Around the country, across industries and occupations, millions of Americans thrown out of work because of the coronavirus are straining to afford the basics now that an extra $600 a week in federal unemployment benefits has expired.

“My worst nightmare is coming true,” said Liz Ness, a laid-off recruiter at a New Orleans staffing agency who fears she will be evicted next month without the added help from Washington. “Summer 2020 could be next year’s horror movie.”

Lawmakers on Capitol Hill are struggling to work out an agreement that would restore some federal jobless aid. A marathon meeting in the Capitol on Thursday night generated lots of recriminations but little progress on the top issues confronting negotiators. Even if they do reach a deal, the amount is likely to be less than $600. And by the time the money starts flowing, it could be too late for many Americans who are already in dire straits

“Members of Congress may have the luxury to come to an agreement this week and vote next week and then roll it out over several weeks,” said Brian Gallagher, CEO of United Way Worldwide. “Families don’t have that luxury — they are out of money tomorrow.”

In the meantime, up to 30 million Americans, their jobs lost or income slashed by an outbreak that has paralyzed the economy and killed close to 160,000 people in the U.S., are trying to get by solely on state unemployment benefits, which on average are less than $400 a week.

On Thursday, the government said nearly 1.2 million laid-off Americans applied for unemployment last week. That is a decline from the previous week. Still, it was the 20th straight week that at least 1 million people sought jobless aid. Before the coronavirus, the number had never surpassed 700,000 in a single week.

The rescue package being worked out in Washington would contain more than $100 billion to help reopen schools, another round of $1,200 direct payments to most people, and hundreds of billions of dollars for state and local governments to help them avoid furloughing workers and cutting services as tax revenues shrivel.

Some Republicans in Congress argue that the extra $600 in unemployment benefits is so generous that it is discouraging people from going back to work. Several university studies have cast doubt on that. Economists and labor experts say that the benefits certain jobs carry, such as health care, can be enough for people to go back to work even if the pay is low.

Bethany Racobs-Ashford, the makeup artist with two small children, said the $600 had been a “lifeline.”

The 32-year-old Dallas resident was just entering the busy wedding season when she typically earns the bulk of her income when the outbreak struck, and she lost her job. Her state unemployment aid amounts to only about $828 a month.

“I don’t know what we’re going to do now,” she said.

Fearing eviction from their home, Racobs-Ashford and her family moved in with her 70-year-old mother. She worries about taking on a new job that could compromise her family’s health.

Jackilyn Lopez of Tucson, Arizona, said the $600 had been a “godsend” for her family since she lost her job as a hygienist in March when most dental practices shut down. She and her husband have an 18-month old daughter, and Lopez is due to give birth in three weeks.

Her employer has reopened but has yet to recall Lopez. She feels fortunate that her husband has kept his job as an assembly worker at a laser manufacturer. But Lopez, 30, just received her first weekly unemployment check without the $600, and it was only $213.

“Our groceries are more than that each week, with the diapers and formula,” she said.

Food banks, pantries, and other safety-net organizations report soaring demand from people in need. Charitable groups worry the problem will worsen with the end of the $600 and the expiration of coronavirus-era moratoriums on evictions.

Up to 23 million renters nationwide are at risk of being evicted by the end of September, according to the COVID-19 Eviction Defense Project, a coalition of economic researchers and legal experts.

“We are going to have tens of millions of families not just in desperate need, but they are going to be out of their home, and it’s going to be catastrophic,” the United Way’s Gallagher said.

United Way, which runs the 211 networks, a service that connects the needy with help, typically receives 11 million calls a year. This year, it foresees 20 million calls.

The Greater Boston Food Bank, one of the nation’s largest food banks and a supplier for hundreds of pantries, soup kitchens, and senior centers, said it is seeing the highest demand in its 40-year history. Many people are seeking help for the first time.

So far, food banks and pantries that rely heavily on donations say giving has been strong since the outbreak hit.

In Florida, whose tourism industry has been pummeled, 38-year-old John Brenner of Plantation lost his position as a hotel manager and has been out of work for four months. Florida’s weekly unemployment aid is capped at $275 a week, so “I’m quite reliant on that extra $600,” he said.

“The anxiety the Senate is giving me isn’t helping much,” Brenner said.

Florida Gov. Ron DeSantis said that the state’s unemployment system was deliberately designed to be tedious and “not user friendly”.

