Eliminating student loan debt can put you on the fast-track to achieving your essential life goals. If you’re one of the millions of Americans struggling with this vital issue, you know first-hand the challenges of student loan debt. As student loan balances continue to balloon from one year to the next, what can you do to conquer this overwhelming debt load? Well, many people are waiting for an act of congress to make their student loans disappear.

Yet, chances are that it will be on you to forge a path toward financial liberation. If you’re serious about freeing yourself from student loan debt, you’ll need to take steps that you might not have considered before. These actions include evaluating how many minimum payments on your student loans cost you, curbing unnecessary interest expenses, and finding simple ways to come up with extra cash to pay down loan principal. Making these steps a priority might enable you to eliminate debt sooner and give you the ability to focus your efforts on your most essential life goals.

The Burden of Student Loan Debt

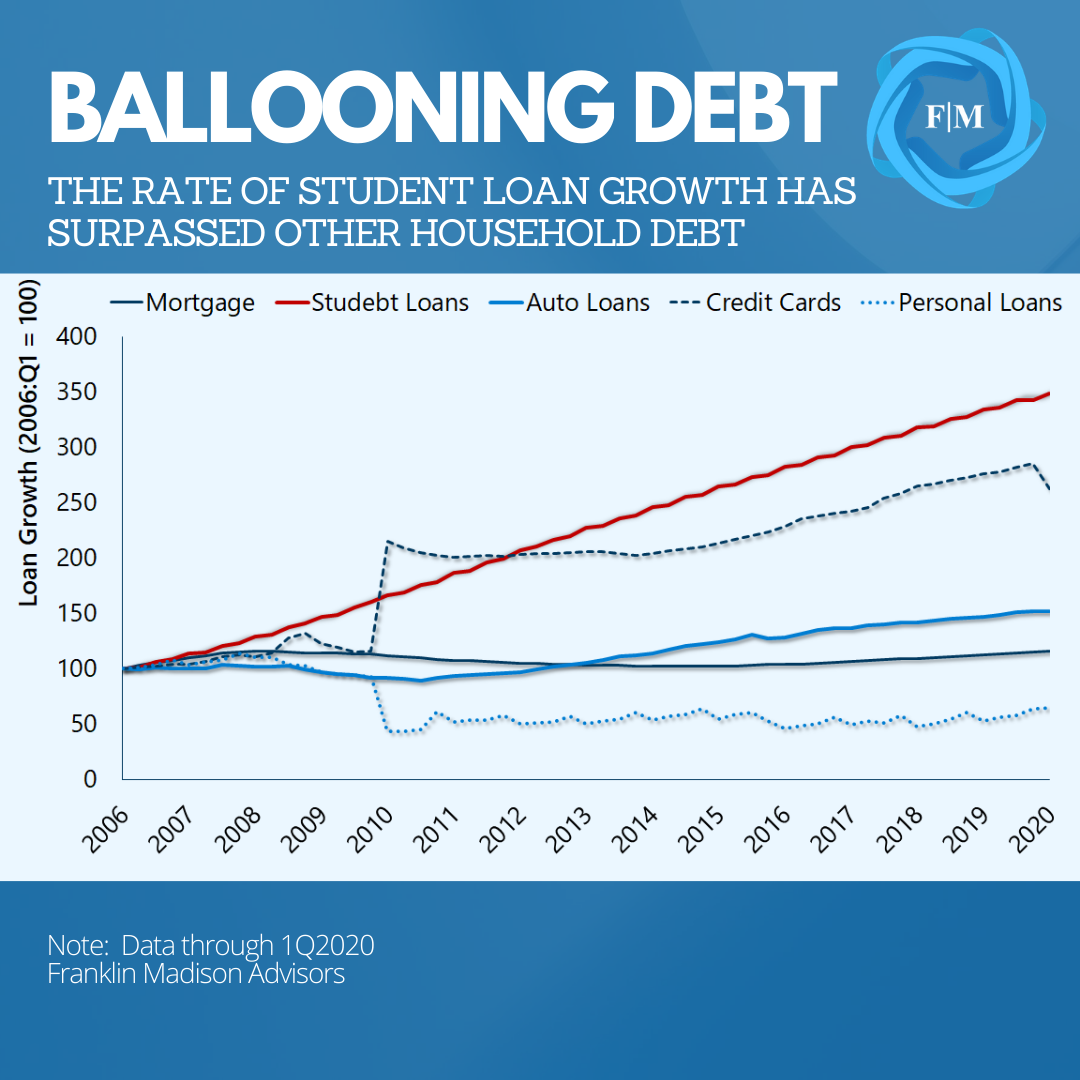

Student loan debt issuance has skyrocketed over the past decade. Government data out in the first quarter showed that total student loan debt outstanding reached $1.7 trillion. Of the amount outstanding, three-quarters were federal direct loans. This ownership share suggests that if you have a student loan, then there’s a good chance that Uncle Sam owns it. And if you feel like your debt burden is unreasonable today, you’re not alone.

Balances outstanding now average $35,000 for the nearly 40 million individuals who have federal student loans — a figure that has doubled since 2007. And while the number of borrowers has increased by 40% over the past seven years, loan default rates have nearly tripled. If you want to pull yourself out of your student loan debt trap and forge a path to financial liberation, you’ll need to make decisions about your student loans that different than what most people are doing right now.

