I’m in my early twenties and can confidently say I’m financially comfortable. However, this is all, unfortunately, thanks to the internet. If it weren’t for YouTubers like Graham Stephen, who are open about their finances and personal investments, I would be lost entirely in the ‘adulting’ sphere.

Looking back on my educational experience, I become so frustrated because financial well-being is not something that is taught in school. Sure, there is maybe one unit of math taught in grades three and four, which focuses on budgeting i.e., for groceries, and sure, you can choose to take financial courses in university, but money and its importance are majorly ignored during socialization.

Many young adults do not set themselves up well for the future. I was not financially informed until four years ago — I had never been challenged to understand the complexity of money and how it affects my life. I have many friends in their late twenties and early thirties who have no idea what a mutual fund is, or haven’t started saving for retirement.

This is not good, considering the government relies on us to define our futures and how well-off we will be, they do a terrible job at encouraging our success.

For this reason, I’m happy to share my top three recommendations for investing that you should aim to begin in your twenties.

You don’t need to be rich to make these choices, and you don’t have to think about them once they are set up.

With these three strategies in place, you will be on your way to success, and you can focus more on the present.

1. Open an RSP or Roth IRA

What is this?

A Retirement Savings Plan (RSP or Roth IRA) is “a registered account designed to help people who earn income from a job or a business, build a nest egg for retirement. Within your RSP, you can hold a range of investments, including Guaranteed Investment Certificates (GICs), term deposits, and mutual funds.”

How do I set this up?

Many organizations offer RSPs and Roth IRAs to their employees. The company I work for started an RSP program last year — you sit down with a financial advisor and determine the best investment package for you, considering your income and how much you are willing to take off your paycheque.

The great thing about having an RSP through your work is you don’t have to think about it once you have it set up. You monitor the account’s progress on your paycheque, and that’s that.

You can also easily set up at RSP by visiting your bank and sitting down with a financial advisor. You will talk about your income, what goals you have i.e. when you want to retire, and how competitive you want your investment profile to be. You can either set up an automatic deposit to go into your RSP account or do so manually, however often you would like.

With the manual option, you will have to remember to continually and consistently invest in this account.

Why is this important?

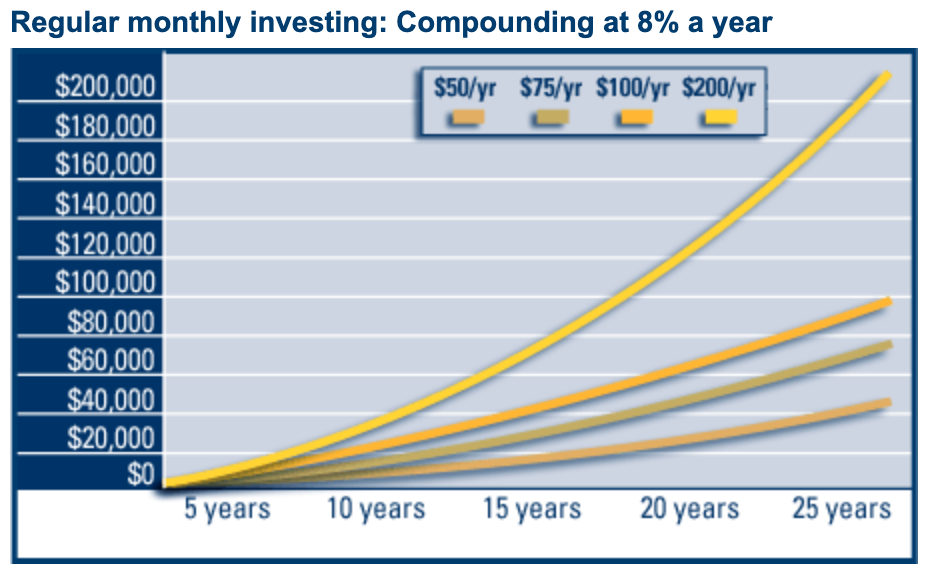

Opening up an RSP or Roth IRA early in your life makes a huge difference in how much money you will have available when you are ready to retire or buy a home. Take a look at the diagram below as an example. Notice how significant the difference is between how much you can save in five years versus 25.

You don’t even have to think about this investment, and you could have upwards of $200,000 ready for you when you are fed up with being in the workforce. Obviously, $200,000 is not enough to retire, but the length of investment makes a huge difference.

RSPs and Roth IRAs are also important because they become tax-free after a certain age. When you are ready to leave the workforce, you can have a completely ‘locked in’ lump sum of money that is entirely yours. Retirement plans provide a level of financial security and allow you to stop working at an adequate time, if you start investing young, and properly.

Individuals with little financial security in their later years are forced to continue working, even if they are no longer physically or mentally equipped to do so — this is the unfortunate reality for a large portion of the human population.

2. Open a TFSA

What is this?

A Tax-Free Savings Account (TFSA) is “a registered investment or savings account that allows for tax-free gains. The amount of money that can be contributed to a TFSA is limited each year. A TFSA can be used for any savings goal and withdrawals can be made free of tax.”

How do I set this up?

Similar to an RSP, a TFSA can be set up by visiting a bank branch. You sit down with a financial advisor and discuss what the goal of your TFSA is, how long you plan to use the TFSA to reach your goal, and how competitive you want the account to be. TFSAs are used for many reasons. I opened a TFSA to start saving for a house as well as a car. You can open multiple TFSAs at once and give unique features to each TFSA.

For example, I could have one TFSA that is extremely competitive, I want to use it heavily for 10 years, and with the funds, I intend to buy a boat at the end of its goal term. I could also have another TFSA that is conservative, I want to use it heavily for one year, and with the funds, I intend to purchase a new couch once my current lease is up.

Why is this important?

The benefit of a TFSA is it allows your money to grow. If you put your money in a regular savings account, it just sits there and doesn’t benefit you in any way. You may also have to pay fees on the money sitting there, and you may be taxed when you go to withdraw. Even if you utilize an extremely conservative TFSA, it can make you a couple of cents each year without you trying and being taxed when you are ready to use them.

If you don’t make a lot of money and want to build additional funds over a long period, a TFSA is a great way to do so. You can be ‘risky’ with little risk, as a TFSA involves you in a broad portfolio of investments, and in general, the market, at least in Canada, has been trending upwards over time.

3. Invest in yourself

My last recommendation is not an account that you can open in a bank, and it is not something you can start once you land a stable job. Investing in yourself means spending your money wisely on items and services that compliment your skills and goals.

As an example, my partner is a full-time freelance photographer. When he first decided to quit his job to pursue his dream, he purchased a couple of expensive items related to photography i.e., a tripod, a couple of lenses, etc. Even though these items cost hundreds of dollars, they assist him in doing his job better.

I’m pushing to become a more skilled and successful writer. Because of this goal, I choose to pay the $5/month subscription fee to Medium, and I’m also signed up for paid courses on SkillShare. I invest in these products because they relate to my goal of making a stable income as a writer.

It is extremely easy to spend your income on food, clothes, and luxurious adventures, especially when Instagram influencers are persuading you to. However, I highly recommend focusing your spending and investing in things that will benefit you and your future. Working on this habit will pay off, trust me.

This is a lot of information to take in, and a lot of it may sound like gibberish — the most important thing to remember from this piece is that you are completely capable of becoming financially-informed and comfortable. If you are already past your twenties, it is never too late to get started, and my three recommendations still apply.

After setting up an RSP, TFSA, and strategically spending your money, being an adult feels a lot less intimidating…until you buy a home.

Now that is a mountain to climb.