Over 4 million people applied for unemployment benefits in Florida by May, reported the Tampa Bay Times, but just six percent of Floridians had received any benefits from the state by the end of April.

“I mean having studied how it [the unemployment system] was internally constructed, I think the goal was for whoever designed, it was, ‘Let’s put as many kinds of pointless roadblocks along the way, so people just say, oh, the hell with it, I’m not going to do that’,” DeSantis told local a CBS news outlet Tuesday.

The nearly $78 million online systems was developed by Republican Sen. Rick Scott, and was allegedly designed to limit benefits and keep unemployment taxes paid by Florida businesses low. Politico reported that an estimated $2.3 billion would be saved between 2011 and 2020.

The online unemployment program known as CONNECT, launched in 2013 while Scott, now a U.S. Senator, held the state’s governor position.

“It’s a sh-- sandwich, and it was designed that way by Scott,” a DeSantis advisor told Politico in April. “It wasn’t about saving money. It was about making it harder for people to get benefits or keep benefits so that the unemployment numbers were low to give the governor something to brag about.”

DeSantis openly criticized the program for the first time this week, though he did not place blame solely on Scott.

DeSantis said he didn’t know if Scott purposefully intended to deter people from filing for unemployment benefits, but added, “It was definitely done in a way to lead to the least number of claims being paid out.”

The program has been known to have basic issues such as frequently crashing and difficulty in submitting claims.

"A lot of these unemployment systems throughout the country, you know, weren't very good, but a lot of them were like 40, 50 years old," DeSantis told CBS4 in Miami. "Ours wasn't really old. I mean, ours was really five, six years ago. And it should have been done better for that price tag to produce better results."

The state’s Senate Democratic Caucuas said Thursday that 1,461,763 Floridians are still waiting for payment.

“I think going forward, I want all our systems, including unemployment, to be user-friendly. And it was not user-friendly,” DeSantis said.

Scott could not be immediately reached for comment.

The coronavirus pandemic has caused significant job loss across the country, but some places have better job opportunities than others, according to a recent study.

On Thursday, SmartAsset published a report that found which metro areas have the most career opportunities during the pandemic, and the recession it caused.

For its report, the financial planning website compared the 200 largest metro areas in the U.S. based on seven measurements including unemployment rate, change in employment from 2019 to 2020, median income, and income growth over career.

SmartAsset also analyzed cities’ annual median housing costs, number of career counselors per 1,000 workers, and the number of post-secondary teachers per 1,000 workers.

The report used data from the Bureau of Labor Statistics and the Census Bureau’s American Community Survey.

According to the report, the Northeast didn’t have many cities that ranked highly. In fact, only three metro areas made it to the top 25 and no Northeastern city made it to the top 15.

SmartAsset also reported that Las Vegas was at the very bottom of the list of 200 cities.

“The local economy relies heavily on the nightlife, entertainment and hospitality industries, making the locale much more vulnerable to a COVID-19 recession,” SmartAsset reported about Las Vegas.

To see which cities made the top of the list -- and what their median incomes and unemployment rates were in May -- here are the 10 metro areas with the best career opportunities during the coronavirus recession, according to WalletHub.

10. Phoenix-Mesa-Scottsdale, Arizona

May 2020 Unemployment Rate: 8.3%.

Median Income: $39,420.

9. Tucson, Arizona

May 2020 Unemployment Rate: 8.4%.

Median Income: $36,900.

8. Boulder, Colorado

May 2020 Unemployment Rate: 8.2%.

Median Income: $51,520.

7. Tallahassee, Florida

May 2020 Unemployment Rate: 8.7%.

Median Income: $36,130.

6. Provo-Orem, Utah

May 2020 Unemployment Rate: 6.2%.

Median Income: $35,950.

5. Champaign-Urbana, Illinois

May 2020 Unemployment Rate: 10%.

Median Income: $40,370.

4. Lincoln, Nebraska

May 2020 Unemployment Rate: 5.0%.

Median Income: $38,890.

3. Gainesville, Florida

May 2020 Unemployment Rate: 8.7%..

Median Income: $36,530.

2. Huntsville, Alabama

May 2020 Unemployment Rate: 7.6%.

Median Income: $41,090.

1. College Station-Bryan, Texas

May 2020 Unemployment Rate: 8.6%.