Relief in Times of Uncertainty

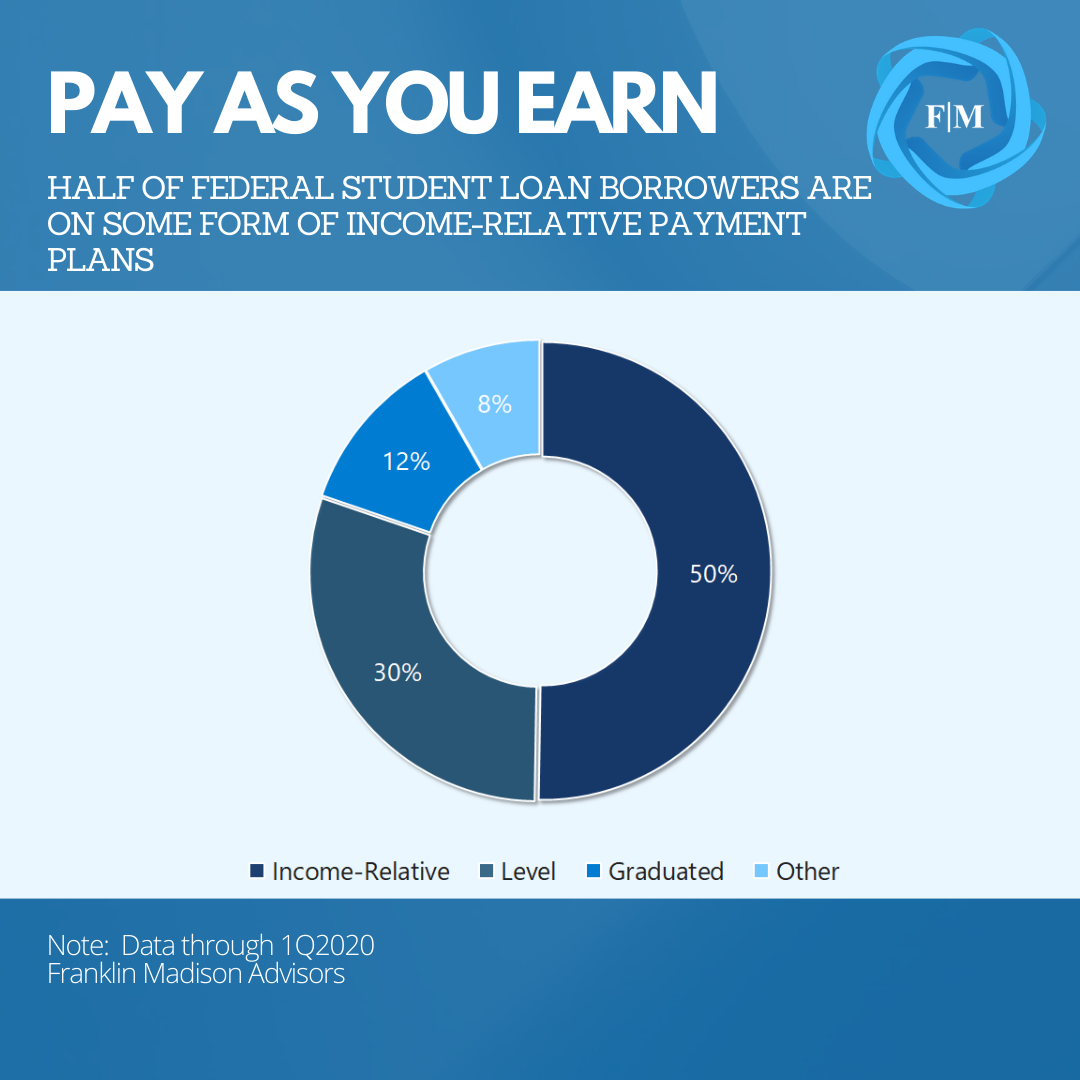

Many college students assume that money borrowed to finance education costs can be reasonably paid back over ten years. This seemingly short payback period is one reason some individuals choose to take on student loans in the first place. By the time they graduate, however, many students accumulate so much debt that they find it challenging to make their standard level payment. That’s when some borrowers choose to utilize income-relative repayment programs.

According to government data, over half of the federal direct loans are in some form of an income-relative repayment as of the first quarter of 2020. These programs include Pay as You Earn (PAYE), Revised Pay as You Earn (REPAYE), Income-Based (IBR), and Income-Contingent (ICR) Repayment. The common thread running through these programs is that your monthly student loan payments are based on how much you take home per year rather than a level, amortized loan amount.

Income-relative programs are vital to helping people manage ballooning debt payments while balancing other essential financial priorities. Compared to a level repayment program, however, income-relative repayment plans might be more financially detrimental than a simple level repayment. This fact is notably the case for borrowers with low income and high debt.

