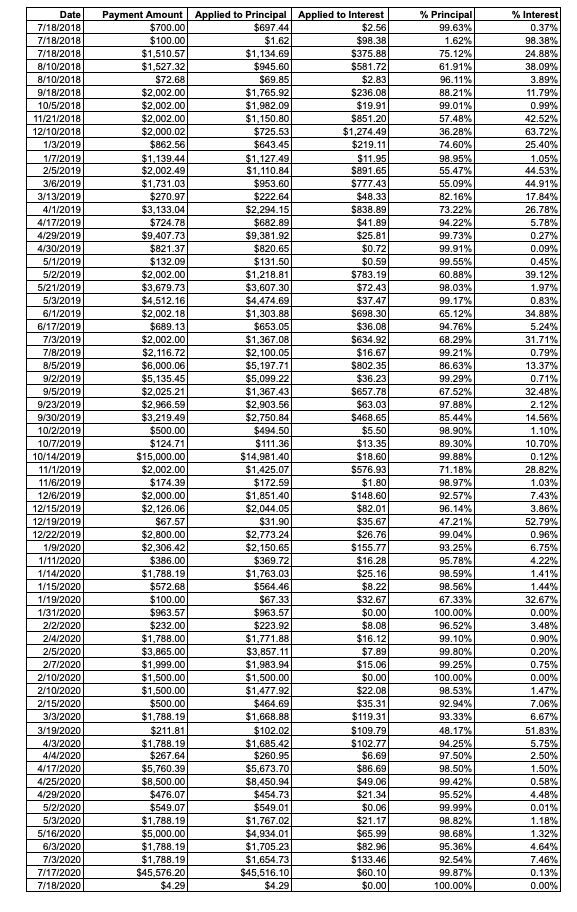

All in, we made a total of 67 payments across a 24 month window that started in July 2018 and ended in July 2020.

With principal and interest, the total payback amount was $184,030.12. If we took the 10 year standard payment plan, the payback amount would have been >$240,000. No thanks. Our average payment on a monthly basis was around $7,357, more details in the table below:

It is possible.

Educated and broke was started in 2018 as my personal financial experiment. It was really a running joke I had with my coworkers. We collectively agreed that there was a generation of young people who were really educated but really broke. It wasn’t until months later, did I realize that I was one of them. When I began to engage my friends, family and coworkers about the role of student loan debt in society, the response was mostly apathetic. Everyone thought it was “normal”, and technically they were right. As of August 2020, 80% of American can’t afford an emergency that costs > $500. 1 out 4 of Americans have more in debt that in retirement, 60% of americans will die with debt, and the average car loan is $508 on a 72 month note.

But you don’t have to choose apathy. The harsh realization is that the government is not going to “wipe our student loan debt” free. I wish they would. I wish our elected officials would take the time to re-evaulate the role of the Federal student loan program, college tuition, and access to affordable education. But sadly It took a global pandemic and economic collapse that impacted almost 300,000,000 american citizens for our elected officials to approve a $2 trillion dollar stimulus package. Compare that to the 45 million americans who collectively owe $1.3 trillion in outstanding student loan debt. It is (sadly) clear that the $1.3 trillion dollars of student loan debt is not considered a macro economic crisis that will impact the US economy. It might impact the economics of your house, of my house…but that isn’t enough to get the attention of the government.

But it is possible to pay off your student loan debt. This is proof. You may roll your eyes after reading this… “easy for you to say, you have a dual income household with no kids and make a bunch of money”. I definitely heard that alot. I ask you to not just to look at the numbers, but also evaluate the intent. The intent of living on a written budget where you spend less than you make and work with your husband/wife/spouse/self to set and achieve a goal.

This is post my contribution to 45 million Americans looking for an answer to their student loan problem. To the educated and broke, those high income earners with college degrees but no savings, the doctors, the lawyers, engineers, educators and everyone in between: commit to no consumer debt, make a written budget before the start of the month, and aim to live off of 60% of your post tax income. You were not born to work, pay bills, and die.

John

California

August 2020