Median Income: $35,880.

Hiring in tech remains muted, sending another distressing signal ahead of Friday’s highly anticipated jobs report.

As of late July, tech job postings were down 36% compared to the same time last year, according to recent data from the online platform Indeed.

The sector has lagged the broader U.S. economy, too. Listings on Indeed’s site nationwide currently sit 21% below last year’s levels. Tech postings started to fall behind in mid-May and, since then, the gap has grown steadily.

New insights from the website Glassdoor paint a similar picture.

While tech job openings did increase between late June and late July, Glassdoor senior economist Daniel Zhao stressed that the industry continues to lag the rest of the economy. Moreover, tech’s recovery has progressed in “fits and starts”, a humbling reminder of COVID-19′s bruising impact as parts of the country grapple with resurgent outbreaks. Over the past week, tech openings increased just 0.6%, pointing to persistent anemic job growth.

“Initially, tech was holding up better than other sectors due to the quick adaptation to remote work,” AnnElizabeth Konkel, an economist at the Indeed Hiring Lab, told CNBC. “But, nationally, as the long-term effects of the pandemic have started to sink in, tech has flatlined. That’s the key change — the economic expectations around the virus went from ‘we’ll be done with this in a month or two’ to...‘we’ll be in this for the long haul.’”

These tech-specific trends dovetail with recent bleak macroeconomic data. On Wednesday, ADP reported private payrolls increased by just 167,000 in July — well below the 1 million analysts expected and a sign that the move to get displaced workers back to their jobs has slowed. On Thursday, new data showed 1.2 million people filed for unemployment benefits last week. While that was a decline versus the prior week, it marks the 20th straight week in which new claims topped 1 million. More importantly, it reveals that 31 million Americans are still collecting unemployment benefits — a sign, some economists say, that many layoffs are translating into permanent employment loss.

With the all-important July jobs report due out Friday, several analysts told CNBC tech’s hobbling recovery underscores the depth of the economic hole out which the U.S. must club.

“What’s going on in tech is a reflection of what’s going on in the rest of the economy,” Zhao said.

As tech accounts for roughly 10% of U.S. economic output, the breadth of the hiring pullback tells a sobering story. The industry, directly and indirectly, supported more than 12 million American jobs in 2019.

In addition, tech companies have started to make cuts over the past month. In mid-July, Microsoft-owned LinkedIn said it will lay off about 960 people, or 6% of its workforce, as the pandemic weighs on demand for its recruitment products. And, just this week, Booking Holdings — the parent company of Booking.com, Kayak, and Priceline — announced plans to shed 25% of its global workforce. Booking.com has more than 17,000 employees worldwide.

Emerging tech hubs faring worse

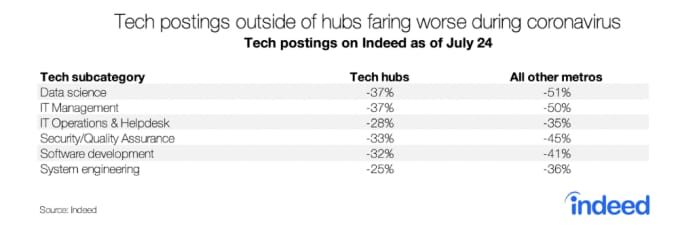

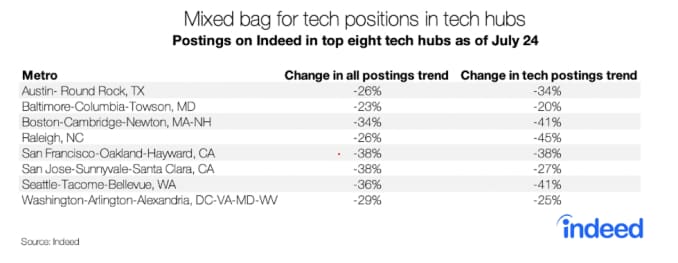

The one-two punch of layoffs and a hiring slowdown has hit the most prominent tech hubs, like the Bay Area and Seattle. But the drop-off is even more pronounced outside of these areas. In eight tech hubs identified by Indeed, data science job postings, for example, are trending 37% below last year’s level, as of late July. In all other metro areas, data science jobs are off by 51%.

Konkel said that could signal tech companies are pushing for centralization, as opposed to dispersing their workforce.