Income-Relative Plans: Not a Long-Term Fix

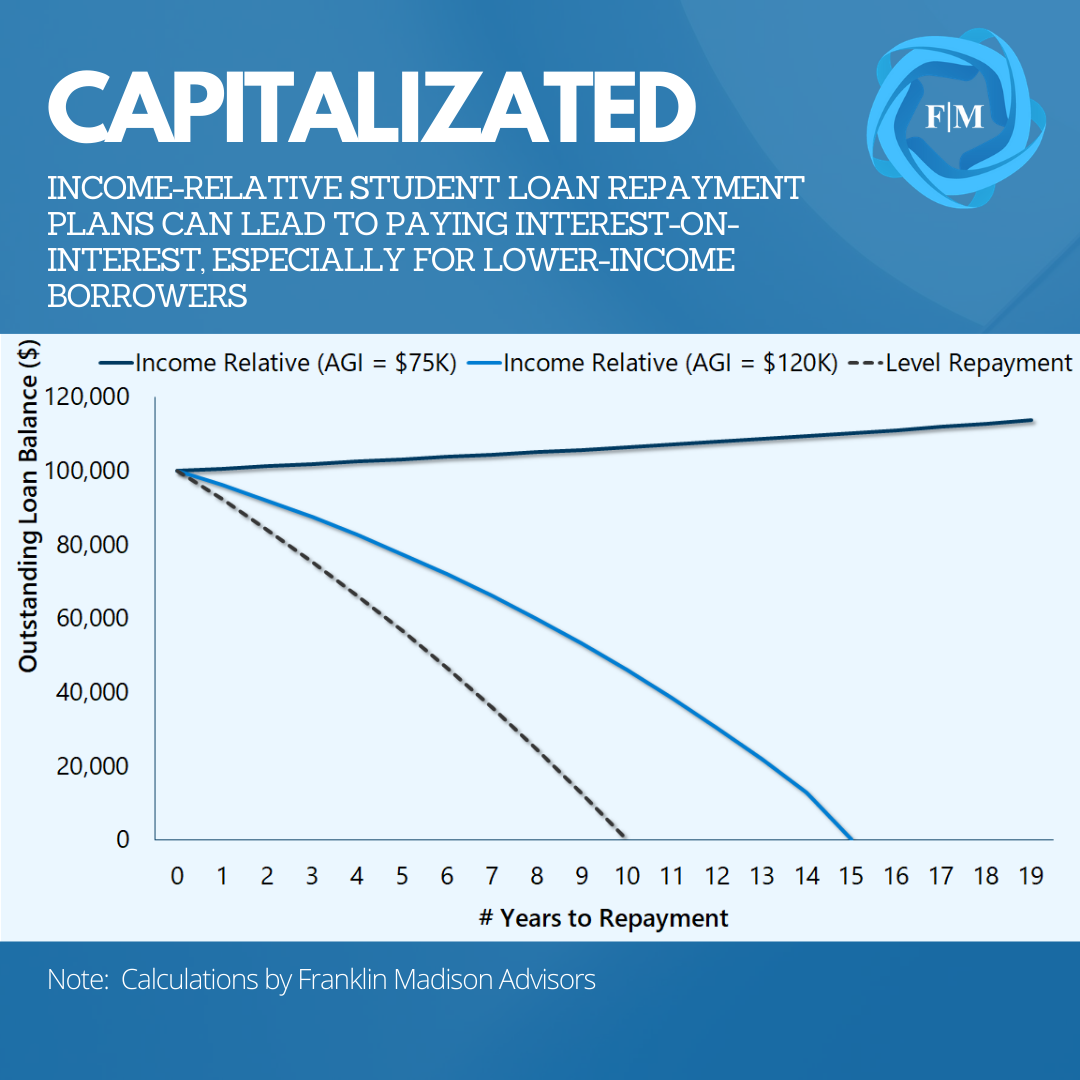

For example, consider a couple with an adjusted gross income (AGI) of $120,000 per year and $100,000 in student loan debt. Under an income-relative plan, the couple might pay an extra $18,000 in interest expense over the lifetime of their loan compared to level repayment. This difference is due to the fact that it would take 16 years to repay the debt compared to 10 years under a level repayment plan, therefore accumulating more interest.

The drawbacks of an income-relative plan become more evident as we move down the income scale. For a similar household with an AGI of $75,000 instead of $100,000, lifetime interest payments would be nearly $84,000 higher than compared to a level plan. What’s more, because monthly payments barely cover interest expenses in this scenario, the unpaid interest is capitalized or, in other words, added back to the principal amount of the loan.

The effect is that the borrower’s total loan outstanding rises over time rather than being paid down. While many income-relative plans allow for loan forgiveness after 20 or 25 years, these borrowers are not completely off the hook. Debt forgiven is, in some cases, considered taxable income. Therefore, the remaining balance might lead to a tax bill of $23,000 for this couple at the end of 20 years.

It is crucial to understand that income-relative repayment plans are an expensive way to pay down your student loan debt. While useful for addressing short-term challenges to your financial situation, these programs should not be relied upon as a long-term approach to paying down debt. If you’re participating in an income-relative repayment program, and are serious about conquering your student loan debt, it might be time to examine what this payment program is costing you.

Avoid Capitalizing Interest

If you’ve ever experienced hardship as a student loan borrower, you probably know how payment forbearance can help you manage obligations during times of financial uncertainty. Forbearance programs allow you to delay making payments on federal direct (and some other loans) for up to 12 months at a time. And today, there are approximately 3.8 million direct loan borrowers in forbearance with outstanding balances that are growing at a rapid rate.

While beneficial in the short-term, this program can undo the progress made on paying down your loans and, in some cases, leave you with a higher balance than with what you started. As noted earlier, capitalizing interest expenses is the quickest way to derail your student loan repayment plans. While income-relative programs might lead to higher debt levels for certain individuals, participating in a forbearance program will almost certainly cause your outstanding loan balance to rise. Let’s use an example to demonstrate this point.