“Before the coronavirus, some of these smaller tech centers were starting to make headway,” Konkel said. “The pandemic has eliminated those gains.”-

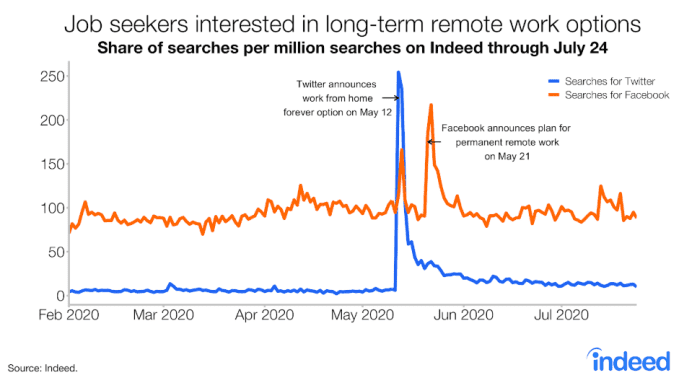

This comes even as many Bay Area-based companies have announced plans to shift to remote work through next year. Facebook and Uber joined Google this week in allowing their employees to work from home until at least July 2021.

Pockets of hiring

The hiring slowdown in tech has extended to all corners of the industry and myriad job roles.

According to Glassdoor, postings in the “information technology” category are down 43% from last year, “consumer electronics” roles are down 42% and listings in “computer software and hardware” are down 36%.

As far as job roles go, data scientist and IT management hiring is particularly tight, with postings 43% and 45% below last year’s levels, respectively, according to Indeed. Listings for jobs in artificial intelligence and machine learning are down 29% year-over-year.

“These roles are seen as more of an investment, and companies are being a lot more conservative than they would have been pre-coronavirus,” Konkel said. “That’s the difference between those categories and IT help desk jobs, for example. Making sure employees have the hardware they need — that’s what firms are seeing as hyper-critical.”

Despite the overall slowdown, some pockets of tech have continued to hire.

According to Glassdoor, postings in the “internet and tech” category — which include many roles at social media and e-commerce companies — are higher than they were at the same time last year. Between late June and late July, internet and tech roles on the platform rose 57% to 124,200. Those listings are 102% higher than the year-ago period.

Businesses that are close to e-commerce, like food delivery and online retail, have also held up better than other tech sectors. While Zhao admits that these companies saw a large surge in hiring at the beginning of the crisis as spending dramatically shifted online, he emphasizes that that trend has extended during the first half of the summer.

“E-commerce and delivery have been some of the largest drivers in job openings in tech just over the last few weeks,” Zhao said.

Companies that help businesses handle remote workforces are also hiring at a steady clip. A spokesperson for Slack, which makes chat and collaboration software, recently told CNBC the company had aggressive hiring targets heading into 2020, and those haven’t changed. At the outset of the pandemic, the company prioritized front line customer support to accommodate an influx of customers and has been looking to fill engineering and data scientist roles.

Rising demand from job seekers

Meanwhile, demand for tech jobs is rising, which could mean that tech workers don’t have as much leverage as they used to.

In February, tech job postings received 68% of the total clicks of an average posting on Indeed. By late July, tech listings were attracting 95% of clicks. Facebook and Twitter, for instance, have grabbed prospective employers’ attention with their permanent remote options, according to Indeed’s search data.

Konkel suggested this heightened competition for spots could spell a loss of bargaining power for tech workers and push companies to scale back certain benefits.

“Even during an economic crisis, there are some roles where the shortage of qualified and experienced workers is being felt to some degree,” Zhao added. “And this crisis is unusual in that it’s not just a decline in the demand for workers, but also a decline in the supply — because you have a lot of qualified workers who are standing on the sidelines, either because they don’t feel like now’s a good time to switch jobs or they’re staying home to take care of their children or family.”

Zhao stressed that the last two months are a key reminder that any employment rebounds in tech — and the “extremely fragile” broader economy — hinges on controlling the public health crisis.

“Any progress can be easily and quickly reversed,” Zhao said. ” If reopening prematurely leads to growing outbreaks, economic gains will be fleeting at best, leaving the economy stuck in the doldrums. At worst, rising cases risk imperiling the already frail economy and sending us back into a double-dip recession.”