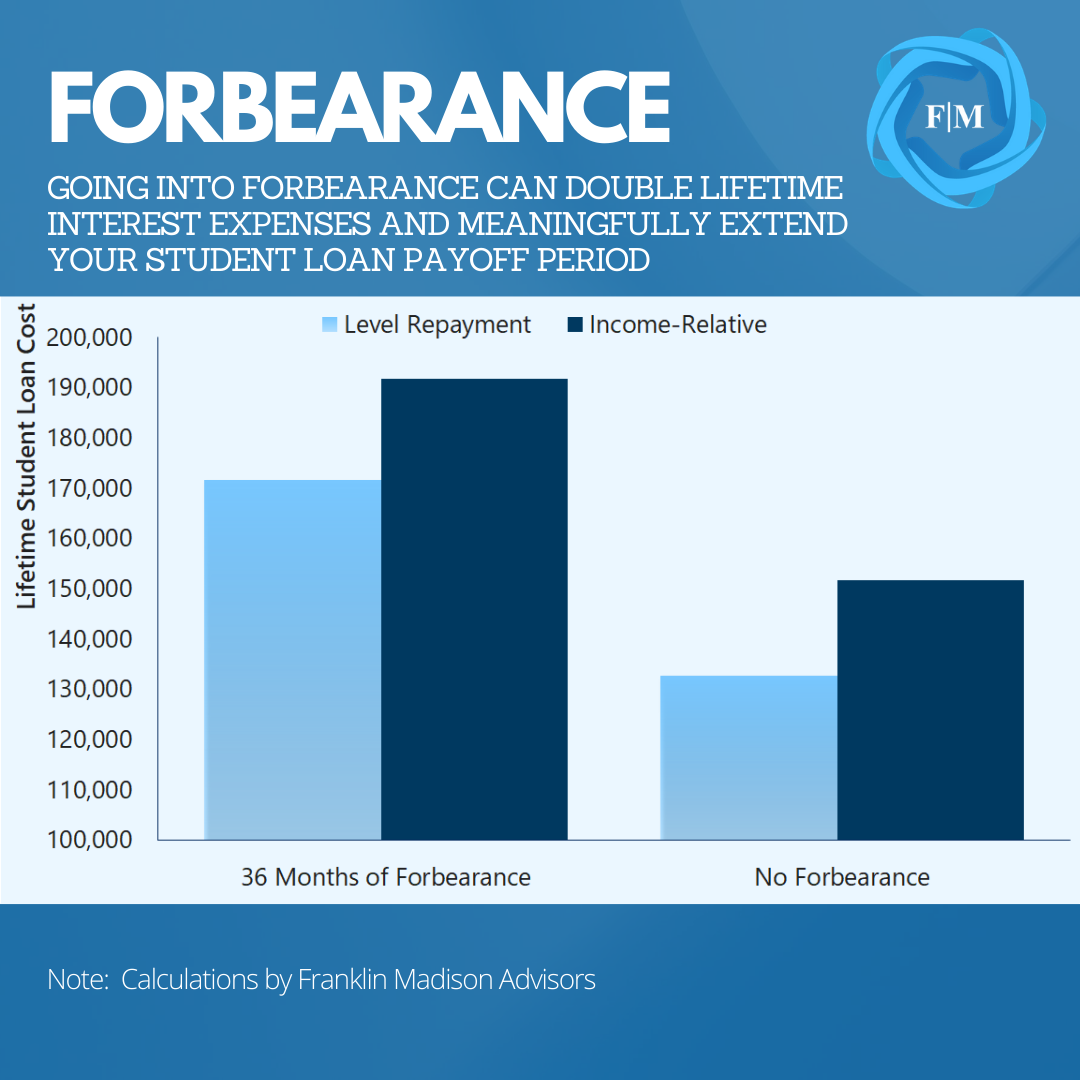

The Cost of Forbearance

Recall the earlier illustration of a couple with a household AGI of $120,000 and $100,000 in student loan debt. Under an income-relative repayment plan, they might pay off their student loans in about 15 years, costing them about $152,000 over the lifetime of their loan. Now, what would happen if we introduced forbearance into the picture?

Assuming that this couple used forbearance to delay payments by 36 months, their student loan would cost over $191,000 by the time the debt is paid off and $40,000 more than had they avoided forbearance. Capitalized interest increases the outstanding loan balance and leads to paying interest on top of interest. What’s more, in this scenario, the payback period for the loan goes from 15 years to more than 20, leading to a hefty tax bill when the loan is forgiven.

And how does forbearance affect level repayment plans? Well, $100,000 in student loan debt amortized over ten years at 5.5% interest will accumulate about $33,000 in interest expense. Placing their loans into forbearance for 36 months, the couple would end up doubling interest expense. Because the borrowers are now making up for the lost time when payments were postponed and paying interest on top of interest, it might take 15 years to repay their level loan versus the 10 years had the borrowers avoided forbearance.

The point here is that while forbearance is a useful tool that can help you navigate times of financial stress, when possible, it should be used only as a last resort. More to the point, if you do come upon tough financial times, prioritizing interest payments can help you avoid capitalization. Indeed, if your goal is to quickly conquer student loans and pay down your debt, then not paying interest on top of interest is crucial to this aim.

A Little Extra Goes a Long Way

Income-relative repayment plans can lengthen the time it takes to repay your student loans, while forbearance can lead you to pay interest on top of interest. If your aim is to eliminate student loan debt, consider alternatives to income-relative payment plans, and avoid forbearance. Then, create a strategy to make additional principal payments on your student loans.

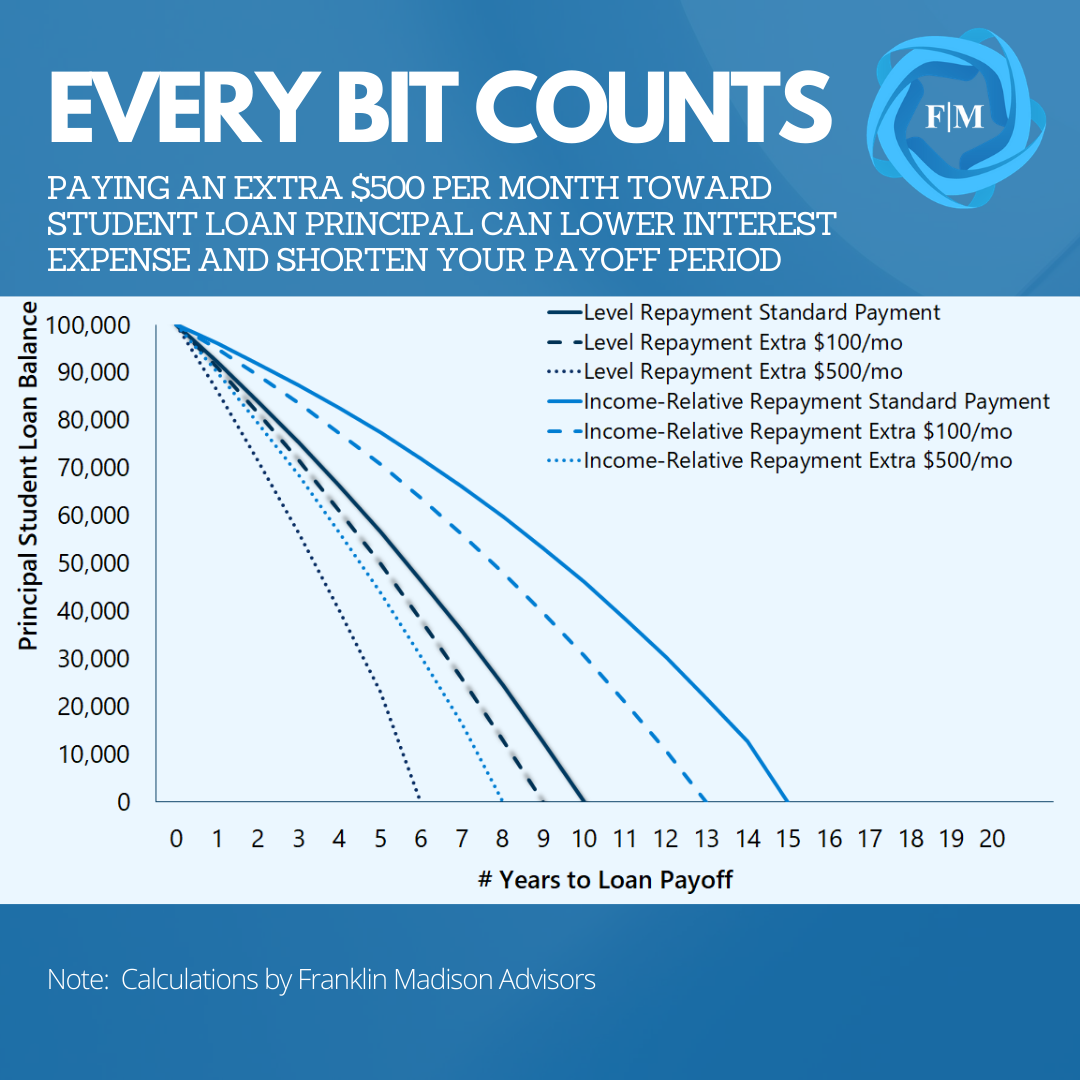

Indeed, whatever your chosen repayment program might be, every extra payment you can make on your loans can shorten the time it takes to pay off your debt and reduces interest expenses. For example, finding a way to pay an extra $100 per month on a $100,000, 10-year level repayment student loan can modestly reduce interest costs and cut your student loan payoff period by a full year.

How does this apply to income-relative payment plans? When using some of the same assumptions as before, making an extra $100 payment on your student loans can result in even more significant financial savings and shorten your payback period. Recall that for a couple with an AGI of $120,000 and $100,000 in debt, it might take them just over 15 years to pay down their student loans. By paying down an additional $100 in principal per month, they can eliminate debt in 13 years and save over $8,000 in interest expenses.

Taking this example one step further, let’s look at increasing principal payments from $100 to $500 per month. In our 10-year level payment scenario, committing $500 per month to principal reduction would reduce the repayment period to just over six years and lower interest expenses by a third. For the income-relative scenario, a similar contribution could cut lifetime interest costs and the repayment period in half. The point here is that every dollar that you can commit to paying down principal puts you one step closer to student loan debt liberation.

How to Eat an Elephant

Desmond Tutu was once quoted as saying that the only way to eat an elephant is a bite at a time. In the case of student loans, paying down your debt won’t happen overnight. However, as we just illustrated, finding ways to commit even a little extra money to pay down student debt principal can shorten your payback period and minimize interest expenses.

Even so, finding an extra $100 or $500 per month might seem like a daunting feat for some individuals. What can you do to come up with extra money to pay down your student loan debt faster? Here are a few suggestions:

· Make a Budget, Prioritize Debt Repayment — What gets measured, get managed. Knowing where your money is going every month can help you identify ways to reduce or eliminate spending and free up cash that can be applied to paying down student debt. The short-term sacrifice of prioritizing debt repayment by reallocating spending away from non-essential matters and toward paying down your debt for the next few years might lead to a lifetime of financial gain.

· Pay Down Smaller Debts First — If you have multiple student loans, prioritizing the payoff of your smallest balances can help free up cash to pay down your higher balances. The idea here is to quickly pay off debts with low balances and then apply the extra monthly cash flow to pay down your next smallest account balance, repeating until your student loans are paid off. Applying this same principle to credit card balances is another way to free up some extra cash. On average, Americans carry credit card balances of $6,200 and make minimum payments of $120 per month. Paying off your small credit card balance then applying those payments to your student loans is another way to reduce your student debt quickly.

· Consider Refinancing — Interest rates have fallen considerably over the past year. With student loan rates as low as 3.5%, refinancing higher interest student loan debt can lower your monthly payment. You can then use the money saved on your monthly payments to pay down principal. However, keep in mind that certain benefits afforded to federal student loans (like forgiveness) may not apply if refinanced with a private lender.

· Use Windfalls to Pay Down Debt — You’re likely to come into some financial windfalls during the year. For example, many people receive a bi-weekly paycheck yet pay expenses monthly. This means that twice a year, you’ll have “extra” checks coming your way. If your budget allows for it, consider using these additional paychecks to pay down student loan balances. Also, consider applying other windfalls, like a tax refund or your stimulus check toward your principal loan balance.

Student Loan Debt Liberation Begins with You

What could you do with an extra few hundred or thousand dollars per month right now? For some individuals, this additional cash might make the difference between buying a bigger house or a newer car. It could even mean getting closer to critical financial goals like funding a college savings plan for their children or shoring up retirement savings.

While many people are waiting on an act of congress to make their student loans disappear, you will likely need to forge your own path toward financial freedom. This includes limiting the use of costly income-relative repayment plans and avoiding capitalized interest. To be sure, taking a measured approach to paying off your student loans may liberate you from seemingly impossible debt and put you on the fast-track to achieving your essential life goals.